The U.S. energy transition is here. While the infrastructure projects to support new sources of power will take time to build up, the shift is evident.

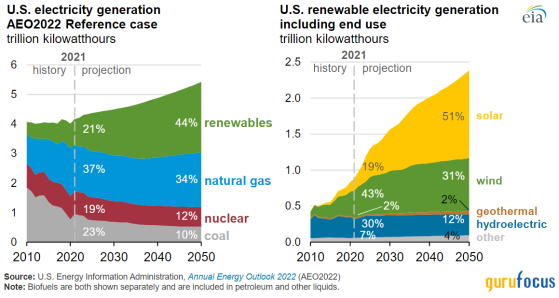

The first chart on the left shows the electricity generation in the U.S. by energy source. While renewables are practically tied with coal and nuclear at around 20% of total U.S. production, the Energy Information Administration projects renewables will originate almost half of the total U.S. electricity generation by 2050. And within the renewable space, solar energy has the highest growth as it is expected to expand from around 19% currently to 51% of total electricity generated by renewables in 2050. As such, solar stocks will be the main beneficiary of this energy production boom.

Source: U.S. EIA

Additional data shows wind turbines generated more electricity in the U.S. than coal-fired power plants in March and April. This is the first time wind generation has ever exceeded coal-fired generation for two consecutive months. Wind and solar combined also surpassed coal generation during the first four months of 2024.

Overall, the U.S. has tremendous solar potential, particularly in the Southwest. And some of the beneficiaries of this trend are naturally going to be the renewable energy sector leaders. One of these top players, First Solar Inc. (NASDAQ:FSLR), is particularly interesting. The company is a manufacturer of solar panels and a provider of utility-scale PV power plants, which it puts at the forefront of this growth potential.

Stock performance, business overview and recent earningsThe share price of First Solar has been on a clear rising trend over the past five years, in line with the growth of the solar segment. At the time of writing, the stock is trading at around $220.

Despite the recent sell-off where the markets erased 25% of the company's market capitalization, the stock is still up an impressive 30% year to date. This is because First Solar has continued to excel and perform above expectations, showing growth quarter after quarter. Management even found growth catalysts where it did not initially expect to find solar demand.

Indeed, the second-quarter earnings release showed a doubling of quarterly profits, driven by a demand surge in artificial intelligence. The energy demand of data centers has increased almost exponentially over the last several years, which has provided a great boost in profitability for First Solar.

Both the backlog and the pipeline are so extended that the company had to make significant U.S. manufacturing capacity expansions. The Tempe, Arizona-based company already has manufacturing facilities in Ohio, but revealed plans for a new facility in Alabama and another new plant in Louisiana. As such, it is clear the demand is there. According to First Solar's latest earnings release, the bookings backlog extends all the way to 2030. This means growth is primarily dependent on its ability to expand production and not to find new demand sources.

This is the sign of a well-run company with quality production, struggling to meet demand rather than attract it. The total bookings backlog through 2030 reached 75.90 gigawatts. To put this figure into perspective, the current total capacity of the company is 7.10 GW and is expected to almost double to 14.10 GW by the end of next year. These facts practically guarantee high growth rates for at least the next five years, and most likely for the next decade as the solar segment continues to expand.

Financials and valuationThe past several years have shown relatively mixed growth with sharp contrast between the top and bottom lines. Revenue grew only 4.30% per year in the last five years (which includes the Covid-19 pandemic, where demand for energy was relatively low and fossil fuels very affordable), but both Ebitda and free cash flow kept growing at average rates of 35.70% and 25.40% per year. This suggests that while the company struggled to expand during the pandemic, it managed to become much more efficient and reduce its cost of production. Further, both the top and bottom lines will accelerate in the next three years, mostly due to the aforementioned expansion in production capabilities.

Source: GuruFocus

Although the stock may look somewhat expensive at first glance in relation to a decade ago, it is cheaper than in recent years and the market appears to not yet have priced in the high growth rates. The stock is trading at 20 times earnings, below the pre-Covid levels of 25 to 30, but significantly higher than a decade ago when growth prospects were much more uncertain and the overall conviction on the solar segment rather low. The stock should see an expansion of its valuation multiples as the high growth rates continue being confirmed and U.S. election fears subside.

Risk factorsThe main risk factors for the company are external, given the robust internal demand and pipeline. The two main external factors are the upcoming U.S. presidential election and competition from China.

First, the pending U.S. election sparked a large sell-off in the aftermath of the attempted assassination of Donald Trump (the poll numbers of the Trump-Vance ticket improved significantly in the weeks after the event). Former President Trump has been critical of the Inflation Reduction Act that largely supports renewable energy infrastructure. There is concern that the IRA will be repealed if he were to win the election. However, the company and the solar segment overall continued to grow during his time in office, benefiting from corporate tax cuts. Another factor is that Vice President Kamala Harris, who is widely seen as strongly supportive of renewable energy, has recently become favored to win the election.

In any case, the growth of solar energy as a share of the U.S. surpasses completely political preferences and it is unlikely for any candidate to block a sector with so much potential for employment.

The other risk is competition from China. The Chinese solar companies could dump their cheaper products into the market and significantly impact First Solar, a U.S. manufacturer. The good news is there is a consensus in the U.S. between both parties to protect national manufacturing.

While Trump favors fossil fuels, he is likely to favor made in the USA products and implement protectionist measures that would shield First Solar from Chinese competition. Further, President Joe Biden announced some tariffs in May and it is unlikely that Harris would repeal them. Both parties have, therefore, apparently prioritized the protection of U.S. manufacturing. As such, First Solar should continue being protected from cheaper competition from abroad.

Bottom lineThere are real macro trends that are pushing solar as one of the top sources of U.S. energy production. First Solar, as one of the leaders in the space with made in USA branding, an extended backlog and quickly expanding production capabilities, should be able to continue increasing its profitability and see its revenue growth accelerate in the near term. The valuation has yet to recover from the U.S. election fears and to expand as the growth rates estimates are improving. There are real risks, but the positive factors should give investors the confidence to jump in now before the stock rises again.

This content was originally published on Gurufocus.com