KraneShares last month announced the launch of the KraneShares China Internet & Covered Call Strategy ETF (KLIP). The ETF seeks to provide current income by utilizing a covered call strategy, by buying shares of the popular KraneShares CSI Internet ETF (KWEB) and selling corresponding call options on said ETF.

Assessing the previous landscape

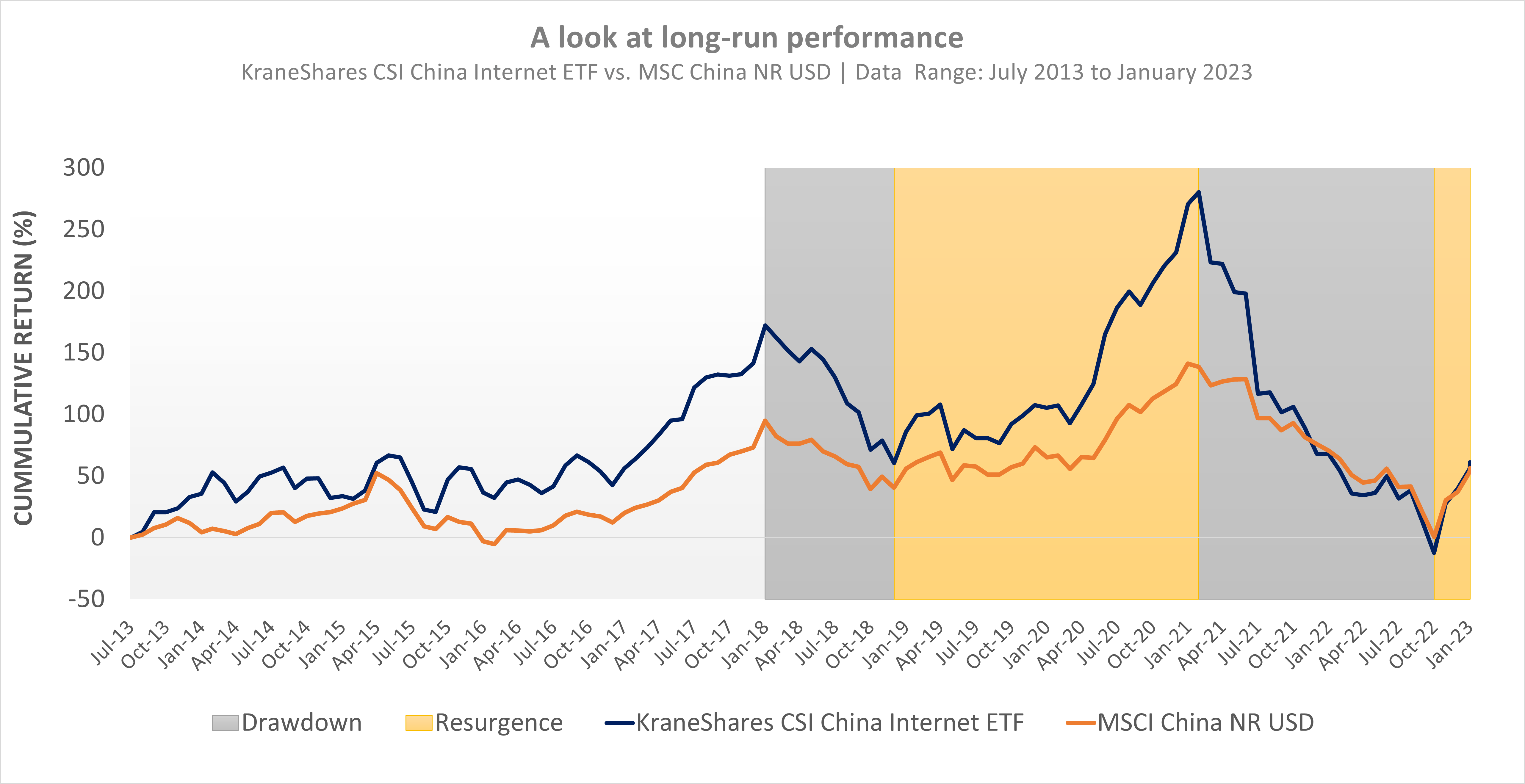

KWEB tracks the CSI Overseas China Internet index, which consists of China-based companies whose primary business activities are focused on internet and internet-related technology. In recent years, Chinese internet/e-commerce focused businesses have faced heightened regulatory scrutiny by the Chinese government, dampening any monopolistic influence well-known companies, such as Tencent, Alibaba (NYSE:BABA), and Baidu (NASDAQ:BIDU) could have on the nation’s society and economy. This stricter regulatory environment, coupled with instituted lockdowns to mitigate the spread of COVID, has had a material impact on the investment performance of these companies.

At present, the Chinese government has begun reopening the economy and removing restrictions put in place to stop the spread of COVID. Early indicators are showing a positive sentiment for Chinese equities, as there have been intimations by the Chinese government that they will ease the regulatory environment to support the private sector; a welcomed message by many Chinese big-tech firms.

Capitalizing on an inflection point

The reopening of the Chinese economy and the loosening of regulatory restrictions are good news for the private sector, however, there is still a lot of uncertainty. Tencent, one of the world’s largest video game makers, was recently granted its first license to release foreign video games in China after waiting 18 months for government approval; and while sentiment for Alibaba has buoyed, it has come at the expense of its founder, Jack Ma, who had to give up controlling rights to the Ant Group – an affiliate company of the Alibaba conglomerate. These developments highlight the latent regulatory risks to the industry that may dissipate over time or linger indefinitely, ultimately shaping the long-term performance of businesses that operate within the sector.

The KraneShares China Internet & Covered Call Strategy ETF (KLIP) provides investors with an ‘uncertainty hedge’ should these highly-regarded, Chinese internet/e-commerce focused businesses experience bumps in the road as the industry regains its footing in the near term. Furthermore, KLIP provides investors with the opportunity to generate additional income while potentially reducing volatility in their portfolio. This strategy can be a valuable tool for those looking to enhance their income and manage risk in China-focused investments.

At this juncture, the optimistic outlook and positive investor sentiment that exists for these businesses will likely result in high investor interest. KLIP allows investors to capitalize on this fervor through call option-writing, which can be truly impactful to one’s overall portfolio performance.

This content was originally published by our partners at ETF Central.