Big data giant Palantir Technologies Inc. (NYSE:PLTR) has been on quite the run over the past year. The stock has surged north of 74% year to date, fueled by stellar quarterly results and robust positioning in the artificial intelligence race. While estimates point to superb growth ahead, the positive sentiment might boost the stock in the short term, but downside risks are increasing. Moreover, the stock has gotten remarkably overbought lately, which points to choppiness ahead.

In today's digital age, companies are flooded with boatloads of data. However, that data is valuable only if it can be efficiently harnessed, visualized and applied to enhance decision-making. The challenge lies in data being scattered across various systems, with critical pieces isolated in platforms that need to communicate more effectively. Palantir, though, offers a one-stop shop solution that effectively consolidates disparate data

into a unified platform. Unsurprisingly, the company has seen demand grow strongly, with AI adding new layers to its story.

Nevertheless, in recent weeks, we have seen tech stocks, particularly those led by AI, take a massive hit. Palantir, however, posted double-digit growth. That leaves little margin for error, though, with even the slightest miss in sales, free cash flow or earnings per share potentially triggering a sizeable drop in value.

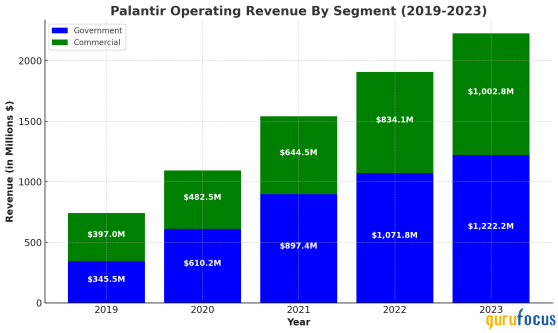

Strong surge in commercial segment expansionPalantir has often been criticized for being a one-trick pony, heavily reliant on government contracts. However, over the past few years, its commercial business has become a much larger part of the overall picture. Diversifying its revenue base has enabled the company to effectively tap into the evolving demand for AI and data analytics solutions across various sectors. Additionally, it allows the company to reduce the risks associated with the cyclical nature of its government business.

Source: Author created based on filings

The chart above shows the remarkable strength of Palantir's commercial business, especially from 2020 onward. The government segment has grown from a relatively modest $345.50 million in 2019 to $1.22 billion last year, but its commercial segment's growth has been even more remarkable. Commercial revenue nearly tripled from $397 million in 2019 to roughly $1 billion in 2023.

Recent results, especially in its commercial segment, have been even more impressive, as noted by CEO Alex Karp in an interview around the time of the first-quarter earnings call. He said, "Our commercial business is exploding in a way we don't know how to handle. We don't know what to do with the onslaught of demand."

The table below shows Palantir's quarterly segment revenue over the past three quarters. In the second quarter, the company's government revenue reached $371 million, growing 10.70% sequentially and 23% year over year. Moreover, its commercial segment grew at a more impressive pace, generating $307 million and growing 32.40% on a year-over-year basis.

Source: Author created based on filings

The first quarter showed more balanced growth between the two segments, with government revenue of $335 million rising 15.90% and commercial revenue of $299 million jumping 26.60%. The fourth quarter of 2023 marked the highest sequential growth for Palantir's commercial segment at 13.30%, reflecting strong momentum in the lead-up to 2024.

A deeper look at the second quarter shows incredible momentum in its commercial business, marked by a superb increase in client count.

Revenue surged 27% year over year and 7% sequentially to a substantial $678 million. Notably, commercial sales in the U.S. gained 55% year over year to $159 million, with customer count rising 83% to 295 customers. The remaining U.S. commercial deal value also increased remarkably, jumping 103% year over year and 11% sequentially. Moreover, it closed 27 deals over $10 million, with the overall customer count growing 41%, contributing to a robust net income of $134 million.

Moreover, Palantir has achieved stellar progress in the crucial rule of 40 metrics. Rule of 40 shows the sum of the company's year-over-year revenue growth and its adjusted operating margin for each period presented.

Source: Palantir's second-quarter 2024 filing

The company's most recent filing illustrates its rule of 40 performance. Starting from the third-quarter of 2022 at 39%, the metric experienced a slight decline to 38% in the second quarter of 2023. However, from that point onward, the metric has consistently improved, topping out at 64% by the second quarter of 2024. This trend reflects Palantir's operational efficiency in boosting growth, positioning it well for financial health and long-term sustainability.

Technical indicators point to an overheated stockShares of Palantir have seen a remarkable bump in value over the past several years, with 2023 being a particular standout. The stock is currently trading near its 52-week high of $30.36, consistently notching higher highs over the past year.

Source: Author created based on GuruFocus data

The company's quarterly beta values point to substantial volatility following a steep drop from 2.68 in September 2023 to 1.27 in December, followed by a gradual recovery. However, the recent stabilization near 1.70 hints at a more consistent risk profile.

Over the past three years, we have seen the stock experience significant fluctuations. It reached an all-time high of $39 in early 2021, but soon went into correction territory. However, from late 2022 onward, there has been a noticeable recovery in its price, with the stock consistently making new highs. The current bullish trend has everything to do with investor confidence, driven by Palantir's growing position in the AI and data analytics sectors.

Source: Author created based on historical data and author calculations

Technical indicators confirm the bullishness in Palantir. Its moving average trend shows the stock has been rising steadily, with the 200-day average at 21.82 and the year-to-date average at 22.94, indicating a healthy upward trend over a sustained period. The price change metric underscores this positive momentum further, particularly with a significant 13.81-point increase over the 200-day period.

However, the relative strength index shows a gradual decline from 68.01% over nine days to 57.08% over 100 days, suggesting that despite the bullishness, Palantir's stock might be losing some momentum relative to the broader market. This could mean a potential consolidation phase or reduced buying interest.

Therefore, it is hard to overlook that the stock is currently trading in overbought territory. Moreover, a competitive analysis shows the shares command the highest price-sales ratio, surpassing 28.40. Furthermore, Palantir is trading 38% above its five-year average price-sales ratio of 19.30.

The bottom linePalantir has experienced a remarkable surge in its share price over the past year, driven by stellar quarterly performances and strong AI positioning. Though the market remains optimistic about its future expansion, its overbought status suggests potential volatility ahead.

Nonetheless, its AI prowess shines through its cutting-edge platform, leveraging large language models to deliver actionable insights across multiple sectors. Palantir's boot camps, where businesses develop tailored use cases, have sharply increased its commercial customer base. Despite recent market challenges, the stock continues to rise rapidly. However, its shares trade at a remarkably high price multiple, with even the slightest miss in performance triggering a significant drop in value.

This content was originally published on Gurufocus.com