Wall Street's three main stock indexes skyrocketed over the week, to register their strongest weekly rally in a year amid Powell’s dovish comments, Treasury yields in free fall (US 10-year T-note yield down 27 basis points), weaker-than-expected jobs report, and strong corporate earnings and guidance. The S&P 500 rose 5.85%, the tech-heavy Nasdaq Composite climbed 6.61% while the blue-chip Dow Jones Industrial Average gained 5.07%.

In an impressive comeback performance, sectors that had been some of the most neglected by investors since the beginning of the year experienced a strong rebound this week outpacing even the broad-based indexes. This is especially true for rate-sensitive sectors such as real estate, the week’s top performer with a gain of 8.55%. Financials also fared well, up 7.35% for the week. However, this solid momentum is not enough to bring the year-to-date performance of the two sectors back into positive territory (-5.27% and -1.47% respectively). Aside from the outstanding performance of the “big giants” and their associated industry sectors (namely, information technology, communication services, and consumer discretionary), all S&P sectors have posted negative or close-to-zero results since the beginning of the year.

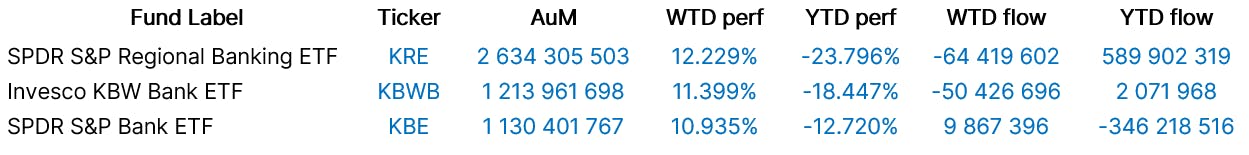

It’s also worth noting that all sector-specific fund segments, without exception, reported net outflows this week in contrast to the broader U.S. equity asset class segment which witnessed net inflows - possibly signaling a shift in strategy by investors towards ETFs tracking broad-based indexes.

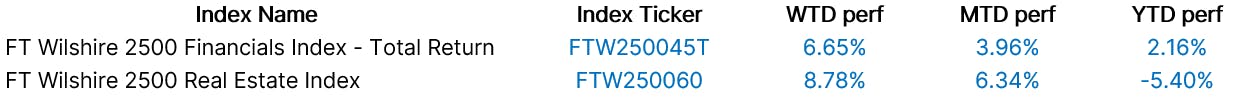

The FT Wilshire 2500 Financials Index (FTW250045T) and the FT Wilshire 2500 Real Estate Index (FTW250060) gained +6.65% and +8.78% respectively.

Group Data

Index Data

Funds Specific Data: REM, MORT

Funds Specific Data: KRE, KBWB, KBE

This content was originally published by our partners at ETF Central.