If you're a dividend investor, you're probably familiar with the WisdomTree U.S. Quality Dividend Growth Fund – a top performer in the Morningstar "Large Blend" category with a five-star rating. What does this mean?

Well, DGRW has managed to outperform most of its 1,289 peers as of May 30 over numerous historical periods on a risk-adjusted basis. Over the last 10 years, the fund, even facing drag from a 0.28% expense ratio, has managed to match the total returns of the S&P 500 index – a challenge 87.42% of all U.S. large-cap funds failed to do according to SPIVA.

But if you subscribe to the idea of diversifying internationally, DGRW won't check the boxes. Fortunately, WisdomTree offers a global counterpart – the WisdomTree International Hedged Quality Dividend Growth Fund. Here's what you need to know about this ETF.

How does IHDG work?

IHDG is technically a passive ETF as it tracks a benchmark, the WisdomTree International Hedged Quality Dividend Growth Index, but it's not the usual plain vanilla market cap-weighted methodology you might be expecting.

In line with WisdomTree's expertise and Jeremy Siegel's research, IHDG employs something known as "fundamental indexing." This approach focuses on fundamental measures such as long-term earnings growth expectations and three-year historical averages for return on equity and return on assets.

Fundamental indexing doesn't just change how stocks are selected—it also changes how they're allocated. For IHDG, the weighting is based on annual cash dividends paid, which means the ETF tilts towards higher-yielding stocks rather than simply the largest ones by market cap.

Finally, to offset the negative effects of a historically robust USD, IHDG employs currency hedging. This means if the U.S. dollar appreciates, the ETF doesn't face additional headwinds, maintaining its performance against foreign currency fluctuations.

How has IHDG performed?

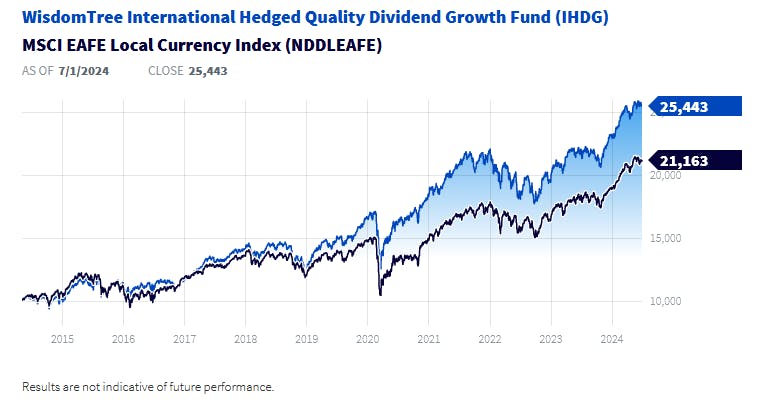

We've seen marked outperformance from IHDG. Even after accounting for its 0.58% expense ratio, IHDG has strongly outperformed the MSCI EAFE Local Currency Index (NDDLEAFE).

Unsurprisingly, this stellar performance has earned IHDG a five-star rating from Morningstar, placing it among the top funds out of 378 in the foreign large growth category.

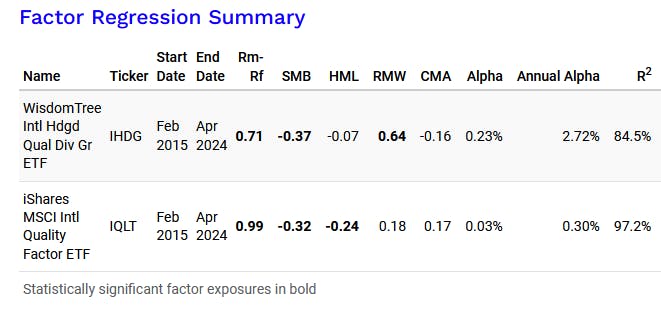

One of the most notable aspects of IHDG's performance is its factor exposure, particularly to the profitability factor (Robust Minus Weak, or RMW).

The profitability factor measures a company's quality and its ability to generate strong returns on equity and assets. High exposure to this factor indicates that IHDG holds stocks with robust profitability, which is a positive indicator of the fund's potential for long-term growth.

As seen in the following factor regression, IHDG has historically provided nearly 3.55x the loading to the profitability factor compared to a "brand name" international developed quality ETF, the iShares MSCI Intl Quality Factor ETF.

This substantial exposure to the profitability factor has helped IHDG generate significantly more alpha, or excess returns above the benchmark, showcasing its strength and effectiveness as a core holding for international equity exposure.

As of July 2nd, investors who buy IHDG can currently expect a distribution yield of 2.86% with quarterly payouts. The ETF is also highly liquid with a minimal 0.02% 30-day bid-ask spread.

This content was originally published by our partners at ETF Central.