Eli Lilly & Co. (NYSE:LLY) led gains in the healthcare sector last week after posting strong results. The company raised its annual forecasts as the new diabetes drug Mounjaro experiences a surge in demand, fueling investor excitement over the medicine. Mounjaro is FDA-approved for treating type 2 diabetes, a medical condition characterized by inadequate insulin production or utilization, resulting in elevated blood glucose levels. It is typically employed alongside diet and physical activity to reduce blood sugar levels. But Mounjaro is also popular as an off-label weight loss aid in individuals with obesity, serving as an alternative to extensive surgical measures and its associated potential complications.

The LLY shares skyrocketed by 17.53% week-over-week (+44.40% year-to-date), setting a new record high, further propelled by optimistic data from a rival drug. The rally makes Lilly the top-performing stock in the S&P 500 Pharmaceuticals Index to date this year, and the largest healthcare corporation in terms of market capitalization, which stands at approximately $500bn.

Lilly’s performance was instrumental in pushing the healthcare sector higher (+2.46% over the week) and providing a positive boost to pharmaceutical ETFs which saw returns of between 3.5% and 5.6%.

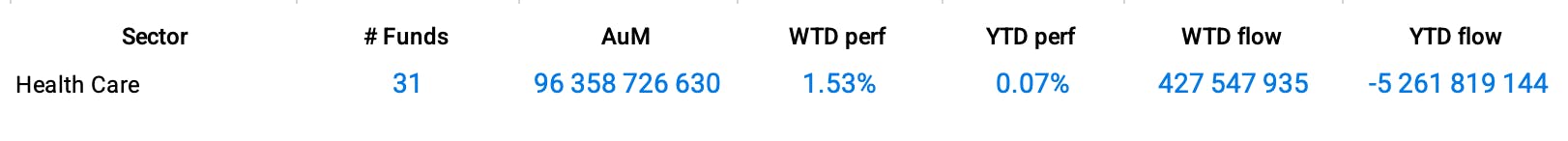

Group Data: Health care

Funds Specific Data

This content was originally published by our partners at ETF Central.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI