Against an uncertain geopolitical environment, global military spending saw its steepest spike in over a decade, with the U.S. vastly outspending everyone else. While it is no secret that the U.S. military-industrial complex accounts for a material portion of the U.S. government's total budgetary resources, the companies that benefit from this ongoing spending tend to be large and slow-growing but remarkably stable due to their long-term contracts with the U.S. government.

This article will examine the iShares U.S. Aerospace & Defense Index ETF (Ticker: XAD), which is designed to track U.S. companies' performance in the aerospace and defense sector.

A look at global defense spending

The Stockholm International Peace Research Institute (SIPRI) recently reported that total global military spending reached $2,443 billion in 2023, an increase of 6.8 percent in real terms from 2022. This was the steepest year-on-year increase since 2009. Against the backdrop of a heightened geopolitical environment, nations are prioritizing military strength and bolstering their capabilities.

In 2023, the 31 North Atlantic Treaty Organization (NATO) members accounted for $1,341 billion, 55 percent of the world's military expenditure. In 2006, NATO defense ministers agreed that each member country would commit a minimum of 2% of its GDP to defense spending; as of 2023, 11 out of 31 NATO members met or surpassed this level—the highest number since the commitment was made. Another target—directing at least 20 percent of military spending to 'equipment spending'—was met by 28 NATO members in 2023, up from 7 in 2014.

U.S. defense spending continues to rise

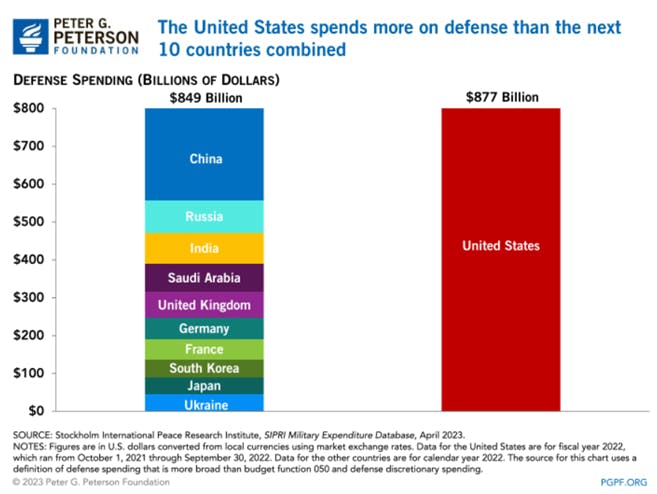

The Peter G. Peterson Foundation (PGPF), a nonpartisan organization dedicated to increasing awareness of America's long-term fiscal challenges, recently reported that the U.S. spent $820 billion on national defense during the 2023 fiscal year, according to the Office of Management and Budget, which amounted to 13 percent of federal spending. Defense spending continues to be of seminal importance, as the U.S. spends more on defense, relative to the size of its economy than any other G7 nation. As a reference point regarding the U.S.'s military scale of spending, the following chart contrasts the nation's spending in 2022 versus the collective spending of the next 10 largest nations, in the same year.

As reported by PGPF, the majority of the overall defense budget, $776 billion, was spent by the Department of Defense (DoD) on military activities. The remaining $43 billion was spent on defense-related activities by other agencies, such as the Department of Energy and the Federal Bureau of Investigation. DoD funding for military activities supports a broad range of activities. The largest category, operation and maintenance, cost $318 billion in 2023. It covers the cost of military operations such as training and planning, maintenance of equipment, and most of the military healthcare system. The second largest category, military personnel, supports pay and retirement benefits for service members and cost $184 billion in 2023.

Several smaller categories accounted for the rest of DoD spending. In 2023, procurement of weapons and systems cost $142 billion, and $122 billion was spent on research and development of weapons and equipment. The military also spent over $10 billion on the construction and management of military facilities and $1 billion on family housing.

Investing in U.S. defense contractors and the ecosystem

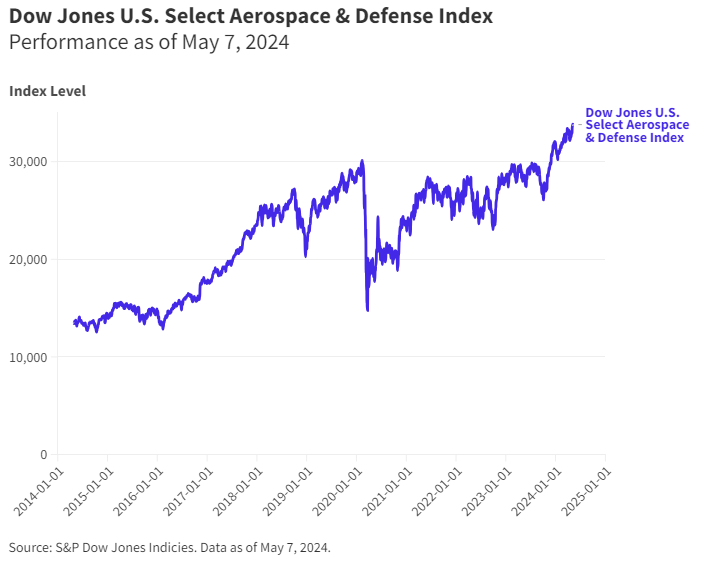

While investing in some defense companies does have ethical implications, these firms are also contributors to the U.S. and global economy, despite how their products and services may be utilized. For investors who desire to gain exposure to specialized industrial sector equities, the iShares U.S. Aerospace & Defense Index ETF (Ticker: XAD) is a solution that provides exposure to manufacturers, assemblers and distributors of aircraft and aircraft parts primarily used in commercial or private air transport and producers of components and equipment for the defense industry, including military aircraft, radar equipment and weapons. The fund tracks the Dow Jones U.S. Select Aerospace & Defense Index.

XAD is a fairly concentrated portfolio with approximately 40 holdings. While many of the names held within the fund may not be readily known, the top three (as of May 7th, 2024): RTX (NYSE:RTX) Corp., formerly Raytheon (NYSE:RTN) Technologies Corporation (18.39%), Boeing (NYSE:BA) (13.60%), and Lockheed Martin Corp (NYSE:LMT). (13.09%), are familiar to many. RTX Corp. and Lockheed Martin Corp. are globally focused firms specializing in aerospace, arms, and defense. In the case of Boeing, while they are known for commercial aircraft development, they also provide various defense, space & global security services.

From a performance standpoint, XAD has less than 1-year performance. Thus far, the ETFs 3-month, 6-months, and since inception return has been 8.94%, 17.33%, and 15.83%, respectively, as of April 2024 month end. Given that the fund tracks the Dow Jones U.S. Select Aerospace & Defense Index, observing its long-run performance provides insight into the ETF's potential investment experience.

XAD is a solution worthy of consideration for investors interested in gaining exposure to companies involved in specialized industries that are highly guarded and regulated. Furthermore, these companies benefit from the U.S. Government's spending.

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.