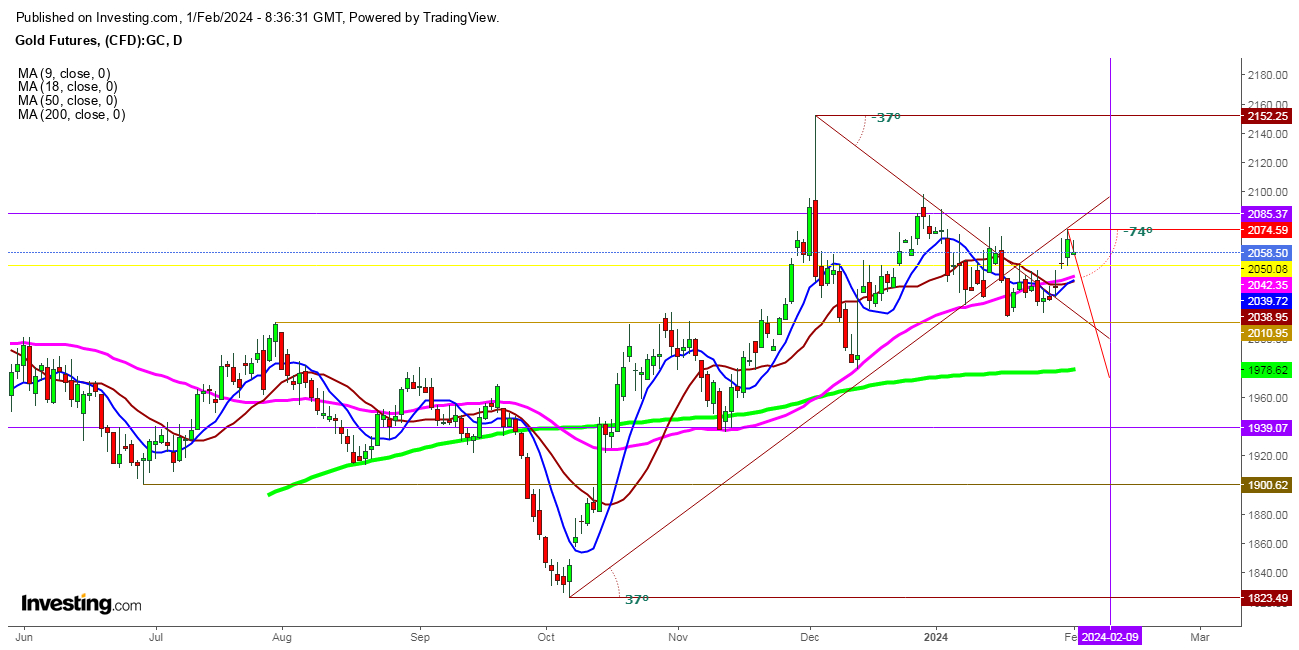

Since I wrote my last analysis, I find that despite the surging hopes for a rate cut of 25 basis points by the Fed in its meeting on Jan.30-31, gold futures continued to witness selling pressure below the immense resistance at $2067 this week.

On Thursday, gold futures look to gain weakness while the dollar hovered near a seven-week high after the Federal Reserve kept interest rates steady and shot down expectations for a March rate cut.

Most of the markets have been showing exhaustion since Fed Chair Jerome Powell said the bank was in no hurry to begin cutting interest rates, especially by March 2024. But Powell noted that the U.S. economy remained resilient and stopped just shy of declaring victory over inflation. This spurred bets that the Fed’s rate cuts will only be delayed by a few months, with markets now positioning for a May rate cut.

I find that the Fed could potentially cut rates by a bigger margin later this year to make up for a delay in the rate cuts.

Undoubtedly, the immediate impact of the Fed’s hawkish tone looks evident enough to result in a slow and steady slide in the yellow metal as the reversal of strength in the dollar index looks quite strong to keep the precious metals under pressure as the focus tilted towards the upcoming meetings of the Fed in April and May 2024.

In the daily chart, the formation of an exhaustive candle on Thursday looks evident enough for a steady but slow exhaustion is likely to continue despite the increasing probabilities of a steep slide before Jan. 9, 2024, as the exhaustive candle formed in today’s trading session ensures the entry of big bears after the Fed’s move.

Watch my attached video, which I uploaded on Jan. 20, 2024.

Disclaimer: The author of this analysis may or may not have any position in the Gold futures. All the Readers are requested to take any long or short trading position at their own risk.