ETFs within the US financial sector showed promising recovery last week, following the Federal Reserve's latest meeting. Chairman Jerome Powell's decision to maintain steady interest rates for the second consecutive round offered investors some reprieve, suggesting that the era of aggressive rate hikes - which has pushed borrowing costs to their highest level in 22 years - is about to take a softer turn.

For many, this dovish turn came as a relief. Despite the Fed's hawkish policy since March 2022 which has seen a total of 11 interest rate hikes, the U.S. economy has performed admirably with the S&P500 marking an increase of 13.51% year-to-date. Not all sectors share in this success story though. Notably, financials have been neglected by investors. Despite a significant rebound this week (+7.35%), the year-to-date performance of the S&P financials sector remains in negative territory (-1.47%).

Banks took a blow from decreased loan demands due to prohibitive interest rates. Plus, they were still reeling from the collapse of Silicon Valley Bank (SVB) in March which slashed almost 15% off the sector's performance within just 11 days.

Yet this week presented a turnaround for the beleaguered industry group as it ended amongst one of the top-performing sectors. Leading in its wake was BMO (TSX:BMO) Equal Weight U.S. Banks Index ETF (ZBK), which manages assets close to $586 million, recording an impressive weekly performance of 10.36%.

Hamilton U.S. Mid/Small-Cap Financials ETF also saw encouraging advancements with its NAV gaining 8.78%. These signs may point towards a resurgence in banking and financial sector-related ETFs - despite significant outflows over the week - but it’s worth noting that all the S&P sectors without exception reported net outflows this week in contrast with the broader U.S. equity asset class which witnessed net inflows.

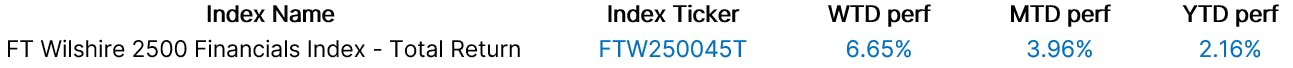

The FT Wilshire 2500 Financials Index (FTW250045T) gained +6.65% last week, bringing its year-to-date performance into positive territory at +3.96%.

Group Data

Index Data

Funds Specific Data: ZBK, HUM, QXM

This content was originally published by our partners at the Canadian ETF Marketplace.