Gold Non-Commercial Positions:

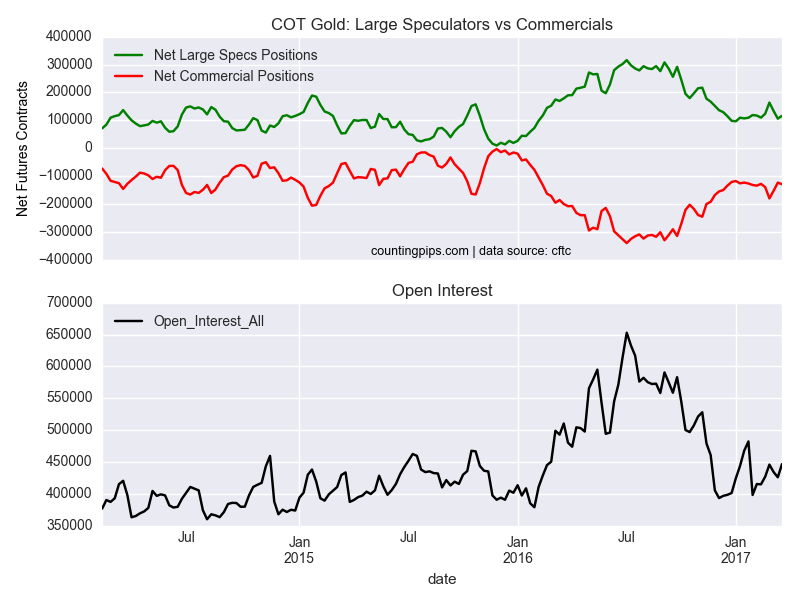

Large speculators and traders increased their bullish net positions in the gold futures markets last week following two weeks of sharp declines, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of 116,252 contracts in the data reported through March 21st. This was a weekly rise of 10,214 contracts from the previous week which had a total of 106,038 net contracts.

Gold speculative positions have remained in a rather tight range mostly between the +100,000 and the +130,000 contract levels since the beginning of the year (a jump to +163,000 contracts on Feb 28th being the exception).

Gold Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -128,997 contracts last week. This is a weekly change of -5,710 contracts from the total net of -123,287 contracts reported the previous week.

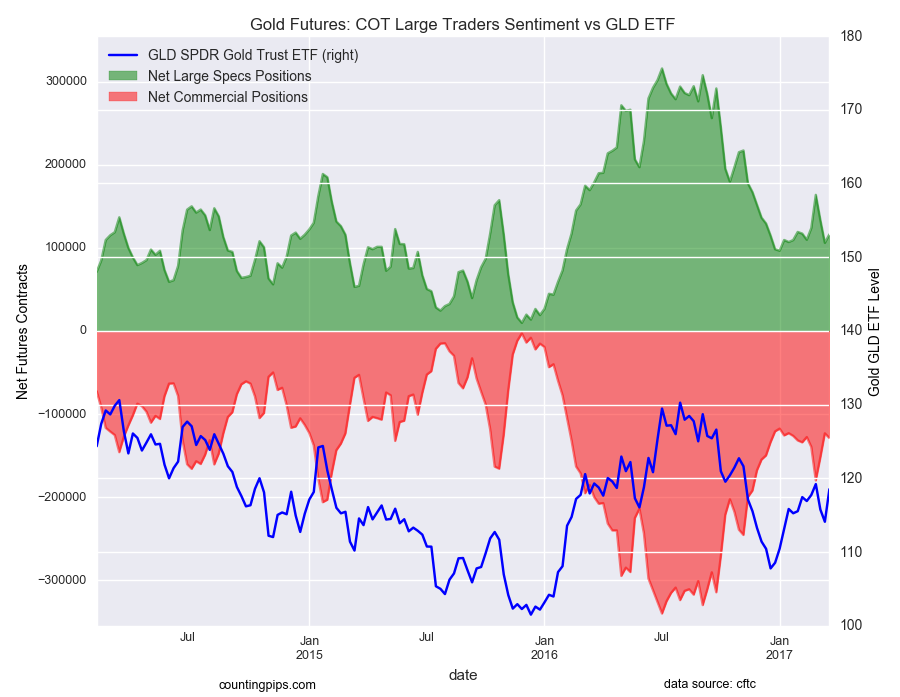

Gold ETF (NYSE:GLD):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $118.54 which was a gain of $4.42 from the previous close of $114.12, according to ETF financial market data.