While inflation has begun to trend downward in the US, it remains a top-of-mind concern for the Federal Reserve as it is currently above its 10-year average. Though elevated inflation can deteriorate the value of stocks and bonds – it is beneficial for real assets and commodities. The recently launched First Trust Bloomberg Inflation Sensitive Equity ETF (Ticker: FTIF) seeks to capitalize on this relationship, as the ETF will focus on companies that are directly or tangentially exposed to these asset classes.

The ETF, using an indexing investment approach, attempts to replicate, the Bloomberg Inflation Sensitive Equity Index before the fund’s fees and expenses. In turn, the index has been constructed to track the performance of companies with a sector classification of Energy, Industrials, Materials or Real Estate that demonstrates a strong positive correlation with inflation.

Inflation Sensitivity

The economic drivers of both commodities and real assets are highly correlated to inflationary trends, historically resulting in high degrees of outperformance during periods of high inflation and moderate return performance during normalized inflation periods. For investors utilizing these asset classes within their portfolio, they can derive three distinct benefits:

- Positive inflation sensitivity aids in mitigating the potentially damaging effects of accelerating inflation.

- Diversification potential, as rising inflation erodes the performance of equity and fixed income instruments.

- Attractive return potential, as over a full market cycle, the risk-adjusted performance of these asset classes can be compelling.

Inflation & Energy

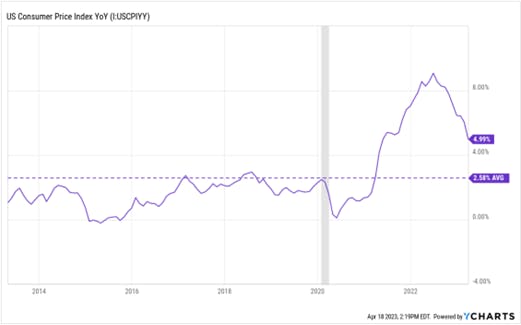

As reported in the March 2023 US Consumer Price Index summary, prices have increased by approximately 5% over the last 12 months. While this is lower than the 6.04% reported in February 2023 and 8.54% of the previous year, it is still higher than its 10-year average of 2.58%

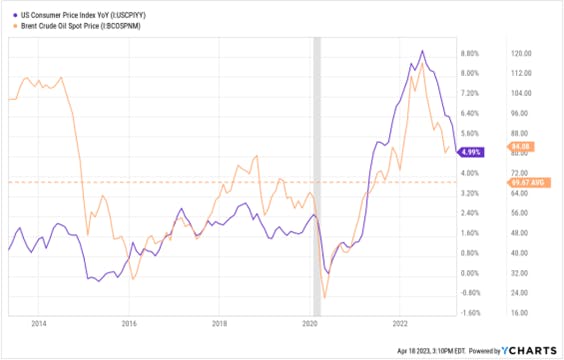

Though the gradual decline of inflation is a positive occurrence, there are seminal activities occurring globally that could undermine the progress being realized. As outlined in a recent article, OPEC’s planned production cuts in May 2023 and for the remainder of the calendar year will undoubtedly have an impact on the current inflation environment. While the decline in oil from a peak of $130 to $80 has had a material impact on global purchasing power, by way of lower energy costs – the announced actions of OPEC will impact consumers directly, such as at the gas pump, or indirectly by way of companies reflecting rising transportation (i.e., fuel) costs in the prices of their goods and services.

Inflation & Real Estate

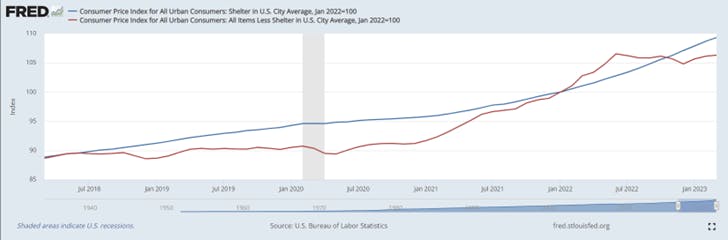

The shelter category, which includes housing costs, rose 0.6 percent in March and continues to be among the largest components of the CPI’s monthly all-items increase. The shelter index increased 8.2 percent over the last year, accounting for more than 60 percent of the total increase. In looking at the data, the price of shelter has been continuously increasing, while the price for all other items has varied over time.

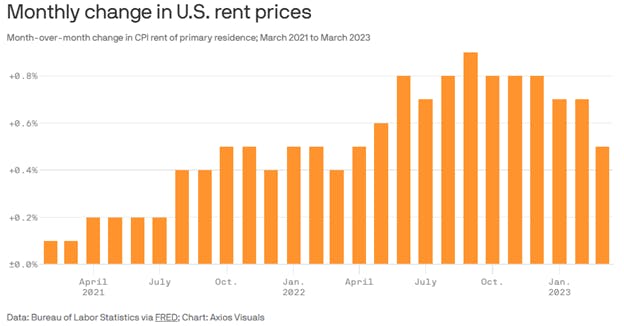

Within the shelter category, owner’s equivalent rent of residence (OER) and rent of primary residence (rent) measure the majority of change in the shelter cost consumers experience, which is informative from a real estate perspective. Though property values tend to appreciate over time, rental income is the primary pathway of deriving cash flow from real estate. As evidenced from the following chart, against the backdrop of a high inflation environment, average rent has increased commensurately.

Because property owners have the ability to adjust their prices (i.e., rents) based on the prevailing macroeconomic environment, this flexibility makes the real estate asset class appealing during inflationary periods. For investors in real estate, the high degree of autonomy present within the asset class allows for continual income maximization, across various stages of the economic cycle.

Inflation & Domestic Production (Industrials & Materials)

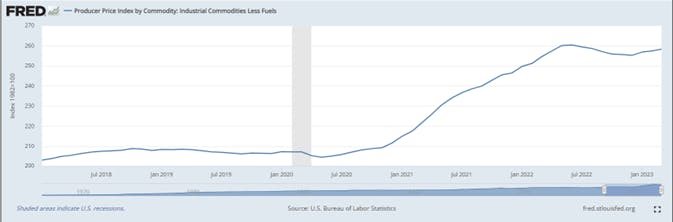

The Producer Price Index (PPI) measures the average change over time in the selling prices received by domestic producers for their output. In looking at the recent performance of the index, specifically the Producer Price Index by Commodity: Industrial Commodities Less Fuels, we can glean some insight into the industrial commodities sector of the economy.

Subsequent to the recession of 2020, there was an increased demand for industrial commodities and materials that allowed industrial sectors of the economy, such as mining, manufacturing, and construction to increase their prices accordingly. Given the essential nature of these industries, any price increases they incurred were then passed along to consumers. Hence, The PPI serves as a leading indicator for the CPI, so when producers face input inflation, the increases in their production costs are passed on to retailers and consumers.

Investors in companies that produce industrial commodities benefit from the pricing power these firms have, as they are able to adjust their product pricing according to changes in the economy. Given the economic importance of many of these industries, investors are able to ultimately benefit from the innate inflation-hedge present within these businesses.

Concluding Remarks

For investors seeking an investment solution that is attuned to inflation changes in the US economy, FTIF is designed to address said goal. The ETF is focused on sectors of the economy that are best suited to benefit from rising prices and investment criteria of the fund ensures that only the top 50 companies with the highest free-cash-flow yield based on a trailing 12-month period are reflected within its holding, thus ensuring yield-generation is consistent over varying economic cycles.

This content was originally published by our partners at ETF Central.