1 humanoid robot at $5/hour can do the work of 2 humans at $25/hour: MS

- Energy giant Exxon Mobil shares have gained 49% since the beginning of 2022

- Brent price has surged since Russia's invasion of Ukraine

- In case of short-term profit-taking, investors could consider adding XOM stock in long-term portfolios.

Shares of oil major Exxon Mobil (NYSE:XOM) hit a multi-year high on Mar. 8, and are up around 49% so far in 2022. By comparison, the Dow Jones Oil & Gas Index returned 47.5% and Chevron (NYSE:CVX), leading peer and competitor, is up 44.7% year-to-date.

Shares of the oil and natural gas producer have a 52-week range of $52.10-$91.50 and the company’s market capitalization currently stands at $363.3 billion. Readers might be interested to know that in the early days of the pandemic in March 2020, Exxon shares went as low as $30.11.

The fortunes of oil stocks mainly depend on the price of the commodity. As we write, Brent crude is around $127. Yet, it started 2022 below $80. In other words, Exxon shares and its peers have benefited from the run-up in the price of crude oil.

The Russian invasion of Ukraine has been the major reason behind this eye-popping increase in the oil price. According to JPMorgan, in the coming months, we could possibly see oil at $185.

Exxon Mobil released Q4 financials on Feb.1. Revenue was $84.96 billion, up 83% year-over-year. Earnings per share of $2.05 were better than analysts’ expectations.

On the results, CEO Darren Woods commented:

“We've made great progress in 2021 and our forward plans position us to lead in cash flow and earnings growth, operating performance, and the energy transition.”

Meanwhile, during the company’s Investor Day on Mar. 2, the oil giant scaled back its US Permian Basin growth expectations for this year from 25% to 20%. Management also announced plans to exit assets in Russia (i.e., the Sakhalin-1 LNG venture). This move will have an approximately 1%-2% impact on the company's earnings and its oil production.

Prior to the release of the quarterly results, Exxon stock was around $76. As we write, it is at $87.70.

Finally, the current price supports a dividend yield of 4.0%.

What To Expect From Exxon Mobil Stock

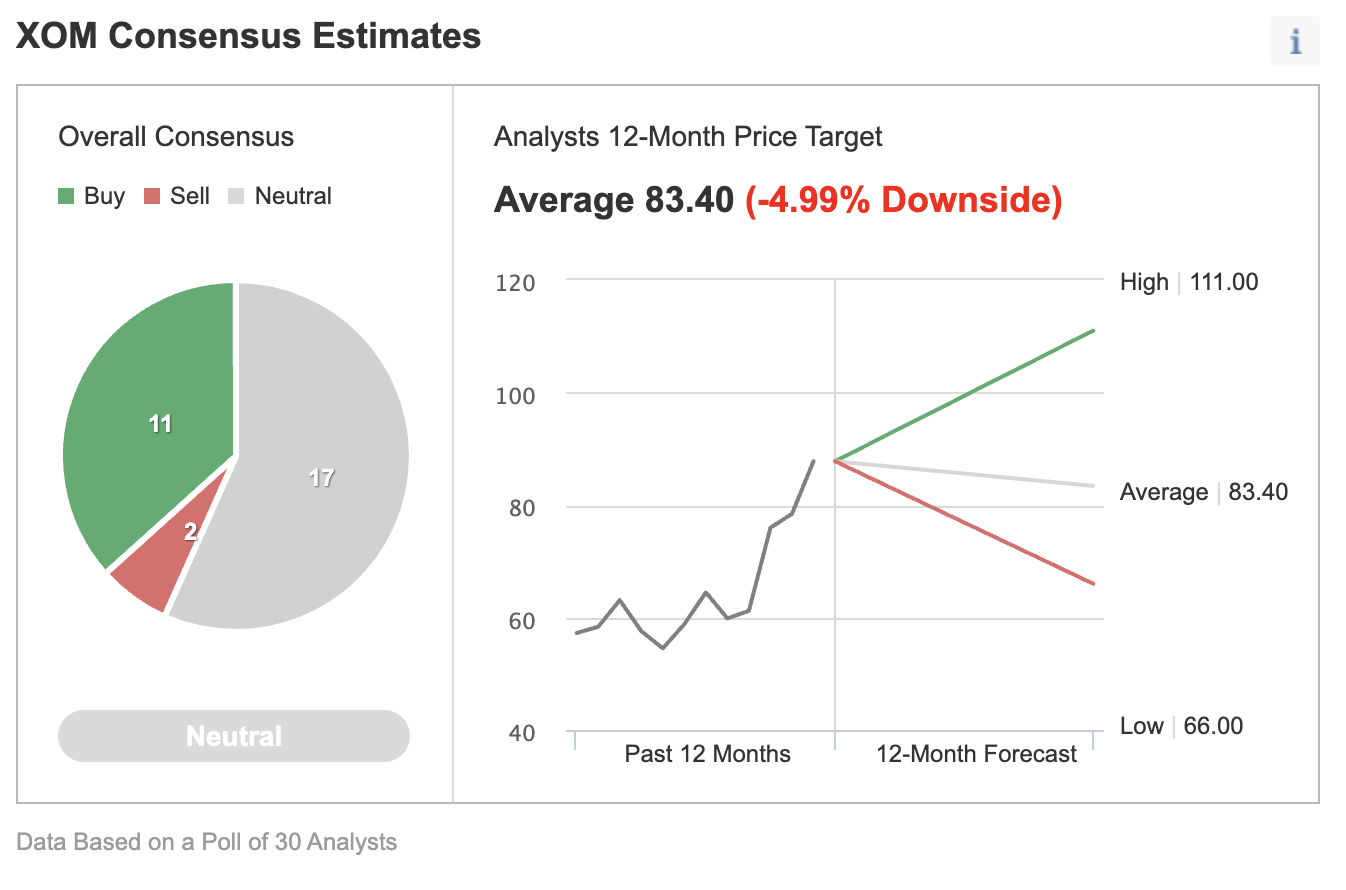

Among 30 analysts polled via Investing.com, XOM stock has a "neutral" rating.

Source: Investing.com

Meanwhile, Wall Street has a 12-month median price target of $83.40 for the stock, implying a decrease of more than 8% from current levels. The 12-month price range currently stands between $66 and $111.

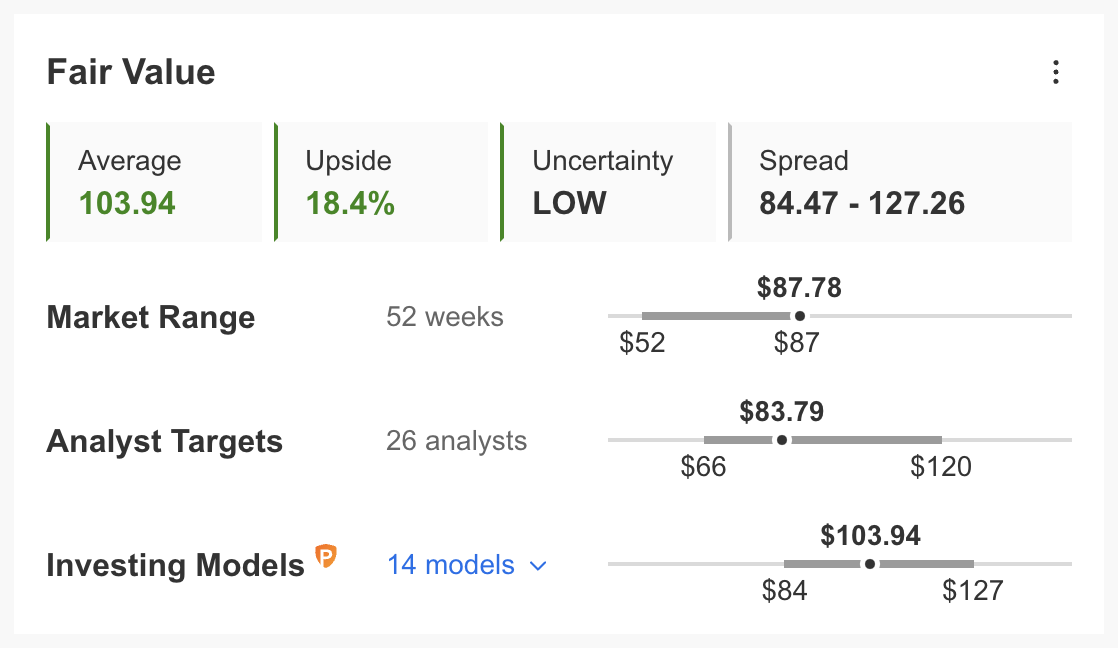

However, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for Exxon stock on InvestingPro stands at $103.94.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase about 14%.

At present, XOM’s P/E, P/B, and P/S ratios are 16.6x, 2.3x, and 1.4x. Comparable metrics for peers stand at 16.2x, 1.6x, and 1.3x. These numbers show that despite the recent run-up in price, the fundamental valuation for XOM stock is not necessarily frothy yet.

Although we remain bullish on XOM stock for the long run, short-term profit-taking is likely. In that case, we could see a potential pullback toward $80.

Adding XOM Stock To Portfolios

Exxon Mobil bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $103.94, as suggested by fundamental valuation models.

On the other hand, others could expect XOM stock to decline in the coming weeks. Thus, traders who expect profit-taking in Exxon stock could consider setting up a bear put spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on XOM stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bear Put Spread On XOM Stock

Current Price: $87.70

In a bear put spread, a trader has a long put with a higher strike price as well as a short put with a lower strike price. Both legs of the trade have the same underlying stock (i.e. Exxon Mobil here) and the same expiration date.

The trader wants XOM stock to decline in price. However, in a bear put spread, both the potential profit and the potential loss levels are limited. Such a bear put spread is established for a net cost (or net debit), which represents the maximum loss.

Let’s look at this example:

For the first leg of this strategy, the trader might buy an at-the-money (ATM) or slightly out-of-the-money (OTM) put option, like the XOM June 17, 2022, 85-strike put option. This option is currently offered at $5.95. It would cost the trader $595 to own this put option that expires in slightly more than three months.

For the second leg of this strategy, the trader sells XOM put, like the XOM June 17, 2022, 80-strike put option. This option’s current premium is $4.05. The option seller would receive $405, excluding trading commissions.

Maximum Risk

In our example, the maximum risk will be equal to the cost of the spread plus commissions. Here, the net cost of the spread is $1.90 ($5.95 – $4.05 = $1.90).

As each option contract represents 100 shares of the underlying stock, i.e. XOM, we’d need to multiply $1.90 by 100, which gives us $190 as the maximum risk.

The trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the stock price at expiration is above the strike price of the long put (or $85 in our example).

Maximum Profit Potential

In a bear put spread, potential profit is limited to the difference between the two strike prices minus the net cost of the spread plus commissions.

So in our example, the difference between the strike prices is $5 ($85 – $80 = $5). And as we’ve seen above, the net cost of the spread is $1.90.

The maximum profit per share is $3.10 ($5 – $1.90 = $3.10) per share less commissions. When we multiply $3.10 by 100 shares, the maximum profit for this option strategy comes to $310.

The trader will realize this maximum profit if XOM stock price is at or below the strike price of the short put (lower strike) at expiration (or $80 in our example).

Those readers who have traded options before are likely to know that short put positions are typically assigned at expiration if the stock price is below the strike price (i.e., $80 here). However, there is also the possibility of early assignment. Therefore, the position would need monitoring up until expiration.

Break-Even XOM Price At Expiration

Finally, we should also calculate the break-even point for this trade. At that price, the trade will not gain or lose any money.

At expiration, the strike price of the long put (i.e., $85 in our example) minus the net premium paid (i.e., $1.90 here) would give us the break-even XOM price.

In our example: $85 − $1.90 = $83.10 (minus commissions).

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI