Last week's sharp selloff jolted markets, which had barely seen a loss since late 2023. While a recovery was expected, the key question now is whether it has peaked and if the fears that triggered the decline will resurface. Our lead indexes have closed the most recent gaps down, but it will take significant momentum to overcome the next series of gaps.

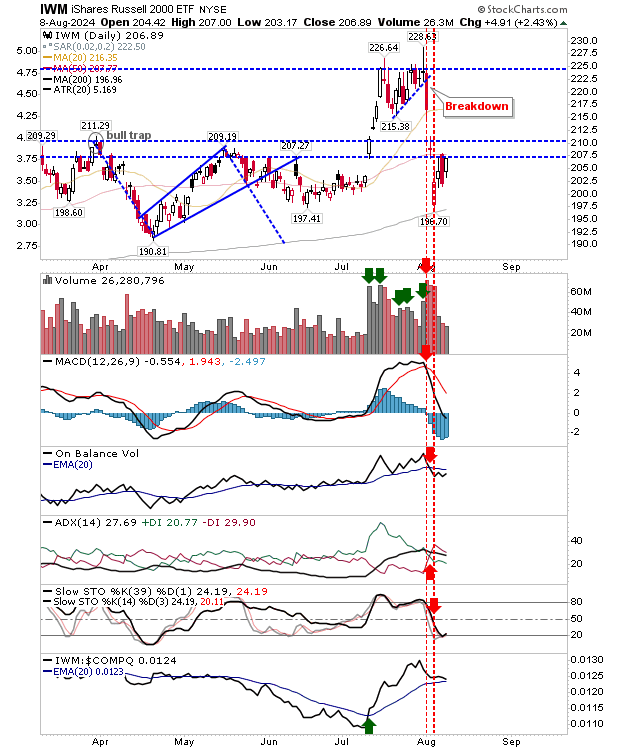

The Russell 2000 (IWM) finds itself in the $207.50-210 zone that had marked breakout resistance in spring and early summer. The most recent of the gaps has closed, so resistance may once again come to the fore in the coming days.

There is not a whole lot of guidance from technicals; intermediate and short-term stochastics have converged, and remain oversold, which might suggest there is another couple of days' worth of gains to come (false rallies often end on the move out of an oversold state); perhaps topping out around $210-211.

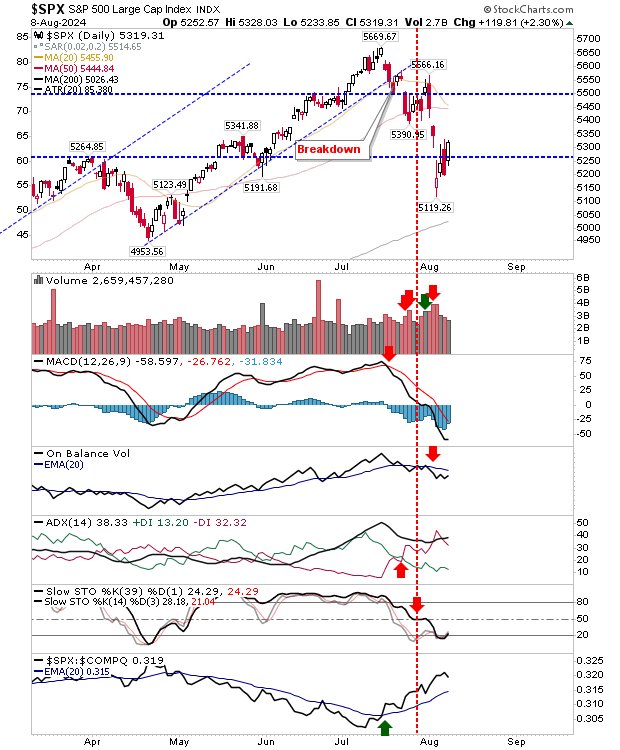

The S&P 500 is also approaching the point of closing the most recent gap. Trading volume has eased since marking the capitulation low at 5,119. Unlike the Russell 2000, the index has managed to climb out of an oversold momentum state, so sellers will be ready to mount a fresh attack.

The 20-day MA is about to undercut its 20-day MA, and this looks like a good place to set an upside target for a swing trade assuming the current momentum state doesn't see sellers attack in the coming days.

Tech stocks, and the Nasdaq by association, experienced the greatest loss since peaking in July, tagging its 200-day MA in the process of selling off. The 20-day MA has already undercut its 50-day MA and is fast approaching rising prices.

As with the S&P 500, momentum has edged out of an oversold state and while there is resistance on the closure of the nearest gap, a larger area of supply can be found just above 17,000.

Heading into today's session, and the next couple of weeks (I'll be on vacation), we ultimately will be looking for a retest of last week's lows. If bulls have control, then the next period of selling should be short, and not get anywhere near those lows.

If we have a 50:50 level of control, the lows will be tested, and then things will likely get messy. If bears have control, then what we have seen to now will quickly reverse (in the next day or two) and accelerate lower down to, and below, 200-day MAs.