By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

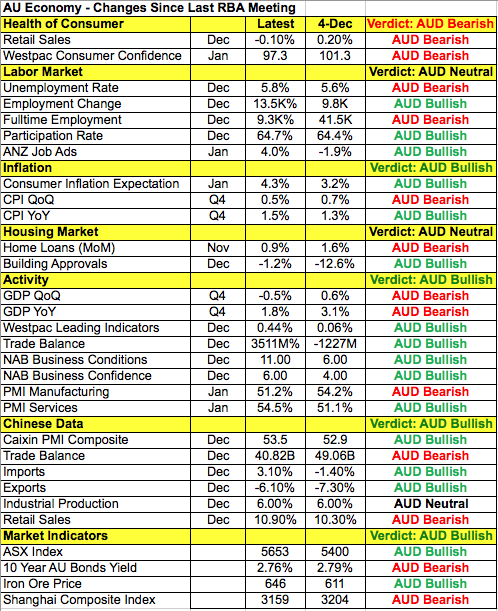

The big story in Monday's foreign-exchange market was USD/JPY and its quick slide below 112. The currency pair has fallen 5 out of the last 6 trading days with the latest wave of weakness taking USD/JPY to its lowest level since November. We can identify at least 3 reasons for the persistent decline in the currency -- first and foremost, investors are nervous about the economy and President Trump's policies. Friday's jobs report failed to impress with wage growth slowing and the unemployment rate rising. More importantly, Trump has been on a campaign to pressure other countries to strengthen their currencies, which effectively means he wants the dollar to weaken. Secondly, ten-year yields fell 5bp on Monday, pushing the dollar lower and when 112, an important support level for USDJPY broke, the currency pair extended its losses quickly. The problem is that data has not been strong enough to convince the market that the Federal Reserve will raise interest rates in March and to offset the President's push for a lower currency. Stocks are also beginning to roll over and if the slide deepens, it would fuel risk aversion that could turn into additional pressure on USD/JPY. With no major U.S. economic reports scheduled this week, we look for USD/JPY to extend its losses toward 110. The November 28 low near 111.36 could provide some support but we continue to look for losses beyond that level. While the euro ended the day lower against the U.S. dollar, it spent most of the NY trading session moving higher. Politics has been as much of a driver as economics and monetary policy. Francois Fillon, who was once the leading candidate in the country's presidential race has been embroiled in a scandal that has allowed Marine Le Pen, the leader of the far-right Front National to rise in the polls. In fact some surveys show that she is in the lead to become the next leader of France, which makes investors very nervous. These concerns are apparent in the bond market with French yields soaring as German yields fall -- pushing the French --German 10-year bond spread to its widest level since 2012. Investors are particularly worried about Le Pen's anti-globalization and immigration views along with her pledge to pull France out of NATO and hold a referendum on EU membership. In the early part of the trading session, the euro dropped as the polls show her gaining momentum but the currency recovered after Fillon said he would remain in the race. ECB President Draghi also spoke Monday and he spent most of the time defending QE. Despite improving data, he does not think that it's time to taper stimulus measures and instead warned that recent inflation data, although improving, is considered to be misleading due to the increase being led mainly by volatile energy prices. In addition to comments by Draghi, the euro was subject to to mixed data coming out of the Eurozone. German factory orders increased in January with a rise of 5.2% when only a 0.7% was expected. However, German construction PMI and retail PMI were lower than previous months. The currency will remain in focus Tuesdat with German industrial production numbers scheduled for release. The Reserve Bank of Australia was slated to meet Monday night and while the central bank was widely expected to leave interest rates unchanged, investors will listen closely for any hints of plans to ease monetary policy. The last time the RBA met, it offered a benign outlook for the Australian economy. While the RBA said "some slowing in the year end growth rate is likely," it also believed that it will pick up again as further "increases in exports of resources are expected as completed projects come on line." RBA expects inflation to remain low but showed no indication that rates will fall further. AUD/USD traders were initially disappointed but shrugged off the rate decision in the European and North American sessions. Since then, there has been both improvements and deterioration in Australia's economy. Consumer spending, for example, has been soft, labor activity lacking and inflation slightly weaker. However business activity and confidence is on the rise as the Chinese economy continues to recover. At the end of the day, we believe the recent strength of the currency will keep the RBA cautious and cap gains in the currency.

The New Zealand dollar traded higher while the Canadian dollar traded lower. There was no specific explanation for the strength of NZD but the Canadian dollar was pressured by falling oil prices. Canada's trade balance, building permits and IVEY PMI reports are scheduled for release Tuesday and given the strength of recent data, payback is expected in this week's releases, which means we could see a further recovery in USD/CAD. Sterling ended the day unchanged against the U.S. dollar as the pair stayed below 1.25.

With no data on the docket for the UK or US, Brexit concerns kept the pound under pressure. A spokesperson for UK PM May said that government was firm on its decision to leave the EU and that any legislation to keep the UK in the EU would be not allowed. Losses in the pound were muted as the EUR/GBP found offers throughout the day. The currency cross took a quick peek below 0.86 before finally settling above that level.