Bitcoin price today: hits record high over $122k ahead of ’crypto week’

- Every investor dreams of buying a stock for pennies and watching it explode in value.

- This article dives into the history of 100-bagger stocks and explores how to filter for potential candidates using key metrics.

- We will also unveil a strategy to identify potential 100-bagger stocks based on historical trends and provide a shortlist of promising candidates.

-

Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

The term "100-bagger" first captured my attention in Peter Lynch's 1989 classic, "One Up on Wall Street." Names like Microsoft (NASDAQ:MSFT), Dell (NYSE:DELL), Nvidia (NASDAQ:NVDA), and Apple (NASDAQ:AAPL) – were just a few examples Lynch used to illustrate the potential for tenfold stock price growth.

But how often do such explosive gains occur, and can we identify the next breakout stars?

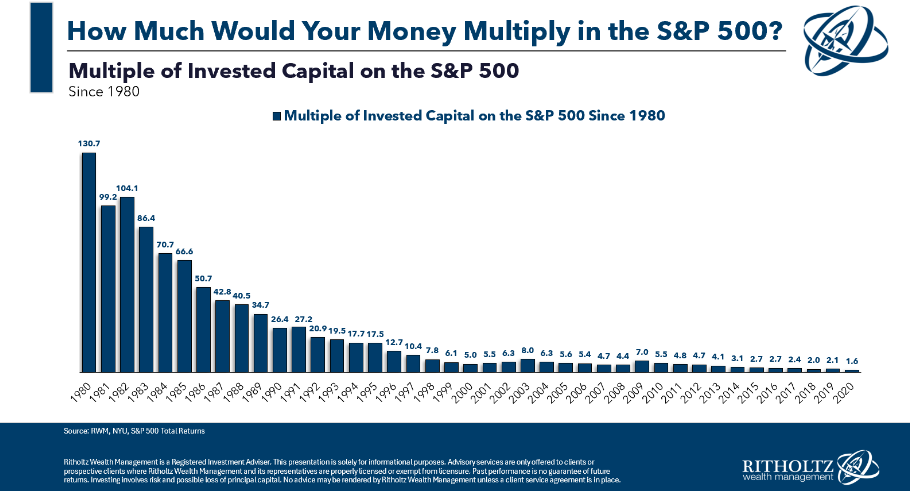

Let's delve into the world of 100-baggers. The chart below reveals a fascinating truth: to find a ten-bagger in the S&P 500 as of late 2023, we'd need to rewind all the way back to the 1980s.

What's really striking is that investors in the 1980s witnessed some stocks multiplying in value by a hundredfold over the years. It's a testament to the long-term growth potential of the stock market, with the S&P 500 averaging 11% annual returns since 1980.

Every investor dreams of buying a stock at a low price and selling it later at a price 100 times higher. Looking at a list of stocks that achieved this feat from 1962 to 2014, there are nearly 400 such examples. But what sets these stocks apart, and how can investors identify them?

Identifying Potential 100-Baggers

While there's no guaranteed formula, several key characteristics often emerge when analyzing historical 100-baggers. Here are some crucial elements:

- Consistent Growth: Companies with a track record of steady earnings growth, particularly on the bottom line, tend to be strong contenders.

- Low Starting Valuations: Look for stocks with attractive valuations, such as a low price-to-earnings (P/E) ratio.

- Small Market Capitalization: Historically, companies with a market capitalization below $500 million have a higher chance of achieving 100-bagger status due to their potential for explosive growth.

Achieving a hundredfold increase often involves consistent growth, especially in earnings, and starting with a low valuation, like a low price-to-earnings (P/E) ratio. Additionally, many of these stocks started out as small companies, as larger companies find it more challenging to grow so significantly.

Building Your Watchlist: Filtering for 100-Bagger Potential

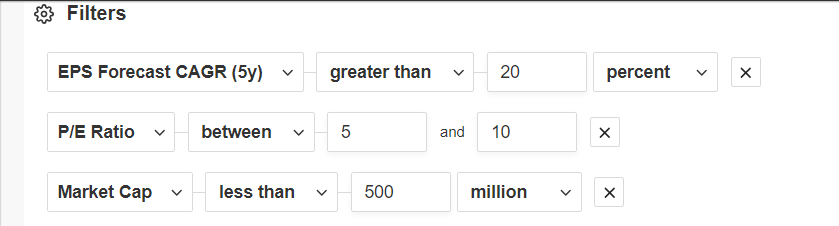

The good news? We can leverage tools like InvestingPro to set up filters and identify stocks with characteristics that align with historical 100-baggers. In this example, we've applied three key filters:

- Compound Annual Earnings Growth: At least 20% over the past five years.

- P/E Ratio: Between 5 and 10.

- Market Capitalization: Less than $500 million.

Source: InvestingPro

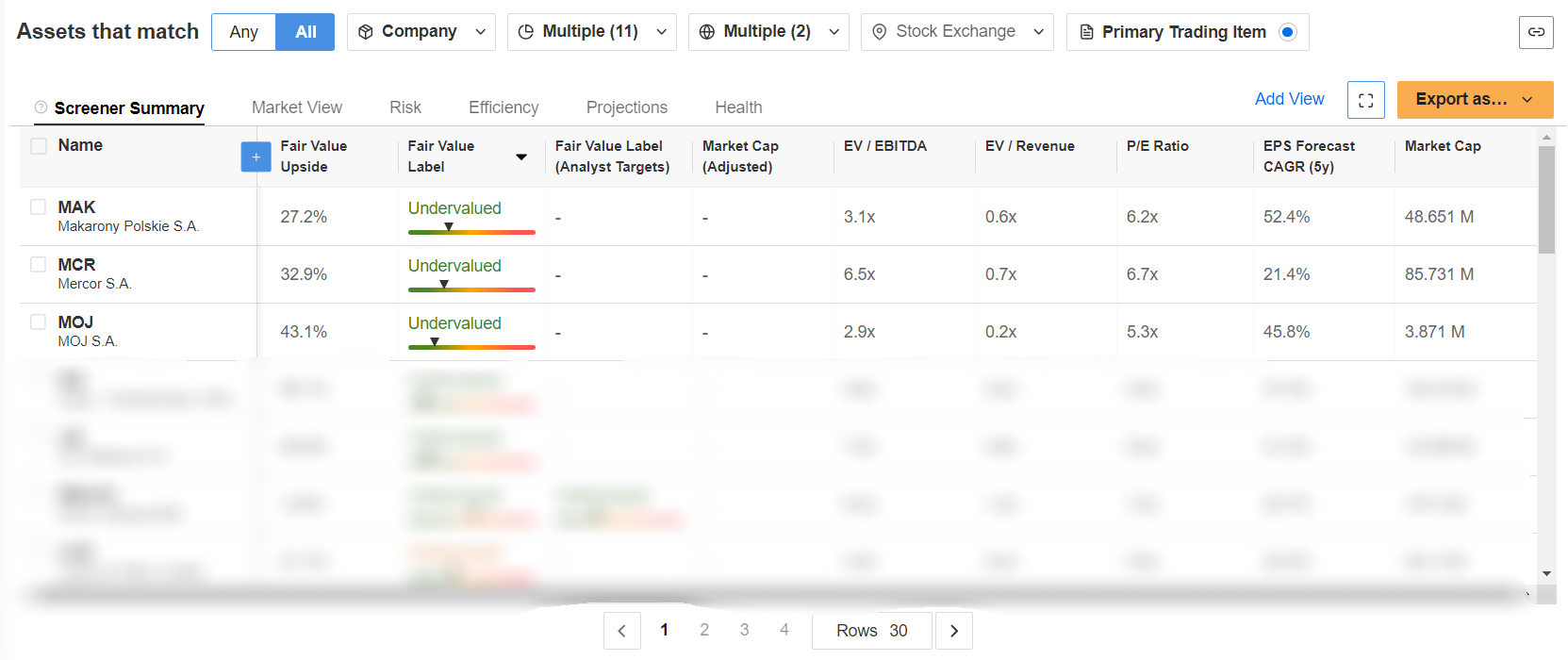

By applying these filters across the U.S. and European stock markets, we've narrowed down a vast database of over 162,000 stocks to a shortlist of 113 potential candidates. Will any of them become the next 100-bagger? Only time will tell.

Could there be hundred-baggers among them? Here are the top three candidates on our watchlist (in no particular order):

Source: InvestingPro

Discover 100-bagger stocks and their Fair Value with InvestingPro+. Subscribe now and get over 40% off your annual plan for a limited time! Subscribe HERE AND NOW!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI