A third straight close above $1,860 is indicating that gold bulls may be closer than ever to their target of the past five months: a return to $1,900.

Since slipping in June from the final mile to the $2,000 level, longs in bullion have hoped the rally will return and they can reprise the record highs seen during the height of the COVID-19 crisis.

For months gold failed to act as the inflation hedge it is meant to be. Its return to that role over the past two weeks has encouraged the pro bullion crowd.

In Monday’s trade on New York’s COMEX, gold’s benchmark December futures peaked at $1,873—just $23 short of the $1,900 target. For three straight days, December gold has also made intraday peaks of $1,870 or higher.

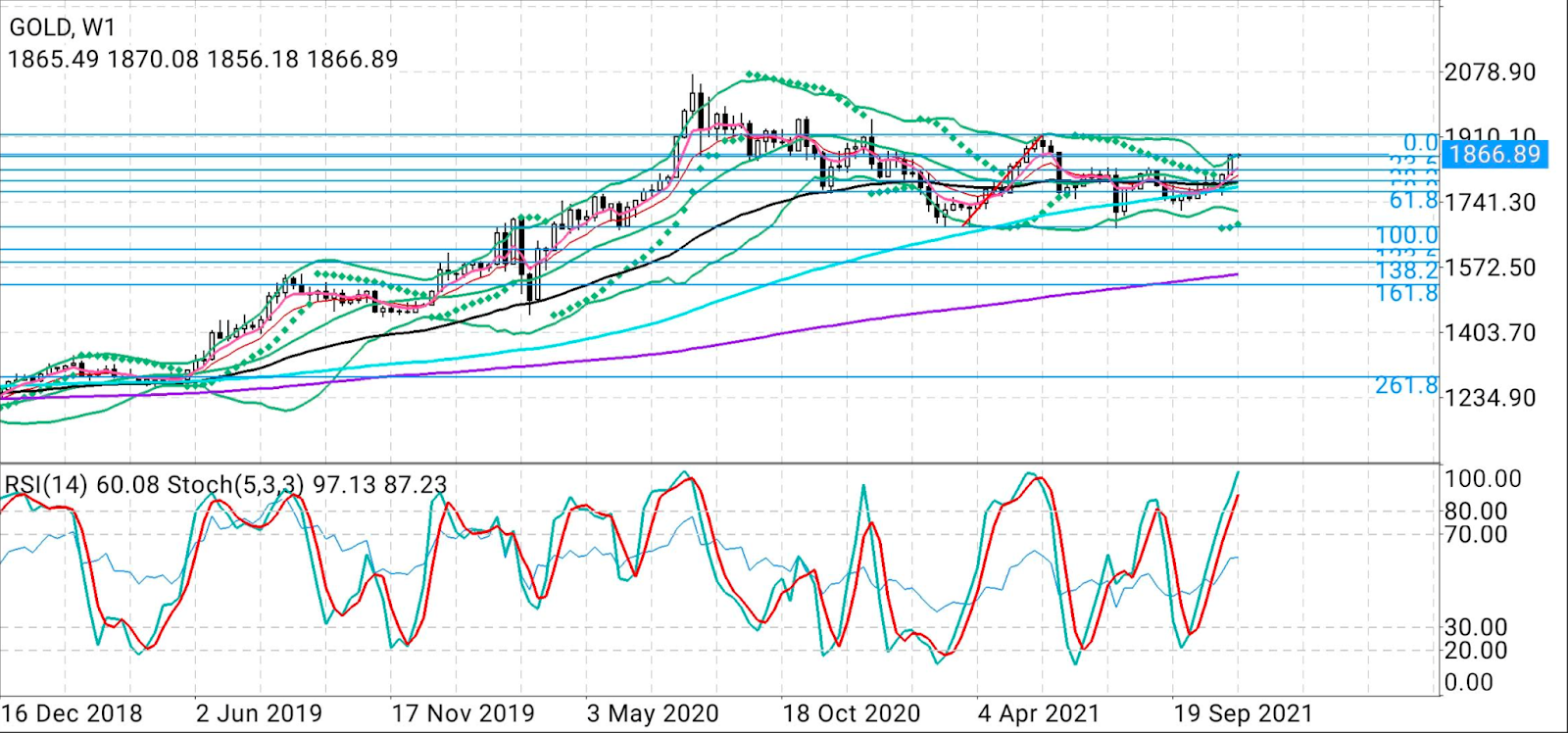

All charts courtesy of skcharting.com

All these moves have strengthened gold bulls' belief that the $1,900 level is finally theirs for the taking, after a series of false starts since June.

“Ultimately this is a market that I think has shown its hand, meaning that we are more than likely going to continue to see upward pressure over the longer term,” Christopher Lewis, who blogs on gold, wrote in a post on FX Empire.

“This is mainly due to the fact that interest rates in the United States are not keeping up with the potential inflationary headwinds, so as long as that is going to be the case, gold has a real chance to make headway.”

Gold’s run-up this time was heightened by the US Consumer Price Index (CPI)—which represents a basket of products ranging from gasoline and health care to groceries and rents—increasing 6.2% during the year to October. It was the fastest growth in the CPI since November 1990, an acceleration driven mostly by prices of fuel at the pump running at seven-year highs.

Bullion has always been touted as an inflation hedge. But it wasn’t able to live up to that billing earlier this year as intense talk that the Federal Reserve will be forced into a faster-than-expected rate hike sent Treasury yields and the dollar rallying at bullion’s expense.

That trend abated somewhat after Fed Chair Jay Powell assured markets earlier this month that the central bank will be patient with any rate hike and that it will only come in the later half of next year.

But with the US 10-year Treasury note, a key indicator of real interest rates, hitting a three-week high of 1.62% on Monday, the Dollar Index reached a 10-day peak of 95.46. That sparked fresh speculation that the Fed may have to dump its 'patient-for-now' stance over inflation and raise rates faster than its planned timeline of between July and December 2022.

Still, gold did not crumble on Monday.

“Gold has become popular despite higher yields and a stronger dollar, as inflation-adjusted yields remain at their lows,” said Craig Erlam, analyst at online trading platform OANDA.

“It's also been seeing some love for its role as an inflation hedge, as we saw in the aftermath of the US CPI data last week. If policymakers continue to stick to the transitory line, gold could continue to see support.”

Gold last traded at $1,900 levels in June.

Prior to that, it hit record highs above $2,100 in August 2020 after rallying from below $1,500 in March, during the height of the coronavirus pandemic.

Technically, the $1,900 level was available for gold’s taking, said Sunil Kumar Dixit, chief technical strategist at skcharting.com.

“Gold has closed above $1,860 for three days, and a week close of $1,860 is the 23.6% Fibonacci level—which is a good affirmation for continuation towards the path of least resistance, i.e. $1,900-$1,916,” said Dixit.

However, with Monday’s slight drop of 0.1% at settlement, the spot price of gold, which skcharting.com tracks, may be exhibiting some correction tendencies, he added.

Dixit said spot gold’s Stochastic Relative was overbought in daily and weekly time frames and this may cause some sideways action without hurting the uptrend.

“Breaking below yesterday's low of $1,856 could also prompt a mild correction to the 10-Day Exponential Moving Average of $1,846 and the 38.2% Fibonacci level of $1,825,” he said.

“I foresee a small resistance at $1,875-1,880 enroute.”

Lewis, who posted his outlook on FX Empire, made a similar point.

“The market has gone somewhat parabolic, so a red candle is probably one of the best things we can see. The move has been rather impressive, but it is difficult to imagine a scenario where we simply go straight up in the air. I think pullbacks at this point in time will more than likely be buying opportunities but try to find some value before you put a lot of money to work.”

Lewis urged investors in gold to pay close attention to the dollar, “because if it starts to strengthen, that could cause a little bit of a headwind.”

Yet, if the spot price crosses Monday's peak of $1,870, it could extend the upside move to $1,881 on an intraday basis, setting a breakout target of $1,900-$1,916 in the short term, Dixit said.

“There is hardly any critical resistance before $1,900-$1,916, as long as gold sustains above $1,860,” he added.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.