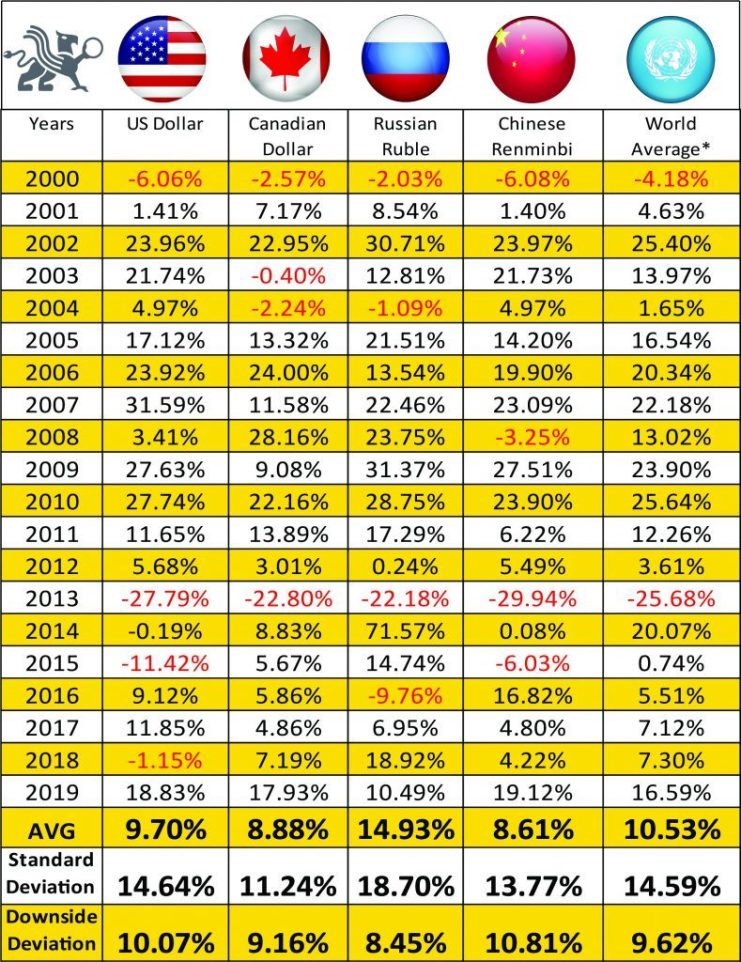

Gold had a good year in 2019, rising about 18%. Since 2000, gold has averaged 11% annually in the major currencies, with 9.7% in USD and 8.8% in Canadian.

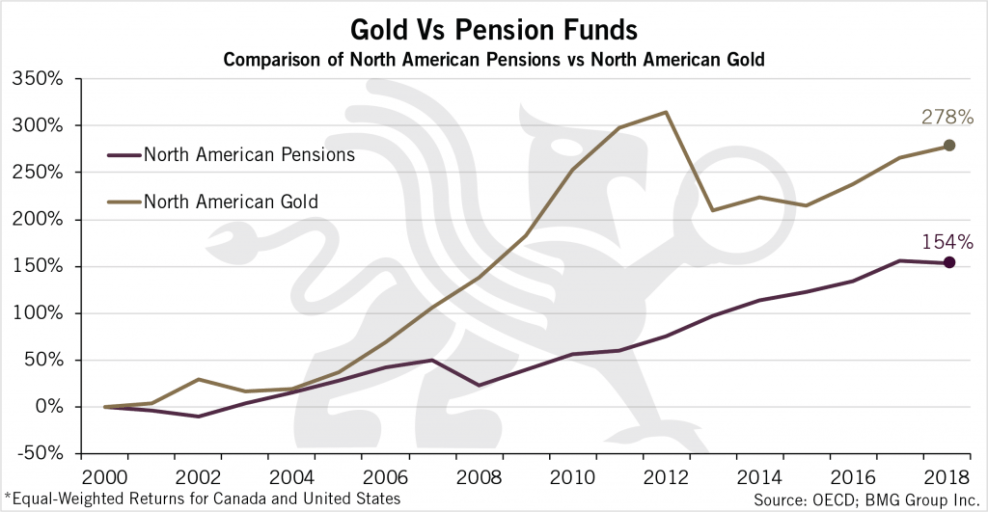

Average North American Pension Returns vs. Gold

According to the OECD, the average annual 15-year pension returns were 6.6% in Canada and 2.6% in the U.S., and an allocation to gold would have improved returns and reduced volatility. Unfortunately, only three global pension funds have any gold and most have no allocation to REITs.

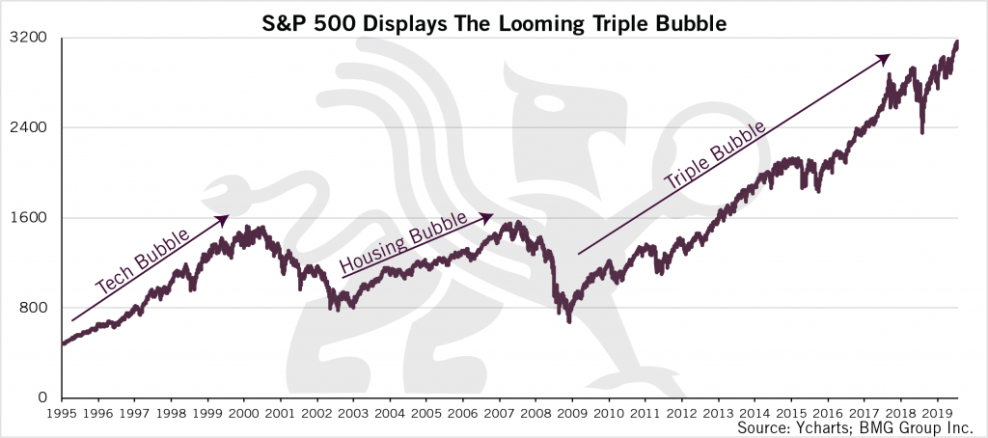

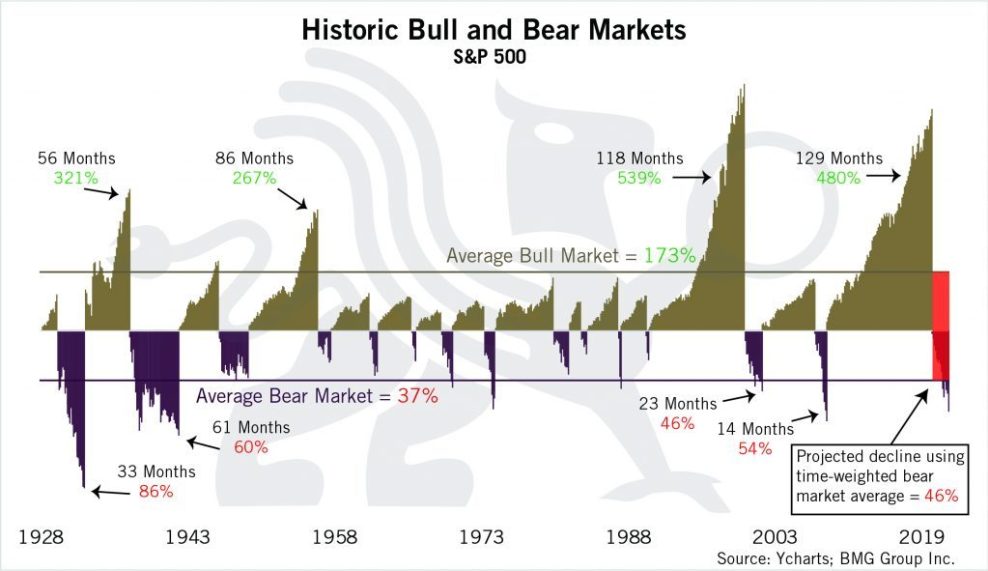

The Next Correction Will Be Worse Than 2008

This is the first time during the 40 years I have been in business that a simultaneous triple bubble in equities, bonds and real estate has occurred.

There is a direct correlation to the amount of liquidity central banks are injecting into the system on a daily basis and these inflated asset prices.

Many economists and financial analysts believe the next correction will be worse than 2008, and some think worse than 1929.

All the factors mentioned above will contribute to making the next correction much worse than 2008.

Historic Bull and Bear Markets (S&P 500) from 1928 to 2019

Whereas the 2008 crisis was largely due to changing perceptions of the quality of $1.2 trillion of sub-prime mortgage debt, today,

What the Future Holds

In the near future, it will only take a small percentage of the $350 trillion in financial assets reallocating to gold to cause an exponential rise in price.

When it becomes obvious to market participants that the next correction is upon us, it will become difficult for pension funds to achieve a meaningful percentage allocation without driving the price to multiples of today’s price.

Allocation Of Gold In a Portfolio

During times of market instability, gold serves its primary purpose of preserving wealth better than any other asset class and it is during market downturns that gold transfers wealth.

From a long-term strategic viewpoint, a20% portfolio allocationt o gold will reduce portfolio volatility and improve returns.

The above excerpts from the original article by Nick Barisheff have been edited and abridged for the sake of clarity and brevity. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.