The European Central Bank acted with uncharacteristic speed last week when it announced an increase in its emergency bond purchases to counter rising bond yields. ECB President Christine Lagarde said it would be “undesirable” if rising yields led to a premature tightening of financial conditions.

Bond yields move inversely to prices, so increasing the amount of central bank purchases would theoretically raise prices and lower yields.

Investors in U.S. Treasuries would like to see the same kind of responsiveness from the Federal Reserve at its policy meeting this week. Inflation concerns in an economy widely expected to take off as workers get vaccinated and with a $1.9 trillion stimulus in the offing are much higher in the U.S.

All Eyes Now On Fed Economic Projections

But the Federal Reserve seems unlikely to announce any capping of bond yields, even though investors are testing the central bank’s resolve by pushing Treasury yields higher. The benchmark 10-year Treasury note yield shot up to 1.63% Friday, a gain of 10 basis points from the previous day.

Such a move would fly in the face of Fed Chairman Jerome Powell’s repeated assurances that inflation is not a concern and the central bank is focused on achieving maximum employment.

In that case, investors will be looking closely at the Summary of Economic Projections that will be released on Wednesday at the conclusion of the two-day meeting of the Federal Open Market Committee.

The Fed puts out its economic projections every other FOMC meeting so the last set came in December. Investors will be looking for any increases in the growth or inflation forecasts now that the COVID relief bill is signed, sealed, and delivered.

They will also be looking for any sign that Fed policymakers have adjusted their dot-plot graph to show a hike in interest rates before the end of 2023.

Don’t hold your breath, however. Many economists believe the FOMC members won’t be completely truthful on those interest-rate forecasts for fear of throwing markets into even more of a tizzy.

The most likely outcome is for the FOMC to hold policy steady and for Powell to repeat his dovish mantra that sustained, inclusive employment is the priority and there is no significant inflation on the horizon.

Fed policymakers, in fact, are welcoming a moderate rise in inflation, and the higher interest rates that go with it, as long as expectations remain “anchored.”

Therein lies the rub, as the saying goes. The Fed has thought long and hard about inflation and decided it no longer needs to worry much about it. The problem is the Fed can change its policies but it can’t change the natural laws of finance.

The 2008-09 financial crisis seemingly broke the back of inflation, but now the extraordinary monetary and fiscal measures to combat the pandemic are presenting another unprecedented situation that some fear will reignite inflation.

No less an authority than Treasury Secretary Janet Yellen, former Fed Chair and accomplished economist, said Sunday that inflation may well increase in the wake of the stimulus but she is confident that it will be a temporary phenomenon and there is little risk of prices galloping away.

Other economists aren’t so sure. Former Treasury Secretary Larry Summers recently warned that inflation expectations could rise sharply with the unprecedented stimulus.

Harvard economist Robert Barro fears “weak policymakers” risk squandering the reputational capital built up by former Fed Chairman Paul Volcker when he tamed inflation in the early 1980s with draconian interest-rate increases.

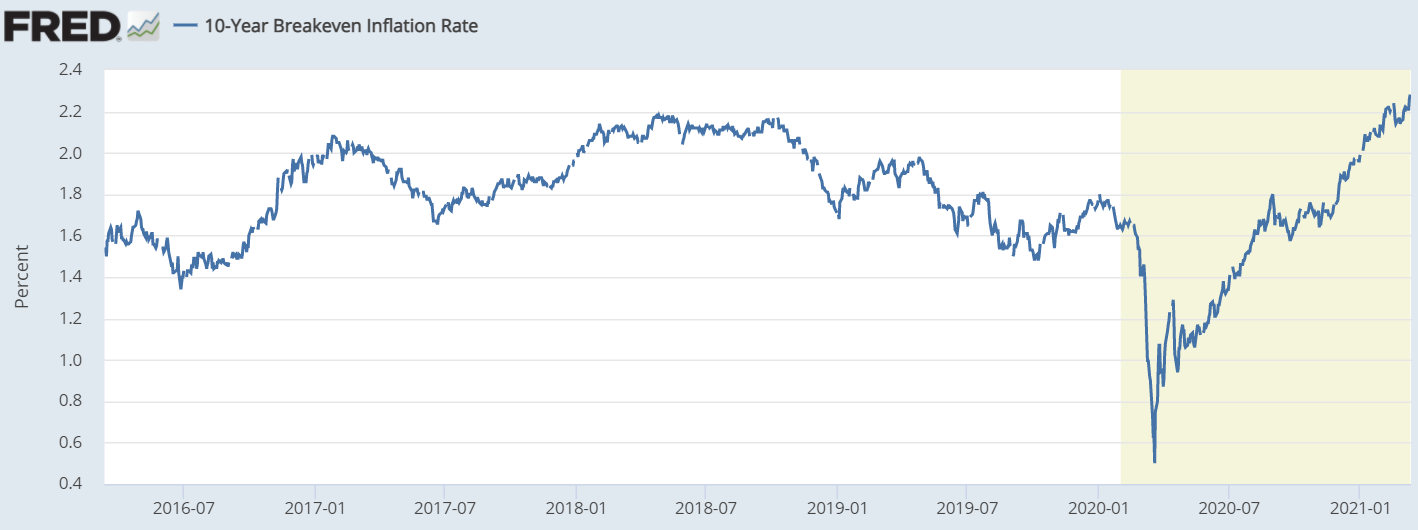

Source: Federal Reserve Bank of St. Louis

A standard market measure for inflation expectations—the 10-year breakeven rate derived from inflation-protected Treasuries—neared 2.3% last week, its highest mark in nearly eight years.

The Fed’s commitment to take decisive action when necessary is what anchors inflation expectations and there is growing concern that commitment is wavering and the anchor is wobbling.

Powell could calm those concerns Wednesday if he reasserts the Fed’s intention to remain wary and act quickly if expectations become unmoored. If he remains silent on the subject, that will speak volumes.