Last week’s review of the macro market indicators noted that heading into August options expiration the Equity markets continued to look strong but maybe in need of a short term pause. Elsewhere looked for gold to consolidate in its uptrend while crude oil rose. The US Dollar Index seemed content to move sideways in broad consolidation while iShares 20+ Year Treasury Bond (NYSE:TLT) consolidated near their high.

The Shanghai Composite and iShares MSCI Emerging Markets (NYSE:EEM) were both biased to the upside for the week. Volatility looked to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed that the SPY (NYSE:SPY) and IWM might need a pause or retrenchment in the short term, while the QQQ continued to lead.

The week played out with gold probing higher only to pullback and end the week near unchanged while crude continued its march higher. The US dollar drifted lower in the consolidation range while Treasuries pulled back to start the week and then held. The Shanghai Composite jumped up over its 200 day SMA and consolidated while Emerging Markets met resistance and consolidated in a tight range.

Volatility continued at abnormally low levels, with a short spike mid week that was quickly reversed. The Equity Index ETF’s all started the week to the upside but then embarked on a two day pullback before rebounding and finishing near unchanged. All of this happened in a very narrow range. What does this mean for the coming week? Lets look at some charts.

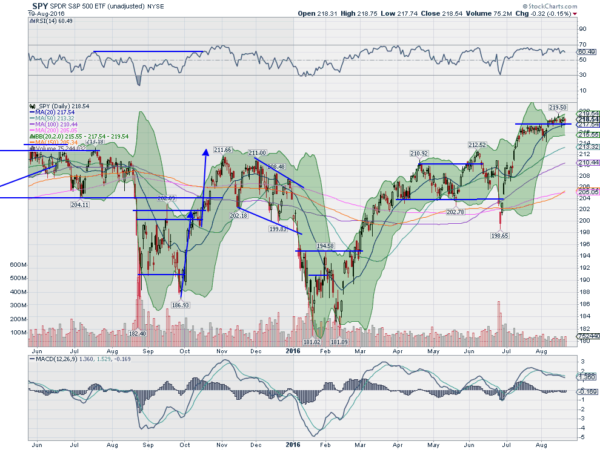

SPY Daily

The SPY started the week strong, pressing to a new intraday high at 219.50 and then new all-time closing higher at 219.09 on Monday. But that was all it could muster for the week. The last 4 days held in a tight range covering less than 2 points. The consolidation is happening over the high plateau from July and the 20 day SMA. The daily chart shows the Bollinger Bands® turned higher and the RSI moving sideways in the bullish zone. The MACD continues a slow pullback with a shallow slope and in positive territory. Overall a positive chart with digestive price action on this timeframe.

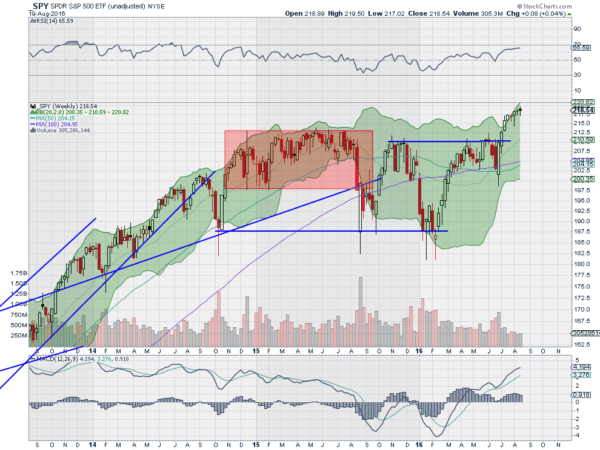

The weekly chart shows a second doji candle after the Hanging Man. These are indecision candles and can resolve either way. The RSI is in the bullish zone and running sideways on this timeframe as well, while the MACD is rising. The Bollinger Bands® are rising on this timeframe as well. There is resistance at 219 and 219.50 and then a price objective to at least 222.70 on an Inverse Head and Shoulders pattern.

Fibonacci extensions of a retracement of the leg lower from December point to the 138.2% at 222.43, the 150% at 225.96 and the 161.8% at 229.48. Support lower comes at 218 and 217 followed by 215.70 and 215 before 214. Possible Consolidation in the Uptrend.

SPY Weekly

With August Options Expiration in the rear view mirror, the equity markets are looking settled and stable, digesting their moves higher. Elsewhere look for Gold to consolidate with an upward bias in its uptrend while Crude Oil continues to pump higher. The US Dollar Index looks to continue lower in its broad consolidation while US Treasuries are biased lower in their short term consolidation. The Shanghai Composite looks to continue higher but Emerging Markets look ready to consolidate or pullback short term in their uptrend.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts suggest more sideways motion in the short term with the possible exception of the IWM which is drifting higher. Longer term, the topping candles suggest a pause or pullback may be in order soon. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.