In a significant turn of events that caught the healthcare sector by surprise, shares of prominent U.S. health insurers experienced a sharp decline, tumbling between 6% to 12% this past Tuesday. This market response came in the wake of the government's final decision on the 2025 rates for Medicare Advantage (MA) payments, revealing a modest base rate cut.

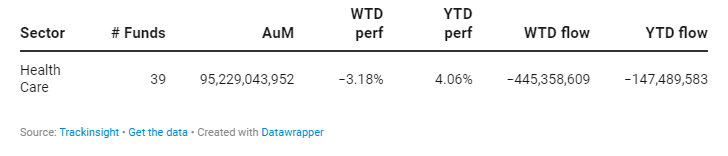

The healthcare sector was the main detractor within the S&P 500 index, with a loss of 3.07% for the week. Healthcare ETFs plunged by 3.18% over the week, bringing their year-to-date performance to +4.06%. Those funds also witnessed significant outflows of $445 million this week.

Rates Fall Short

The finalized rates indicated a modest decrease of 0.2% in average payments for Medicare Advantage plans. This decision remained unchanged from the initial proposal made in January, despite considerable lobbying from healthcare companies.

Impact on Margins and Operational Challenges

This rather unexpected announcement has raised concerns about potential margin squeezes for insurers, particularly those already dealing with elevated medical costs. The situation is further compounded by ongoing uncertainties around insurance claims processing. Notably, the fallout from a hacking incident at UnitedHealth (NYSE:UNH)'s tech unit has added another layer of complexity, disrupting normal operations and financial forecasts for insurers.

Market Reactions and Analyst Insights

Humana (NYSE:HUM), the second largest provider of MA plans in the U.S., witnessed its shares plummet over 9.5% for the week, falling to a four-year low below $300 before bouncing back to $313.11 at the close of Friday. Similarly, UnitedHealth experienced a 7.96% drop, followed by a 6.49% decrease in shares of CVS Health (NYSE:CVS). Analysts, including BoFA Securities' Kevin Fischbeck, have pointed out that the combination of elevated costs and lower payment rates put substantial pressure on insurers. There's a growing concern that companies might have to reduce the range of benefits they offer, further affecting their competitive edge and bottom line.

ETF Focus

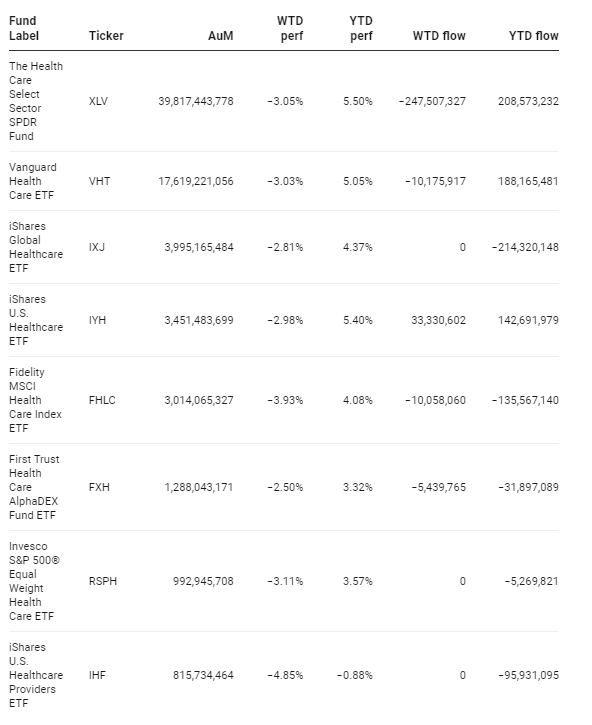

The Health Care Select Sector SPDR Fund ( XLV +0.12%) , the largest healthcare ETF in terms of AUM, endured a significant fall of 3.05% along with substantial outflows, amounting to $248 million over the week. Meanwhile, the iShares U.S. Healthcare Providers ETF (IHF+0.18%) recorded an even larger drop of 4.85%. This result has brought this ETF performance into negative territory since the beginning of the year (down 0.88%).

Group Data

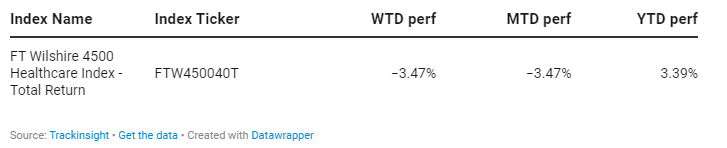

Index Data

Funds Specific Data: XLV, VHT, IXJ, IYH, FHLC, FXH, RSPH, IHF