Will the summer rally in bonds survive the autumn? Fresh doubts are bubbling as the market reconsiders a range of risk factors, including renewed skepticism about the Federal Reserve’s commitment to cutting interest rates.

In a concerted effort to maintain the dovish narrative, a trio of Fed heads on Monday recommended “gradual” and “modest” rate cuts. Fed funds futures this morning align with their collective view: the market’s pricing in an 88%-implied probability for a ¼-point cut at the next FOMC meeting on Nov. 7 and a 67% probability for another ¼-point drop at the Dec. 18 meeting.

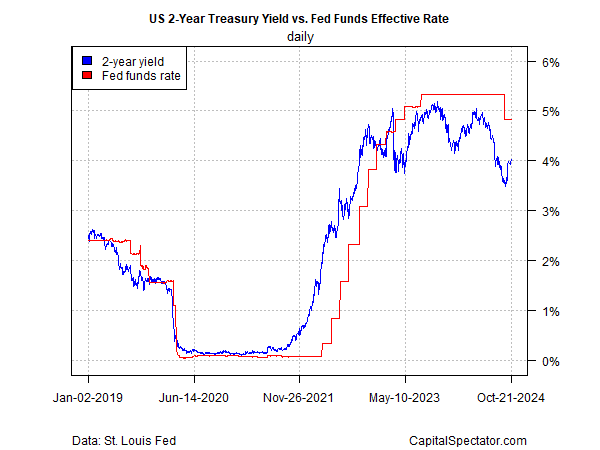

The policy-sensitive US 2-year Treasury yield also remains on board with an outlook for lower Fed funds target rate.

The 2-year rate, which is widely followed as a proxy for policy expectations, was 4.01% yesterday – far below the current 4.75%-to-5.0% target rage – a strong sign that the market expects rate cuts.

Note, however, that the 2-year yield has run higher in recent weeks. In late September, this maturity was approaching 3.5% and is now 50 points higher. There’s still a solid implied rate-cut forecast in the market, but the crowd is starting to dial down the degree of conviction.

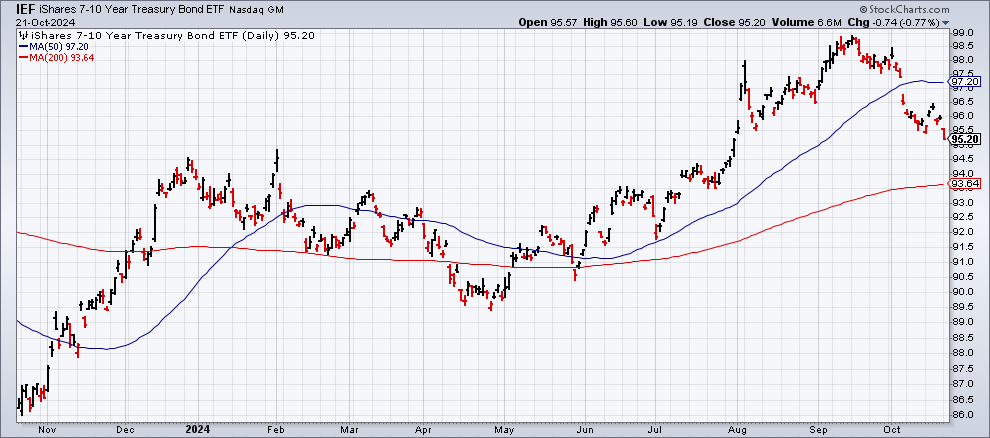

Treasury yields generally have rebounded, taking a toll on bond prices (which move inversely with yields). Consider the iShares 7-10 Year Treasury Bond ETF (NASDAQ:IEF), which fell to its lowest level since July 31.

Some analysts advise that there are more than doubts about Fed rate cuts animating the selloff on bonds.

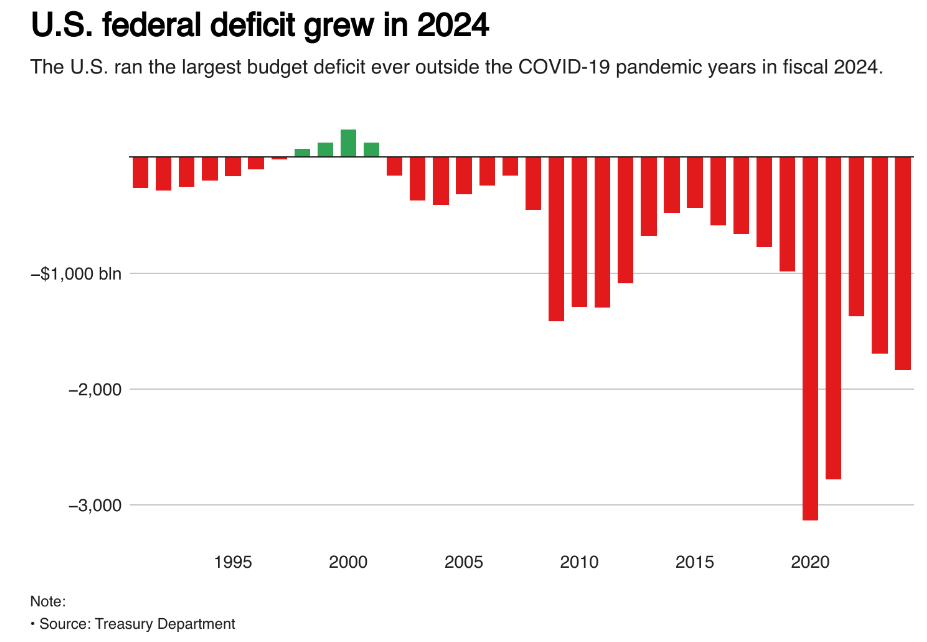

“With less than two weeks now until the US elections, concerns about the fiscal outlook and its potential upward pressure on inflation have become more acute,” says Robert Dishner, senior portfolio manager at Neuberger Berman in London.

A report from the Treasury Department last week advised that the US budget deficit grew to $1.833 trillion for fiscal 2024, the highest on record excluding the pandemic period.

Meanwhile, there’s renewed concern that the economy’s recent strength negates the case for more rate cuts at this point.

“The rise in the 10-year yield is causing confusion that maybe the economy is growing too rapidly and that employment remains too resilient,” says Sam Stovall, chief investment strategist at CFRA Research.

“As a result, the Fed might end up being slower to lower interest rates.”

Markets are still expecting more rate cuts, but the outlook will remain fluid depending on incoming data. A key release that could move markets: the government’s initial estimate of third-quarter GDP, scheduled for Oct. 30.

The Atlanta Fed’s GDPNow model is estimating that Q3 output will accelerate to 3.4% (based on the Oct. 18 nowcast). If correct, the case for arguing that the Fed rate-cutting policies are too dovish look set for an ongoing run of attitude adjustment.