When gold broke out of the falling wedge pattern early January last year, we were quite confused whether the long term downtrend was completed or we are still looking at a futher downside. Rallied to as high as $1,375/oz in the summer of 2016, the move was stalled as Feds were sending rhetoric that rate hike was imminent as US economies improves.

US GDP indeed increased more than expected for three consecutive quarters in 2016. Though gold saw a spike up to almost $1,340 on US Presidential election day in November, the move was short lived as market is geared to welcome the rate hike on December 14th. On the other hand, Feds didn't quite deliver its promises for a 3 rate hike in 2016.

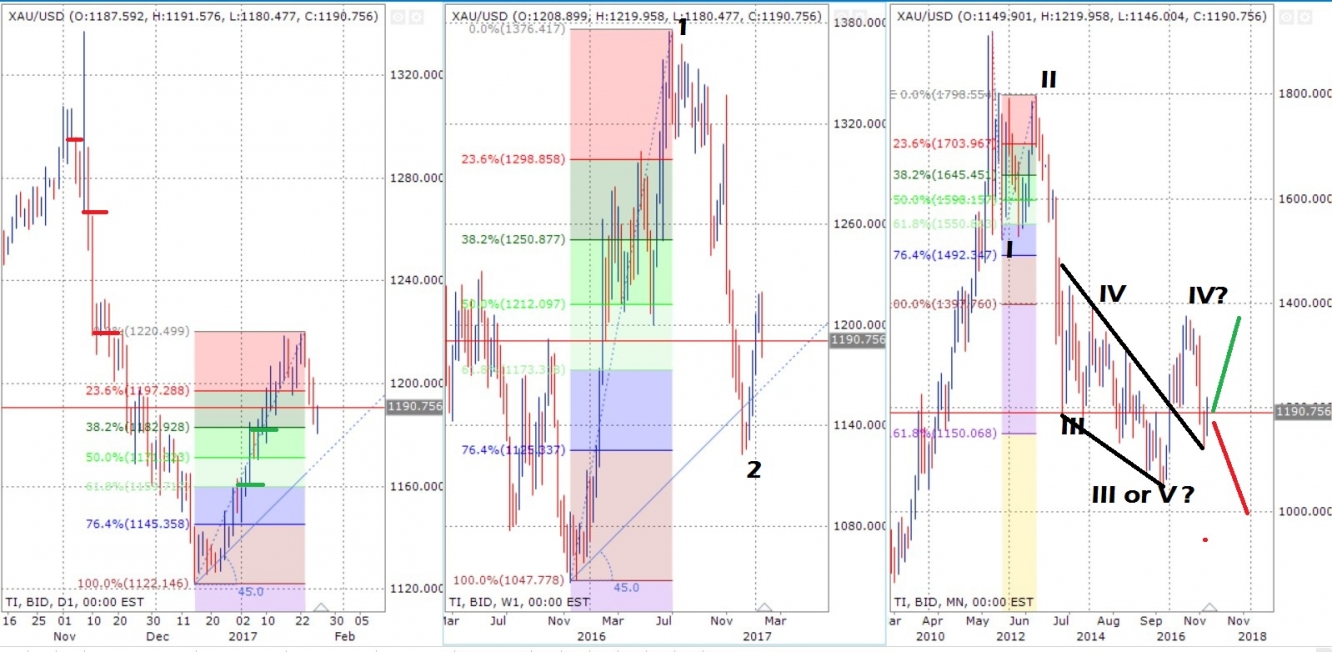

Looking at the monthly chart, we are convinced that the downtrend was completed; as wave 3 usually extends around 161.8% of wave 1, calculated from the base of wave 2. Therefore, the low of December 2016 was the focal point for further upmove. It marks the end of correction for the first impulse wave up. The Q4 US GDP last Friday that was way below previous report (1.9% vs 3.5%) and missed analyst expectation by 0.3% might as well be the catalyst for further gold buying.

Sentiment on the futures markets, confirmed that the downmove post US election was a pullback, instead of a new thrust down, as volume contracted. Indeed, large speculators net long during the week of December low last year was higher than the low during December 2015 (129,311 vs 9,750 contracts).

In the weeks and months to come, we believe that the demand for dollar is more of a political than economic. Recent comments of the new US President Donald J. Trump that the greenback is too strong has dented dollar rise and a potential trade war with China sure could raise uncertainties, which in turn benefits the precious metal complex. Halal Traders look forward to buying on dip with stop on close at $1,150 and limit at $1,280 and $1,380 for this year.

Please read our risk warning disclaimer.