- After gas price slide, consumers might be spending in other areas

- Soft back-to-school shopping season

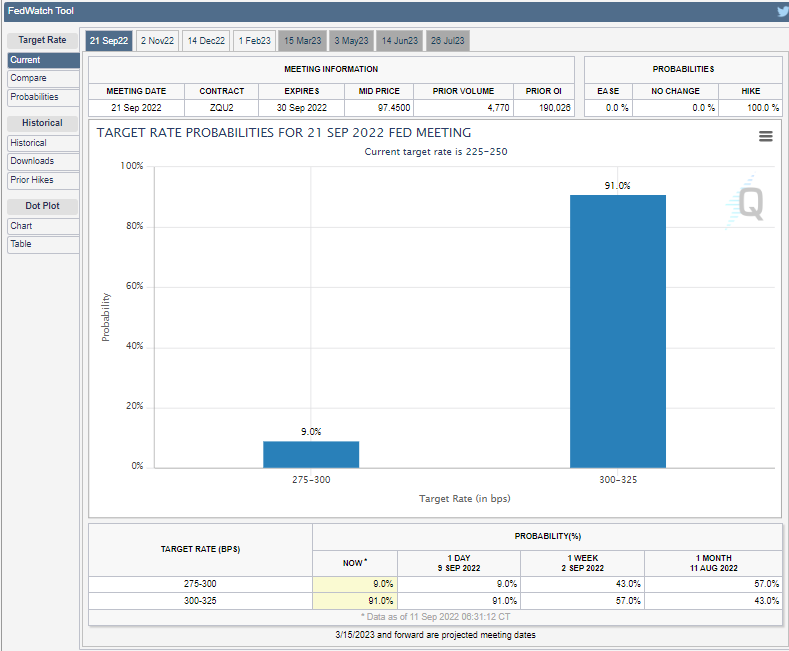

- Traders have priced in a 0.75 percentage point U.S rate hike

Is the consumer on the mend after enduring a tough summer of high gas prices, hefty hotel bills, and costly cookouts? We might hear some sanguine news on the spending situation this week in Thursday morning’s retail sales report.

According to Bank of America (BofA) Global Research, the consensus forecast calls for no change in spending growth from July, but BofA analysts are bullish on a strong reading due to solid card spending data. The consensus is upbeat about retail sales, less autos and gas, however.

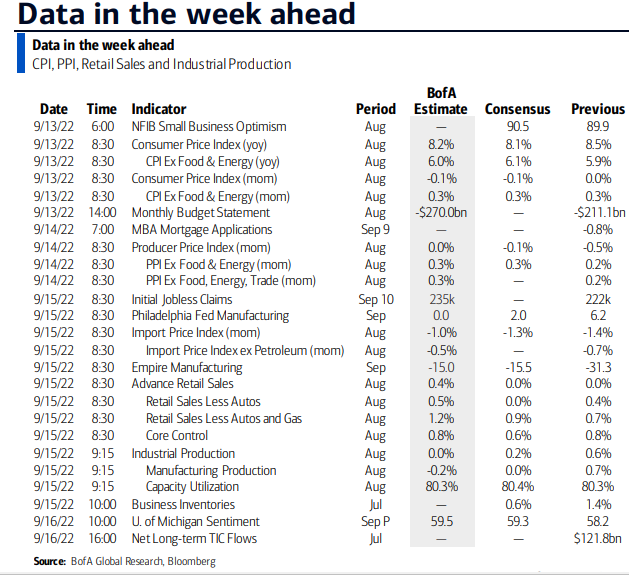

Data Barrage: CPI Hits Tuesday, Retail Sales Comes Thursday

Source: BofA Global Research

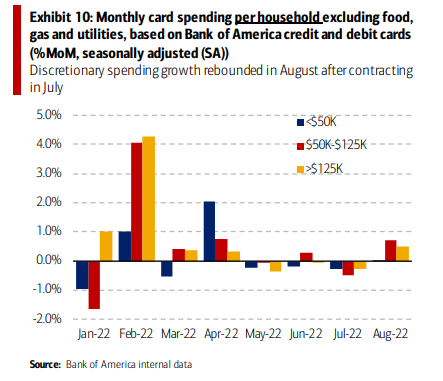

Now that pump prices have fallen for about 90 consecutive days, folks have more money at their disposal to spend on discretionary items. BofA’s card spending data for August reveals that there was an uptick in discretionary spending across the three income groups it breaks out. Last month’s uptick comes after three downbeat months of low to negative spending growth outside of food, gas, and utilities.

Discretionary Spending Ticks Up in August

Source: BofA Global Research

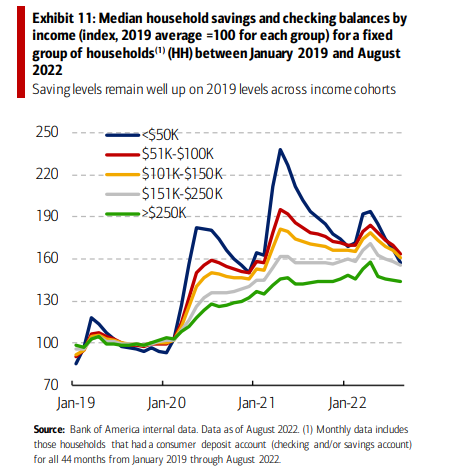

What’s more, while there is much talk about Americans spending down the excess savings they built up during the pandemic, domestic consumers still have a hefty amount of cash sitting in checking and savings accounts. BofA notes that all income groups have savings balances about 60% above pre-pandemic levels.

Excess Savings Remains Elevated

Source: BofA Global Research

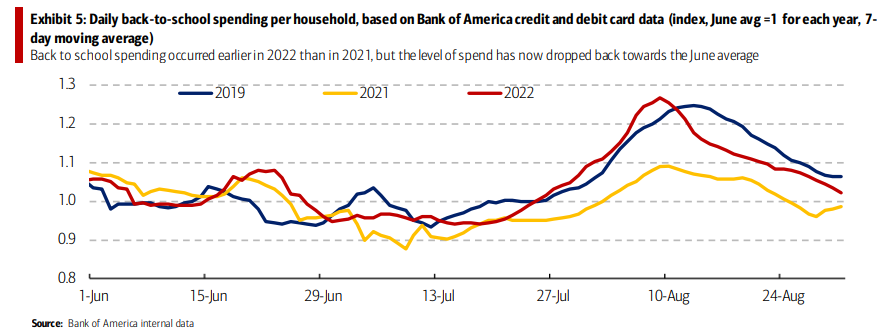

So, the consumer is primed to spend as we approach the heart of pumpkin spice spending season. This comes after a weak back-to-school shopping period in which BofA internal card data suggests total back-to-school spending was down 4% year-on-year versus a +1% forecast from the National Retail Federation.

School Spending High Early in the Season, But Weaker YoY

Source: BofA Global Research

The Federal Reserve wants to see spending cool so that economic growth dampens in the coming months and quarters. Last week, Chair Powell sat down for a seemingly scripted interview with the Cato Institute. His words and rhetoric were more of the same after a blunt and hawkish Jackson Hole address in August. The Fed is hell-bent on beating inflation down through interest rate policy and quantitative tightening that picked up this month.

Traders have just about fully priced in a third straight 0.75 percentage point policy rate hike at next week’s FOMC meeting. The certainty is so high, at 91% per the CME Group’s Fed Watch tool, thanks to a report in The Wall Street Journal last week. The WSJ’s Nick Timiraos has become the de facto Fed Whisperer, so his breaking story that a 75bp rate increase was on the way moved markets. Yields ended the week near fresh highs across the curve.

Confidence is High for a 75 Basis Point Hike

Source: CME Group

The Bottom Line

The economic data front has been quiet since the Sept. 2 August nonfarm payrolls report. This week, though, we’ll get a slew of important reports that while they might not impact the Fed’s decision next Wednesday, will be important for policy action at the November and December meetings.