by Chaim Siegel of Elazar Advisors, LLC

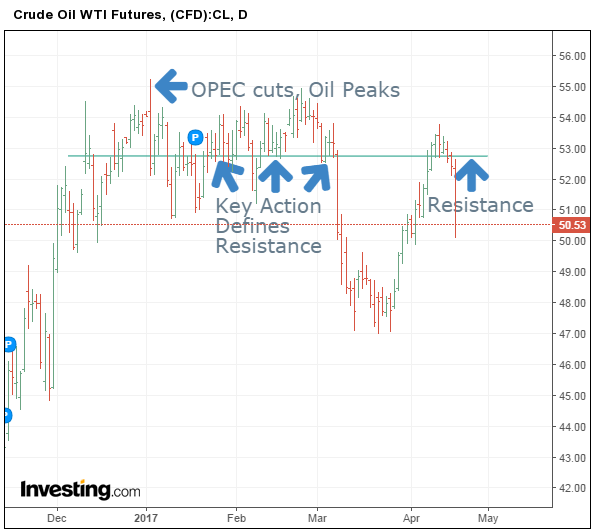

We love to watch 'action' when it comes to the oil market. 'Action' is the trading tool comparing what should happen to what actually does happen. Oil is of course down year-to-date despite OPEC cutting production this year.

We define that as 'bad action.' OPEC is now even considering extending the cuts in order to boost price. Oil should also be breaking out to new highs given current geo-political concerns along with the upcoming US driving season. With all that, oil is still having a tough time below a key technical resistance line. That portends downside for oil.

Bad “Action” For Oil

In early January, at exactly the time when OPEC began their historic move to cut production, the price of oil peaked above $55. We drew the resistance line on the chart above which we noticed had formed based on key action. That line, at $52.75, acted as a critical area for breakouts and breakdowns.

OPEC cuts, extending OPEC cuts, the coming driving season, and most recently a serious US-North Korean geo-political event can’t seem to buoy oil and keep it up. That’s a problem.

If so much good news can’t push oil higher, we fear bad news can more easily take oil lower.

Seasonality And The Summer Driving Season

Oil traders are hoping that typical seasonal demand can support oil prices. It's already mid-April, the portion of the year when driving starts to pick up. The more 'official' start to driving season begins in late May with Memorial Day, May 29th. Either way you look at it, oil typically has positive seasonality about now.

From a seasonal perspective, oil prices historically bottom early in the year and start moving up as spring approaches. We should now be in the “moving up period.”

If the resistance line of $52.75 for oil continues to hold the commodity down, that shows the underlying weakness in oil.

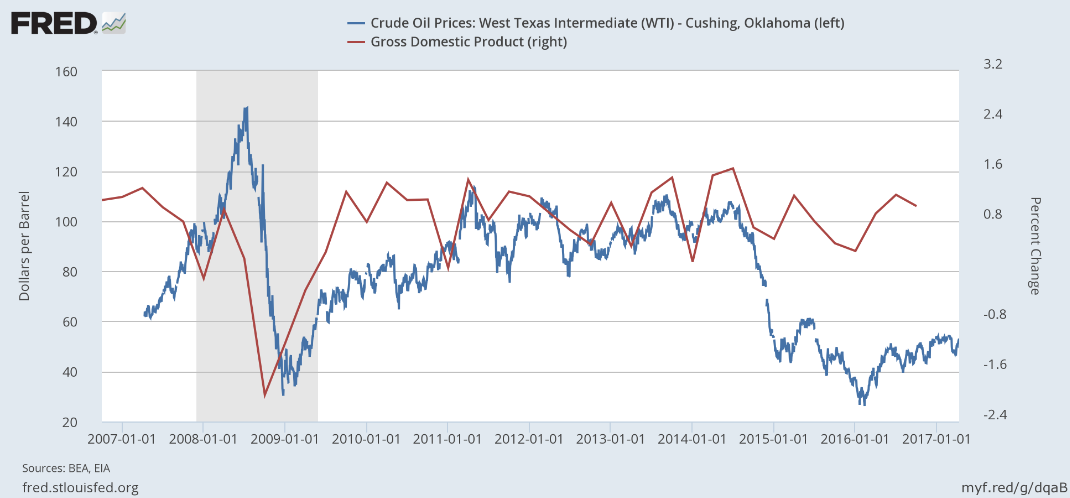

Oil Versus GDP

Another reason we worry about the summer driving season being weak for oil demand is that GDP estimates are currently weak. The Atlanta Fed’s GDP Now estimate is only expecting US GDP of .5% for the first quarter. That would be the lowest growth rate for GDP since January 2014.

Oil and GDP move together to some degree, which is logical. If a weak economy hits during the critical summer driving season, oil is in trouble.

Source: St. Louis Fed

Above, US GDP quarterly changes in red versus the price of oil in blue. Many of the moves up and down, noted by our arrows, had oil and GDP moving in lockstep.

If The Atlanta Fed has it right and GDP slows, that takes the wind out of the sails (and sales) for the summer driving season and weakens support for oil prices.

That’s the risk.

May 25th OPEC Decision

OPEC meets in Vienna, Austria on May 25th. Saudi Arabia, whose vote is critical for the extension of a production freeze decision, hasn’t committed to the cuts continuing. We’d guess market participants are assuming cuts will continue. The risk is if OPEC doesn't extend the production cuts. That would pull away yet another oil price support.

US shale production has of course been eating away at the OPEC cut benefits all along, possibly making the May 25th decision a sell-the-news, negative event.

Yesterday's EIA Release

Even though crude inventories dropped yesterday, oil prices went lower after the report. We take that as the latest sign overhead technical resistance is fierce against a growing array of negative catalysts.

Conclusion

We have critical resistance above and 'bad action' on great news about oil, thanks to US shale out-producing the OPEC cuts. Summer driving season could work against oil’s typical seasonal benefit if US GDP were to slow. All of this makes us bearish on oil, especially if it can’t get above $52.75 and stay there.

Disclaimer: ETFs reported by Elazar Advisors, LLC are guided by our daily, weekly and monthly methodologies. We have a daily overlay which changes more frequently which is reported to our premium members and could differ from the above report.

Portions of this article may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.