The GBP/USD, which had been steady in the last few trading sessions, has fallen back at the start of the new quarter after some relatively hawkish remarks from Fed’s Powell.

The cable managed to hold onto the decent gains it made in Q3 yesterday to ensure a third month of gains. But as rates have approached the key 1.35-1.40 long-term resistance range, the upside could be limited moving forward.

A slew of important US data—including the monthly jobs report—is on the horizon this week, and the cable’s near-term direction hinges on these economic releases.

While the broader US dollar trend remains bearish, the GBP/USD outlook is not so certain. With much of the dollar weakness already factored in, a pullback in the cable could be on the horizon as we approach this week’s US employment data.

Before discussing this week’s macro highlights, let’s talk about those technical levels and factors first.

GBP/USD Technical Analysis

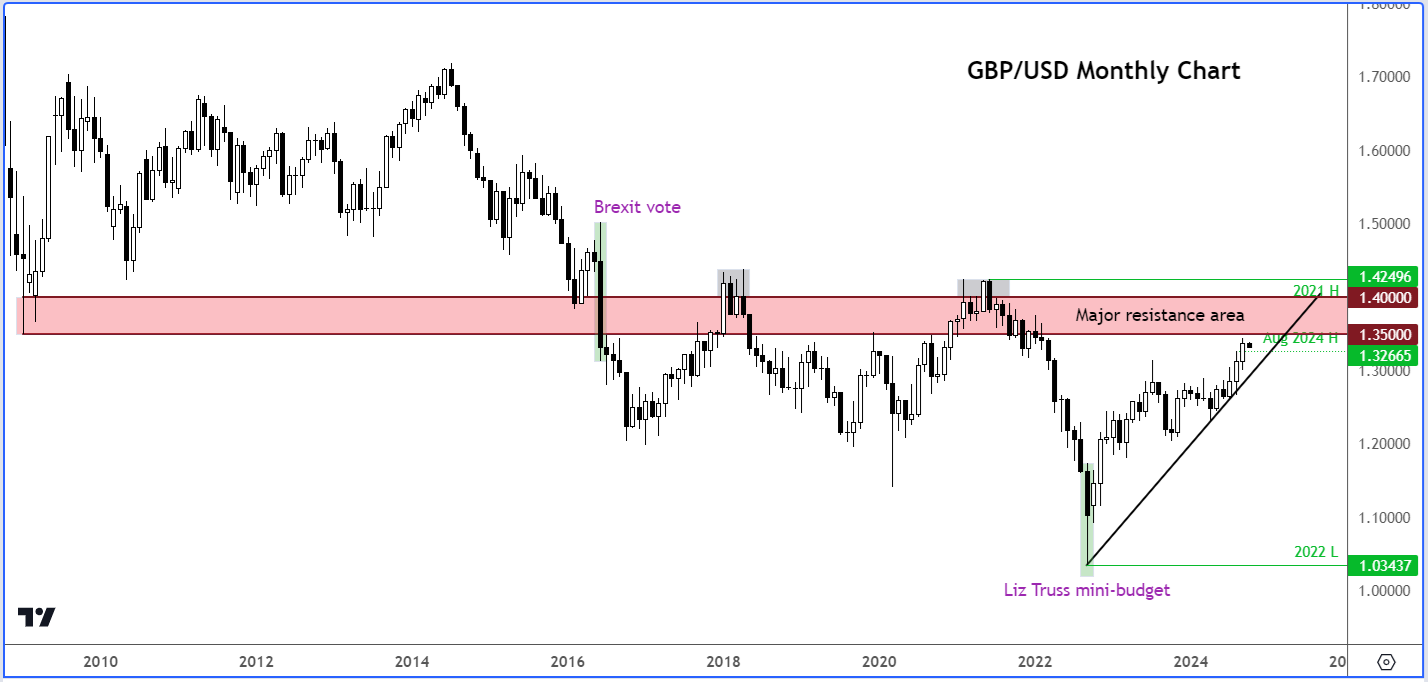

Year-to-date, the GBP/USD is up about 5%. While the potential to extend these gains is there, the cable is now not far from testing a key long-term resistance zone between 1.3500 and 1.4000.

It got close to this area last week, reaching a high so far of 1.3435, before easing back.

Since the 2016 Brexit vote, this 1.35-1.40 range has acted as a strong ceiling, repeatedly rejecting the pair’s attempts to break higher, even if we have had a couple of temporary breaks above this zone.

As rates approach this area again, will history repeat itself, or will a weakening US dollar open the door for more gains?

The weekly chart, meanwhile, shows that the price is approaching overbought levels.

Momentum indicators like the Relative Strength Index (RSI) suggest caution as it climbs above the 70.0 threshold. The last couple of times that the weekly RSI has climbed above 70, we have seen significant drops in subsequent months.

On the daily time frame, the RSI is in a state of negative divergence – i.e., it is forming a lower high relative to the underlying price making a higher high. This is considerable to be a sign of waning bullish momentum.

While the momentum indicators are signaling overbought conditions, what is missing so far is the bearish reversal signal on what matters the most: price.

The GBP/USD has not yet created a bearish price pattern to encourage the bears to short it. The series of higher highs and higher lows must end before the GBP/USD outlook turns bearish.

Therefore, the overbought conditions, at this stage, should be viewed as a warning for the bulls that we could see some profit-taking or some short-term weakness. The bears will need to remain patient until a clear reversal signal emerges.

Key short-term support comes in around 1.3265, a level that had marked the high in August. Below this level, 1.3200 is the next support to watch followed by the Jul 2023 high of 1.3142 – once resistance, this level may now offer support on a pullback.

But given those RSI overbought conditions on higher time frames, it is possible we could see a deeper drop than these levels before the GBP/USD becomes attractive again.

What Will FX Traders Be Watching This Week?

Last week was packed with stimulus announcements from China, bolstering optimism about central bank easing globally. In the US, weaker data and growing speculation that the Fed might deliver another significant rate cut before returning to a more typical 25-basis point pace had also weighed on the dollar.

But today, the greenback is finding some mild support as investors scale back expectations for aggressive Fed rate cuts, following remarks by Jerome Powell. Speaking at the Tennessee conference, the Fed Chair took a more hawkish stance, signaling that the central bank is likely to maintain a steady pace of 25 basis point cuts.

He also emphasized that the committee isn’t in a rush to reduce rates rapidly. While markets are still betting on a rate cut in November, the likelihood of a 50-basis point reduction has dropped from over 50% to around 35%.

This shift in sentiment has given the USD a boost, with the focus now shifting to the upcoming employment data.

Can US Data Trigger a Dollar Recovery This Week?

In a week filled with high-impact data on the US economic calendar, the JOLTs job openings report on Tuesday could be the one to watch. With the Fed’s focus shifting from inflation to employment, another weak jobs number could heighten expectations for a 50-basis point rate cut in November, adding more pressure to the dollar.

Keep an eye out for the employment components in the ISM services and manufacturing PMIs later in the week, which will offer further insights into the health of the US labor market. But the big one will be Friday’s non-farm jobs report.

In August, the US added 142K jobs, below forecasts of 160K. July’s figure was revised lower by 25K, while June’s was revised down by 61K. Despite this, the unemployment rate fell as expected to 4.2%, and average weekly earnings grew by 0.4%, surpassing forecasts.

Concerns about labor market health drove the Fed’s September rate cut, and if the job market cools further, the chances of another significant cut will rise. However, if the September jobs report surprises to the upside, it could dent the current bullish GBP/USD outlook.

Domestically, there’s not much excitement for the UK, but the yield advantage of gilts could help limit any substantial downside for the pound. That said, with key US data looming this week, a slight dollar recovery wouldn’t be shocking, as there is always the potential for data to surprise to the upside.

Even if it doesn’t, much of the weaker US dollar and interest rates narrative is already priced in. So, the GBP/USD may struggle to keep rising without first staging a pullback.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.