Since last week, I warned gold bears that gold was about to make a strong rally towards at least $1,330-40. Yesterday we saw gold price break above $1,350, but the most important is the structure of the rise from $1,302 that is impulsive.

Black line -trend line resistance

Gold price has broken above the black trend line resistance and the Ichimoku cloud on the four-hour chart. This is a bullish sign. The form of the rise is impulsive implying more upside is expected after a pullback. There is no sign yet of a pullback but once it comes I believe it should be bought.

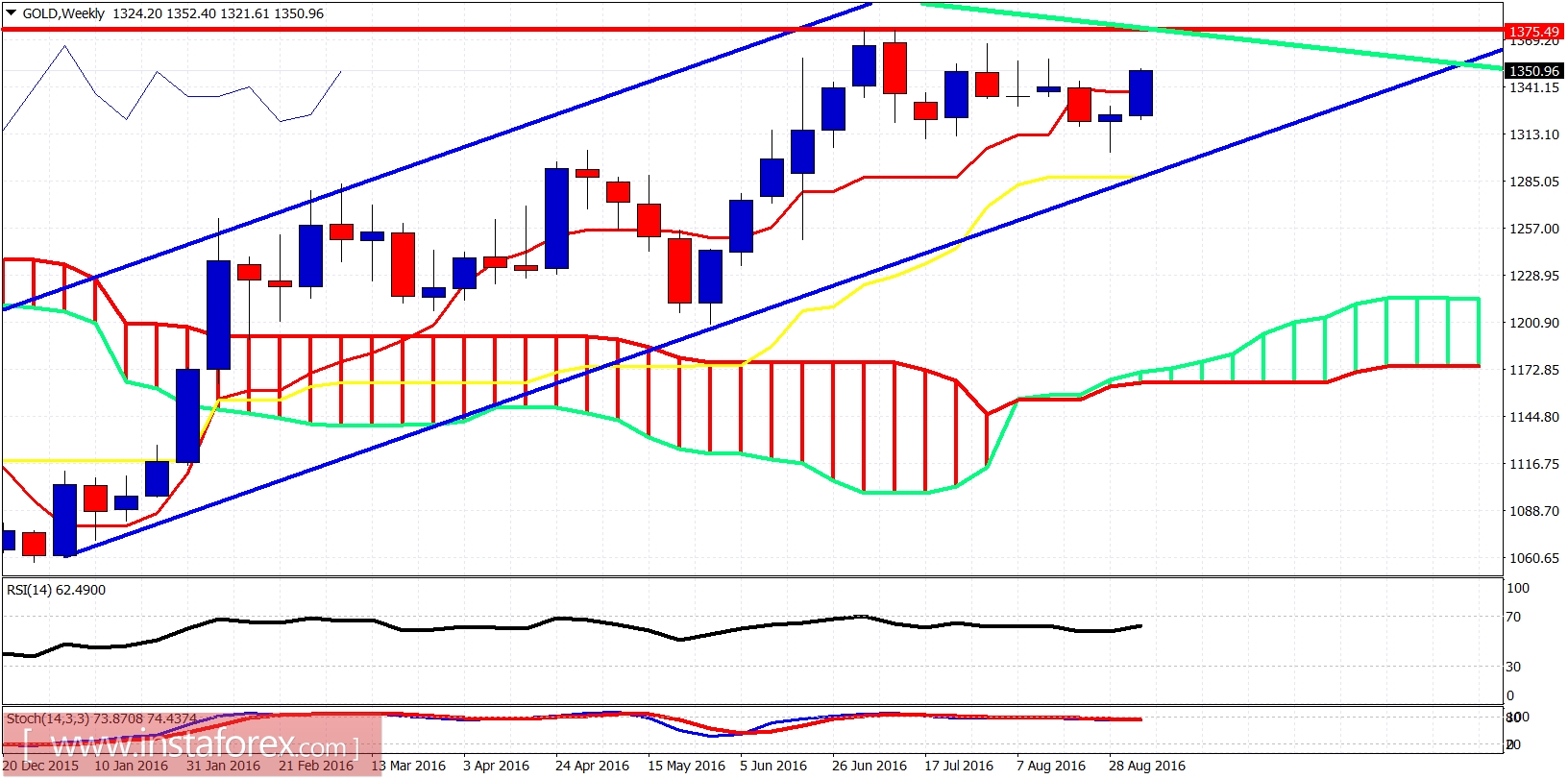

Blue lines - bullish channel

The bullish reversal hammer candlestick from last week is given the follow through bulls needed. Price has broken above the weekly tenkan-sen (red line indicator) implying that the recent highs will be tested. Price remains inside the bullish channel.

With the bounce coming this high and the decline from $1,375 being clearly corrective, a break below $1,300 will open the way for a move to $1,200 which is the next buy level for a long-term move up. For now we assume the decline is over and the most probable scenario is that any pull back will not break below $1,300.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.