- The macroeconomic environment is turning hostile for freight companies, making their shares a risky bet

- FedEx is pursuing a restructuring plan to create long-term shareholder value

- One major challenge for FedEx is to remove its operational inefficiencies, which have kept its costs higher

Global freight and logistics giant FedEx Corporation (NYSE:FDX) has been in a difficult position this year. While the company’s long-term restructuring plan begins to take shape, global macroeconomic headwinds keep pressuring margins, pushing investors away from its stock.

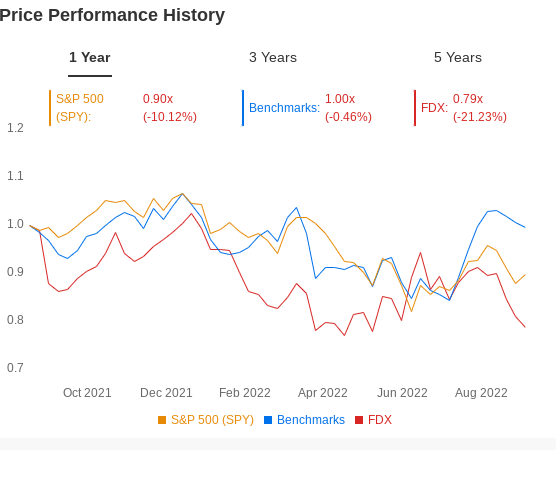

As a result, shares of the Memphis, Tennessee-based giant are down around 20% this year, massively underperforming its close rival, United Parcel Service Inc (NYSE:UPS), down 7.5% during the same period.

Source: InvestingPro

Some analysts believe this weakness is a buying opportunity in FDX, given the company’s plans with activist investor D.E. Shaw to create long-term value for shareholders.

As part of a deal with Shaw, the company hiked its quarterly dividend by more than 50% in June, restructured its board of directors, and promised to cut costs to make its operations more efficient.

One major challenge for FedEx is to remove its operational inefficiencies, which have kept its costs higher. Unlike UPS’ One Network, FedEx’s ground business is operated by independent contractors, while its express business owns aircraft and vehicles and has employees and pilots directly on its payroll.

However, the changes announced this summer indicate that Raj Subramaniam, who took over as CEO from founder Fred Smith on June 1, is more open to addressing investor concerns as FedEx struggles to boost profit margins.

A Compelling Long-Term Story

As these changes take effect, the macroeconomic environment is turning hostile to logistics companies, with freight volume and rates falling. If the global economy enters a prolonged recession, FDX will likely remain under pressure.

That is why some Wall Street analysts remain cautious about the near-term outlook. In a note this week, Citi downgraded FedEx to neutral from buy, saying that near-term challenges are dampening a compelling long-term story.

Its note adds:

“We continue to see lots of potential for cost takeout and streamlining in the business, consistent with the company’s 3-year plan laid out in June for $2b+ in cost takeout. However, we are concerned that macro headwinds in the near-term are going to be more impactful to shares pressuring earnings growth potential in F2023.”

As the world’s largest cargo airline and a major provider of parcel delivery services, FedEx’s business touches many industries, from consumer goods to pharmaceuticals. For that, the company’s performance is usually a proxy of how the broader economy is doing.

According to data provided by InvestingPro, FedEx earnings estimates are down more than 10% during the past three months as analysts factor in a potential slowdown in the freight business. FedEx is scheduled to report its latest earnings on Sept. 22.

Source: InvestingPro

Citi’s note adds:

“Our checks suggest peak TL freight is not materializing, and the pace of imports is slowing into what should be a strong seasonal period. TL spot rates have also taken a recent leg lower, and while rail carloads are holding steady, there is little evidence of improvement, and we see risk to 4Q estimates building.”

Bottom Line

FedEx is becoming an attractive long-term play after the involvement of D.E. Shaw and the new CEO’s focus on cutting costs and bringing in more operational efficiencies.

That being said, this isn’t the right time to go long on a pure economic play, especially when recession risks are rising. Investors, in my opinion, will get a better chance to buy FedEx at a lower price in the upcoming months.

Disclosure: The writer does not own FDX stock.