With less than 24 hours to go before the December FOMC announcement, the U.S. dollar rebounded against most of the major currencies. Some analysts attribute the move to a better-than-expected inflation report and an improvement in the Empire State manufacturing index -- but weakness can still be found in both releases. For example while annualized CPI growth increased from 0.2% to 0.5%, prices stagnated on a monthly basis. Although the Empire State index rose to -4.59 from -10.74, the index remained in contractionary territory for the 5th month in a row. So why is the dollar rising pre-FOMC if Tuesday’s U.S. economic reports leave much to be desired? The answer is positioning.

The biggest lesson learned from the short euro ECB trade is that crowded trades can turn into a big mistake -- even if fundamentals have not changed. Early this month, the ECB cut interest rates and extended its QE program. Instead of driving EUR/USD to parity, the move sparked a 5-cent short-covering rally in the currency. For most of this year, investors were long dollars and after the ECB meeting, they pared their positions on the fear that the long USD/JPY trade would also run out of gas because the most popular view for FOMC is that the central bank would raise interest rates and follow with dovish guidance.

The most disruptive move that the Federal Reserve could make Wednesday is to leave interest rates unchanged. But the chance is extremely slim because keeping monetary policy steady would undermine their credibility. So the only-out-of-consensus view that needs to be taken seriously is a rate hike and strong forward guidance. Most investors expect another 25bp to 50bp rate hike from the Fed next year so it would not be out of the realm of possibility for the central bank to signal that the next rate hike could occur before summer. Any specificity in the central bank’s guidance would be viewed as positive for the currency while ambiguity would be viewed as negative.

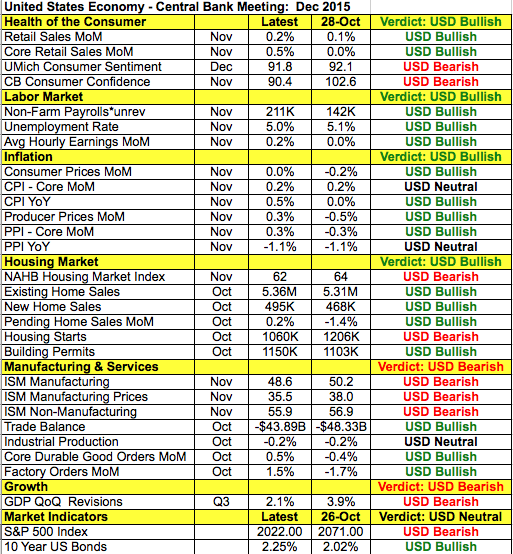

There are reasons for the Fed to be optimistic. Taking a look at the table below, there’s been more improvement than deterioration in the U.S. economy since the October meeting. The labor market, retail sales, inflation and housing market all saw upticks in the past month but we are certainly far from boom times with manufacturing- and service-sector activity slowing and consumer confidence weakening.

However as we wrote in Monday’s note, there’s still more reasons for the dollar to fall than rise after the Fed raises rates. Aside from historical performance, the greatest chance is for a dovish statement. U.S. policymakers have already gone out of their way to ensure that the market realizes that they will normalize monetary policy gradually in the coming year. Inflation remains extremely low, global demand is weak and the U.S. recovery is slow. This is not the time for rapid rate rises and the Fed cannot afford a sharp spike in rates. Once the Fed rate hike passes, the market will start to go into holiday mode. This means more investors will be looking to take profits, go flat and reassess their positions after this year’s moves. The dollar’s gains in 2015 will also force investors and funds to rebalance their portfolios -- a process that will mostly involve selling dollars.

EUR/USD dropped to 1.09 pre-FOMC despite stronger-than-expected investor confidence. The recent slide in the euro and easing by the ECB has and will continue to make European investors more confident about the outlook for the Eurozone economy. 2016 is a year of big risks for Europe with the potential of a deepening refugee crisis, slower growth and increased terrorism. Eurozone PMIs are scheduled for release Wednesday (Manufacturing, Composite, Services) and we are looking for stronger numbers overall.

Sterlingalso traded lower against the U.S. dollar despite better-than-expected CPI. Prices were expected to fall in November but instead they stagnated. However like the U.S., annualized CPI growth of 0.1% is hardly impressive. UK employment numbers are scheduled for release Wednesday and the focus will be on wages. Average weekly earnings growth is expected to slow but if they surprise to the upside, it could help GBP/USD hold 1.50.

The New Zealand dollar was the best-performing currency. An uptick in dairy prices and stronger-than-expected current account numbers contributed to its outperformance. Dairy prices rose for the second auction in a row. The RBNZ cut interest rates last week but shifted to a neutral bias, which we believe will help encourage further gains in NZD/USD if the Fed issues a dovish guidance.

The Australian dollar ended the day sharply lower despite relatively optimistic RBA minutes. According to the central bank, domestic data has been generally positive and output growth should strengthen gradually over the next 2 years. The CPI outlook still affords scope for further easing but based upon recent data, there’s no reason for the central bank to cut rates in the near future. The weakness of AUD may have more to do with the drop in copper and iron ore prices.

USD/CAD ended the day unchanged despite a rebound in oil prices. Weaker manufacturing sales were offset by upbeat comments from Bank of Canada Governor Poloz.