I like to think about equity styles as "fashion trends" – that is, they take turns rotating in and out of vogue. For instance, while growth performed admirably over the last decade, value saw a resurgence in 2022 for the former faltered.

Another equity style that did well last year was dividend investing, both in terms of high-yield dividend stocks, dividend growth, and quality dividend stocks. However, most dividend ETFs in Canada have a domestic market focus, which can limit diversification.

The Canadian economy is already concentrated heavily in two sectors: financials and energy. Domestic dividend ETFs tend to take this a notch higher thanks to the tendency of companies in these sectors to pay above-average yields.

To simplify the matter, I think there's a case for considering dividend ETFs with built-in global diversification. Currently, there are a few ETFs that provide exposure to Canadian, U.S., and international dividend stocks all within a single ticker. Let's look at the available options.

iShares Core MSCI Global Quality Dividend Index ETF (XDG)

A low-cost option from iShares is XDG, which tracks the MSCI World High Dividend Yield Index. This ETF screens holdings for a combination of solid balance sheets, less volatile earnings, steady or increasing dividends, and an above-average dividend yield (12-month trailing yield of 3.36% as of April 18, 2023).

For a reasonable 0.22% expense ratio, XDG currently provides exposure to just over 330 dividend stocks from U.S., Canadian, and international developed markets. Due to the size of the U.S. market, dividend stocks from there currently hold the largest weighting at around 58%.

For those looking to avoid foreign exchange volatility, the ETF is also available in a currency-hedged version as XDGH. With this version, appreciation or depreciation of the CAD versus other currencies will no longer affect returns, whether positive or negative.

Franklin Global Dividend Quality Index ETF (FLGD)

A competitive alternative to XDG is FLGD, which tracks the unique LibertyQ Global Dividend Index for a higher, but still reasonable expense ratio of 0.37%. Unlike XDG, FLGD also includes dividend stocks from emerging market countries, which adds another source of risk and return.

FLGD's index takes a different approach to screening for quality dividend stocks. The index excludes stocks with a negative year-over-year Dividend per Share (DPS) growth in any of the last five years, and also screens for a stable history of dividend payments and quality fundamentals.

FLGD also has return on assets (ROA) and return on equity (ROE) metrics of 11.30% and 27.37% respectively, compared to 9.93% and 20.03% for the MSCI AC World ex-REITS Index, demonstrating strong financial performance and efficient management of resources by its underlying companies.

Dynamic Active Global Dividend ETF (DXG)

Finally, we have DXG, which is truly actively managed. With this ETF, Dynamic Funds currently focuses on just 27 large and mid-cap companies that they view to be profitable, well-financed, and trading at attractive valuations, along with expectations of growing dividends.

As an actively managed ETF, DXG is fairly pricey, with a 0.82% expense ratio. Currently, the ETF's active share metric stands at 92.8%. This is a measure of how much the ETF's portfolio holdings differ from its benchmark index, with more being arguably better for actively managed ETFs.

Why is this? Well, if I was paying 0.82% for an actively managed fund, I'd like to ensure that the fund managers are actually exploiting opportunities they deem attractive and not just tracking the index with a few minor changes here and there. In other words, I'd like to get my money's worth.

Global dividend investing: Summary

Depending on your views about passive indexing versus active management, either of the three ETFs above could suffice to provide global dividend equity exposure.

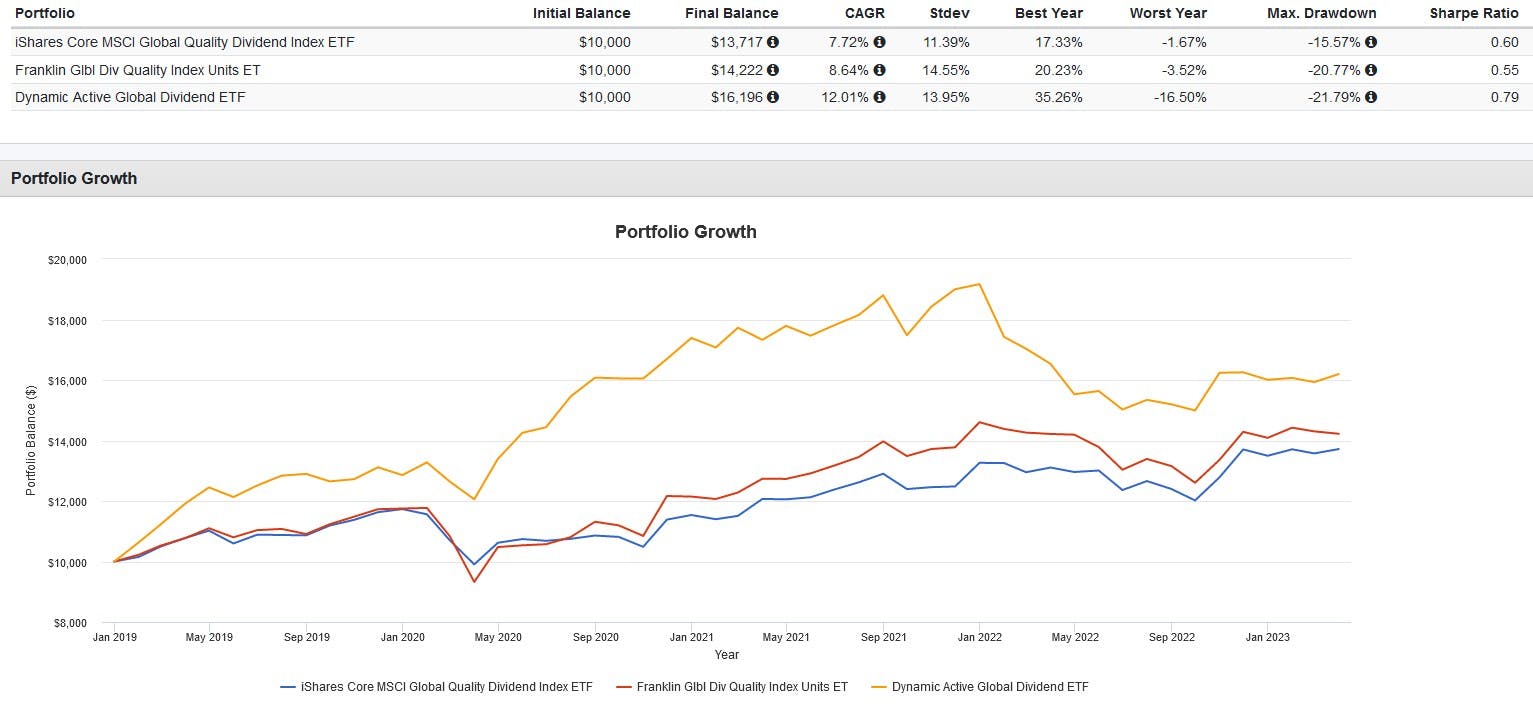

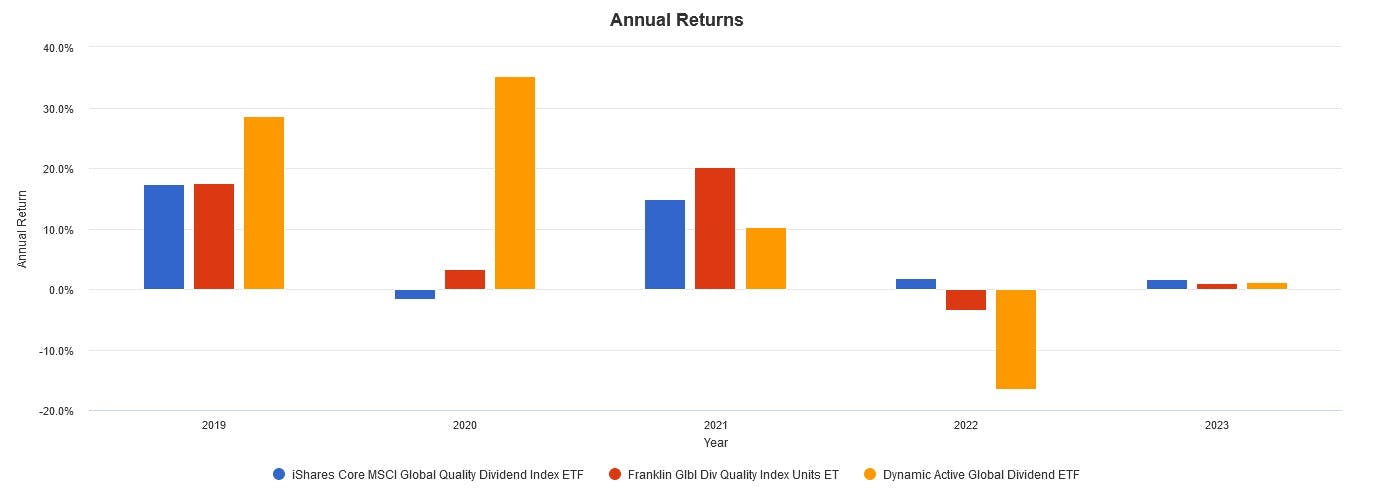

Below, I've provided a backtest of all three ETFs' historical performance on a trailing and annual basis. Keep in mind that these outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results.

This content was originally published by our partners at the Canadian ETF Marketplace.