The USD traded with an offered bias during the last 24 hours, weighed down by geopolitical concerns and Friday’s US CPI report. However, there was a small shift in fortunes as weak dollar shorts (USD/JPY) were pared after comments from US Treasury Secretary Mnuchin that indicated that US tax reform is still scheduled for 2017. As well, the US Treasury Secretary talked down President Trump’s latest verbal jab at the greenback

Outside of Mnuchin dollar supportive comments, overnight currency price action indicates a greater overhang from Friday’s US CPI as the dollar remained offered despite the geopolitical risk tapering. Before Mnuchin comments USD/JPY spent most of the session testing 108.50 and positioned above 109.00 in early APAC.

Given that FX positioning is running meek in the face of geopolitical concerns and the upcoming French elections, this week’s first price action has been dictated by short term players and when coupled with liquidity being rather light whippy and scrappy, currency moves should be the flavour of the week. We should expect liquidity in currency markets to contract further as we near the weekend’s critical French election vote leading to piecemeal trading conditions at best.

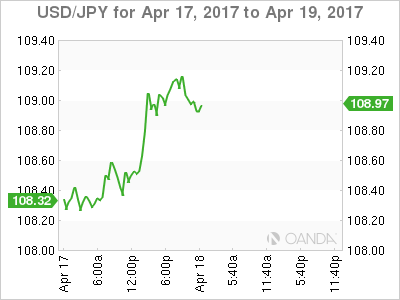

Japanese Yen

It’s hard to turn the page on the regional geopolitical risk at this juncture so that the overhang may keep the dollar bulls at bay, despite soothing comments overnight from US Treasury Secretary Mnuchin.

Short-term traders will be glued to headlines from today about the Aso-Pence interchange. It’s very unlikely any hawkish US views on trade policy will be forthcoming, which could be mildly supportive for the USD. With geopolitical risk temporarily abating, we may see some buying on the back of the geo risk premium during today’s session, which could also support the USD in the short term.

The French election risk is simmering as EUR/JPY flows are likely to also weigh on USD/JPY. With UST haven appeal still in vogue, it too should encourage any near term USD/JPY rallies to be capped.

Overall, there is a high level of reluctance to do anything as traders are shy to expand on the geopolitical theme and in no mood to buy the dollar after the latest tepid US economic data. All in all, investors are content to sit idle, waiting for the storm clouds to break before re-engaging, even if it means being caught behind the initial market moves post-French election.

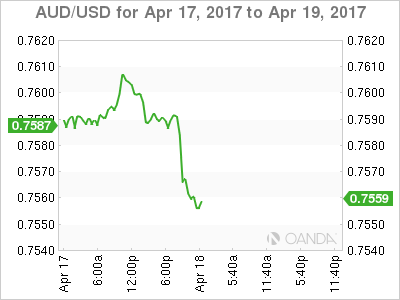

Australian Dollar

The Aussie caught the wind in its sails from Chinese economic data on Monday, and the soft US core CPI figures for February released on Friday but faltered when US Treasury Secretary Mnuchin talked down President Trump’s verbal jab at the greenback late last week.

As with most of the G-10 space, positioning is running light as there’s a reluctance from dealers to chase current price action with regional geopolitical risk weighing and French election uncertainty brewing.