Kathy Lien, Managing Director Of FX Strategy For BK Asset ManagementDaily FX Market Roundup July 1, 2019

The G20 summit ended with a trade truce between the U.S. and China. President Trump and President Xi agreed to restart talks with Trump promising to hold back additional tariffs and allow U.S. companies to sell their equipment to Huawei while discussions are underway. In return China agreed to resume purchases of American goods and buy a "tremendous amount" of American food and agricultural products. The US dollar soared in response but the sell-off in the euro, Australian and New Zealand dollars is a sign that the broader market is not convinced that it will be blue skies from here.

The problem was that a trade truce is not the same as a trade deal. Until tariffs on China are reduced or eliminated the world's second-largest economy faces serious economic challenges. Investors are worried that if China sneezes the rest the world will catch a cold and we are seeing plenty of evidence of that possibility as manufacturing activity in Australia, UK and the Eurozone slow. The U.S. on the other hand is the only one that benefits from tariffs and a half-hearted commitment to restart trade talks. We see that in the data with manufacturing activity in the U.S. exceeding expectations when everyone else misses. In other words, President Trump's trade tantrums hurt everyone else more than the U.S., which is part of the reason why the U.S. dollar was up across the board on Monday.

The Reserve Bank of Australia meets tonight and before sharing our outlook, OPEC's decision to extend its production cut to at least the end of 2019 is great news for oil. However the 1.7% rise in crude prices provided very little support to the Canadian dollar. USD/CAD sold off sharply last week and is due for a recovery. The rally in the U.S. dollar provided the perfect catalyst for a move that took USD/CAD above 1.31. This is a big week for Canada with trade, IVEY PMI and labor-market numbers scheduled for release.

But in the near term, the main focus will be tonight's RBA rate decision. After rising 8 out of the last 9 trading sessions, AUD/USD pulled back sharply on Monday. The Reserve Bank of Australia is widely expected to cut interest rates by 25bp so the key question is what happens next - do they shift from dovish to neutral bias or they leave the door open to additional easing? Judging from the recent gains in A$, investors don't expect the RBA to be excessively dovish because the market is only looking for one more move from the central bank this year.

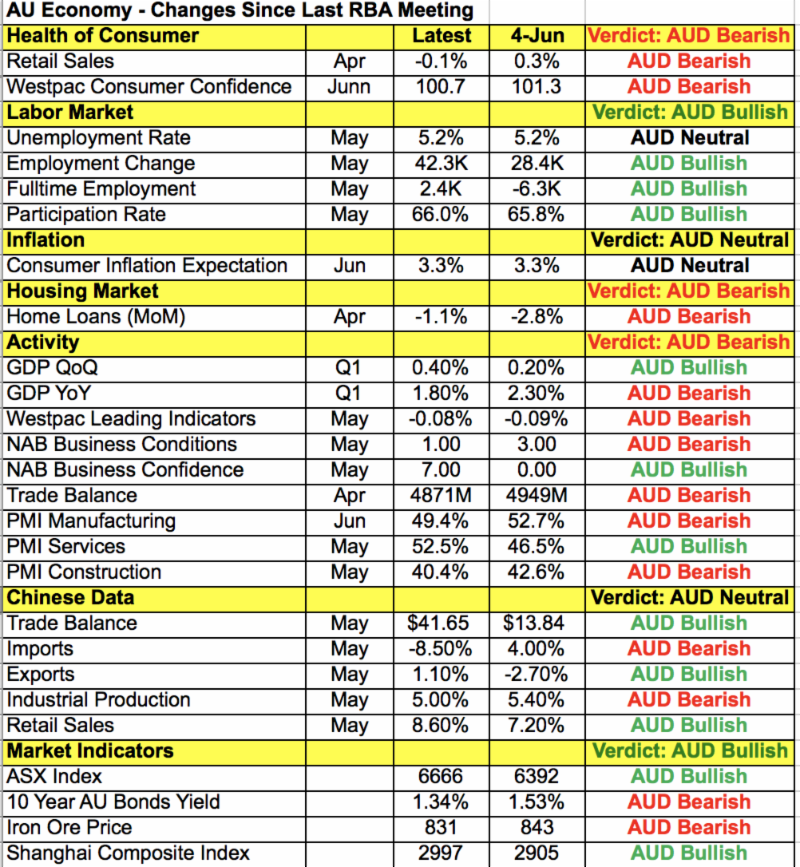

At the start of last week, RBA Governor Lowe openly mused about the effectiveness of more rate cuts if "everyone is easing." This is an awkward comment because while it may be true that contemporaneous reduction in rates could result in exchange-rate parity, lower borrowing costs goes a long way in helping businesses and consumers domestically. According to the table below, the RBA could wait for more evidence before easing. Retail sales and manufacturing activity are weak but the labor market is strong and activity in the service sector is growing.

There are 3 possible scenarios for RBA:

- RBA cuts 25bp, signals they are satisfied with the moves taken so far, no more is needed = AUD/USD to .7050

- RBA cuts 25bp, says more easing may be needed = AUD/USD below .6900

- RBA keeps rates unchanged, pushes cut to next meeting = AUD/USD to .7050