Silvergate Capital's (NYSE:SI) crypto bank shutdown seems to be the latest domino to fall in the FTX fallout. Although its fall had a minor effect on the suppression of the crypto market than FTX, the lingering problem remains. From where to draw liquidity to supply fiat-to-crypto rail?

Silvergate’s Demise Explained

Before Sam Bankman-Fried’s FTX exchange collapsed, Silvergate held $11.9 billion in assets in September. In November, Silvergate’s CEO, Alan Lane, assured investors that Silvergate had limited exposure to FTX, accounting for less than 10% of deposits, without any loans or other FTX investments.

However, the bank issued SEN Leverage loans, exclusively collateralized by Bitcoin. As any bank would do, Silvergate used SEN Leverage to lend against customers’ deposits in return for interest rate. By the end of 2022, Silvergate’s SEN Leverage accounted for $1.1 billion in such commitments.

However, the more significant risk came from the bank’s accumulation of securities in bonds, treasury securities, and mortgage-backed securities. This coincided with the departure after FTX crashed, wherein Silvergate’s deposits shrunk from nearly $12 billion to $3.9 billion in December.

The coup de grace appears to be Silvergate’s $4.3 billion loan from the Federal Home Loan Bank (FHLB) of San Francisco to facilitate these withdrawals. The problem was the FHLB’s earlier-than-expected loan recall caused Silvergate to sell its securities prematurely.

This resulted in a realized loss, totaling a net loss of $1.05 billion for Q4 ‘22. Fast forward to March 1st and Silvergate’s delayed 10-K filing to the SEC. The bank pinpointed the repayment of the FHLB as the main culprit because of the “sale of additional investment securities beyond what was previously anticipated.”

- Silvergate’s value collapse over one month

In the following days, this triggered another bank run. Compounded, all the major Silvergate clients abandoned the SEN ship: Coinbase (NASDAQ:COIN), Paxos, Circle, Binance.US, Gemini, and Galaxy Digital. Silvergate finally announced its liquidation this Wednesday, and SEN’s USD payment rail is going down.

Crypto Liquidity in Shallow Waters

Two key mechanisms facilitate the growth of the crypto market:

- Sending fiat money directly to a centralized exchange to buy and sell crypto. Underneath it, the exchange needs a crypto bank like Silvergate to make the fiat flows happen.

- Converting fiat money into stablecoins and then sending them to an exchange to buy and sell crypto. If the stablecoin is centralized, its issuer needs a crypto-friendly bank to keep the stablecoin’s reserves in a 1:1 ratio.

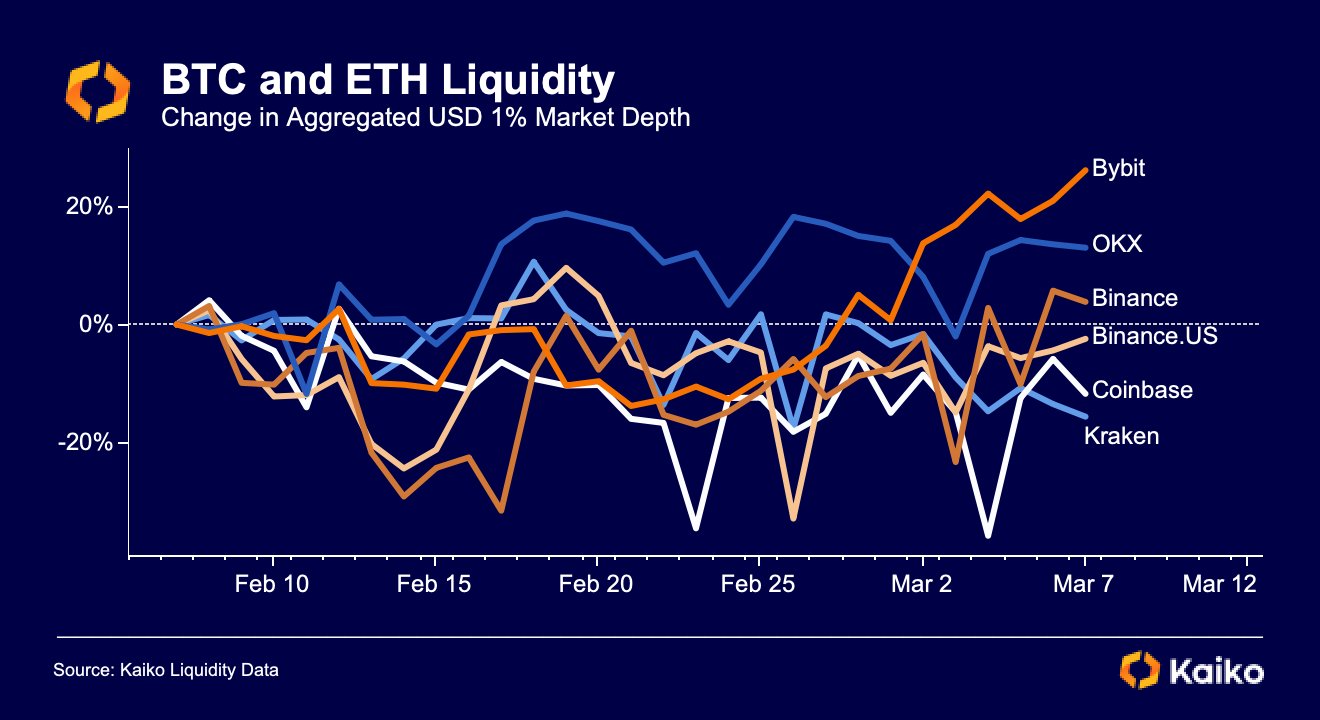

Now that Silvergate is out of action with its SEN payment rail, the crypto market’s liquidity will undergo significant restructuring. We are already seeing that US-based exchanges are suffering in contrast to international exchanges.

- Fewer buy and sell orders manifest as low market depth

Image credit: Kaiko

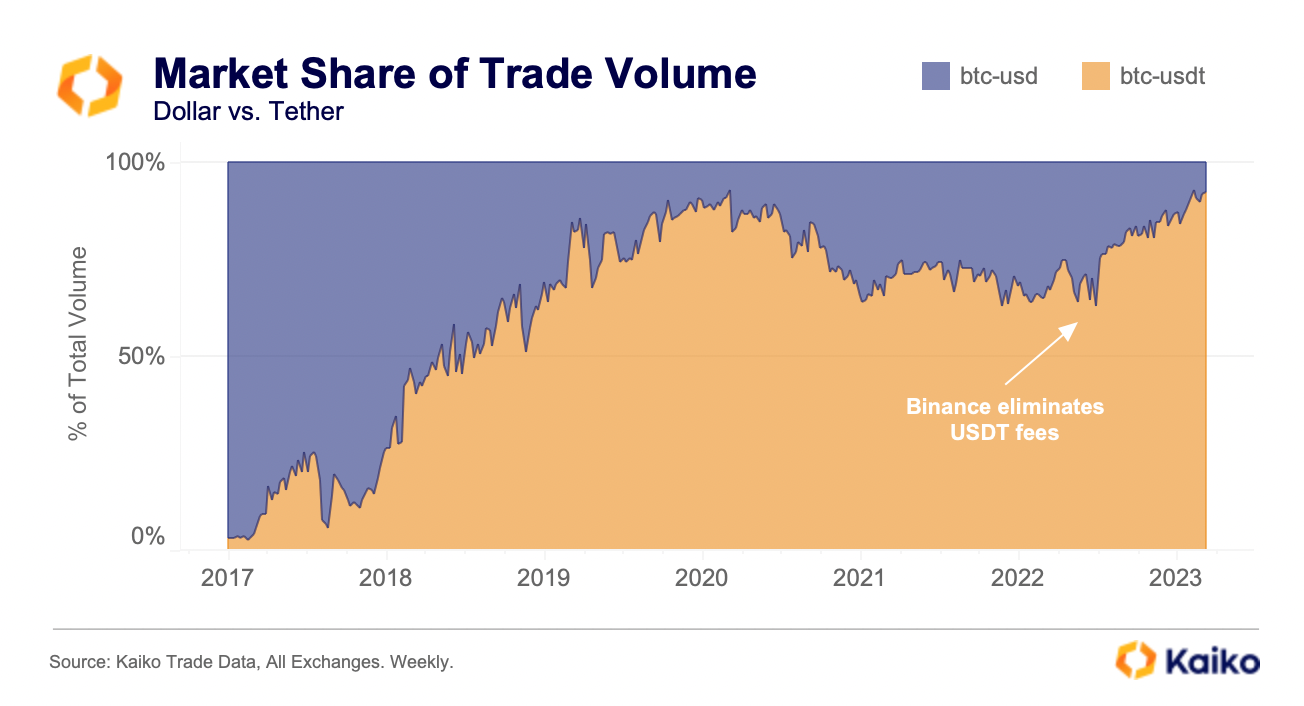

Alongside the shallower market depth, the dominance of USD continues to shrink rapidly in favor of Tether’s off-shore USDT stablecoin.

- USDT – USD but without the liability of US regulatory crackdown

This indicates a rise in stablecoin usage. Over the last week, USDT’s market cap climbed by $3.4 billion, while USDC’s share rose by $2.1 billion. Interestingly, USDC, jointly managed by Coinbase and Circle, suffered a brief -$0.77 billion shrinkage last week, likely due to the US authorities cracking down on Binance USD (BUSD) stablecoin.

In contrast, the off-shore USDT’s market cap has a consistent upward trajectory. Similarly, when Binance switched focus to TrueUSD (TUSD), the stablecoin’s market cap increased by +37% over the last month, from $948 million to $1.3 billion.

What appears to be happening is the return to crypto’s early days. The US regulatory system’s ramped-up activity is highly suggestive of Operation Chokepoint 2.0, with the original version deployed to debunk online casinos under the Obama admin.

Regardless of the veracity of speculations, this leads to a greater focus on international stablecoins instead of those reliant on US institutions.

Inevitably, this will also supply the demand for algorithmic stablecoins. One example is Cardano’s Djed stablecoin, pegged to the dollar but overcollateralized by the blockchain’s ADA cryptocurrency.

Ethereum is still largely dependent on USDC through its multi-collateralized proxy DAI, which is 25% backed by USDC. However, the US crypto ecosystem is likely to be dominated by USDC, already favored by BlackRock. This is the same $10 trillion asset manager the Federal Reserve hired in 2020 to structure its inflationary stimulus response, which the central bank is now attempting to neutralize with interest rate hikes.

***

Disclaimer: This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.