-

Recent macro data fueled a strengthening of the US dollar against the British pound.

-

Fed Chairman Jerome Powell's remarks yesterday added more fuel to the fire.

-

Amidst disappointing UK labor market data and growing rate cut expectations in the UK, the GBP/USD pair may keep declining.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Last week's macro data caused the US dollar to strengthen against the British pound, which was evident in the GBP/USD currency pair downward movement. This mainly stemmed from concerns about the Fed's tough stance on policy until the year's end.

Adding fuel to the fire yesterday, Fed Chairman Jerome Powell stated that the battle against inflation isn't finished yet. He hinted that the interest rates might remain higher for longer than initially anticipated at the start of the year.

UK Data Fuels GBP/USD Downtrend

Yesterday's UK labor market data sparked a decline in the GBP/USD pair as it came in worse than expected, especially concerning the unemployment rate.

Speculation is rising: will the Bank of England cut interest rates before the Fed? Doubts about any US rate cuts have boosted the US dollar.

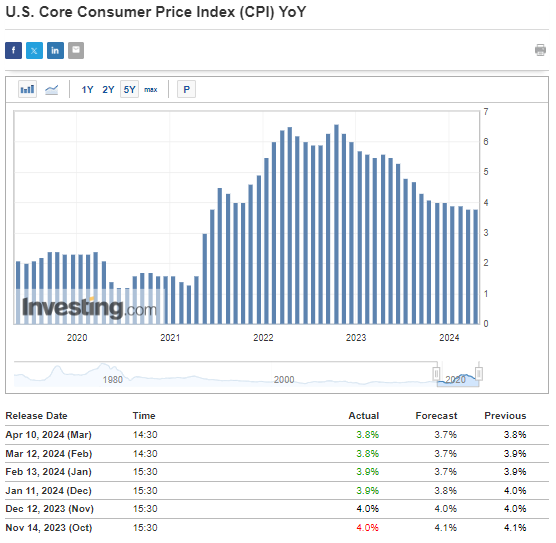

The main worry continues to be core inflation, which, as per the latest figures, stood at 3.8%, slightly above forecasts.

Taking a closer look, let's focus on services excluding energy supplies, which saw a 5.4% year-on-year increase in March. Until pressures ease up in this sector, it's unlikely we'll see a sustained return of inflation to the target level.

Currently, the first interest rate cut in the U.S. is expected in September, standing at less than 46%. In contrast, the likelihood of a cut in the UK is currently higher for August, at 66%.

Additionally, Chairman Bailey emphasized at the last Bank of England meeting that the possibility of policy easing could be on the table as early as the next meeting in May.

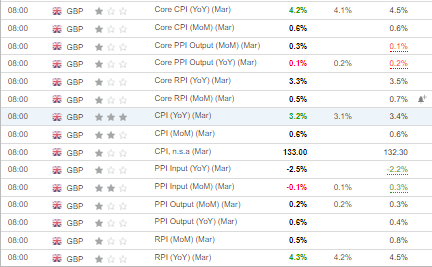

UK inflation for March came in slightly above forecasts, but it didn't cause much market movement as it closely matched expectations. Year-on-year consumer and core inflation data only exceeded estimates by a slim margin of 0.1 percentage points.

The latest data show prices slightly higher than expected for important items, but overall, there's a positive trend of prices slowing down, unlike in the US.

This suggests that those betting on the pound against the dollar might lose out, leading to further drops in the GBPUSD pair.

GBP/USD Continues Downward Trend

After breaking a crucial support level around the 1.25 mark, the GBP/USD pair has paved the way for the downward trend to continue.

Sellers are eyeing the demand zone below the 1.23 level as their next target. In the short term, what matters most is which direction the market breaks out of the recent consolidation that's been happening since the week started.

Any attempt to push the pair up might encounter resistance near the 1.25 level, which used to be a support but is now acting as resistance. A more significant bounce could encounter obstacles around the downward trend line.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as 10% discount on annual and two-year InvestingPro subscription.

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.