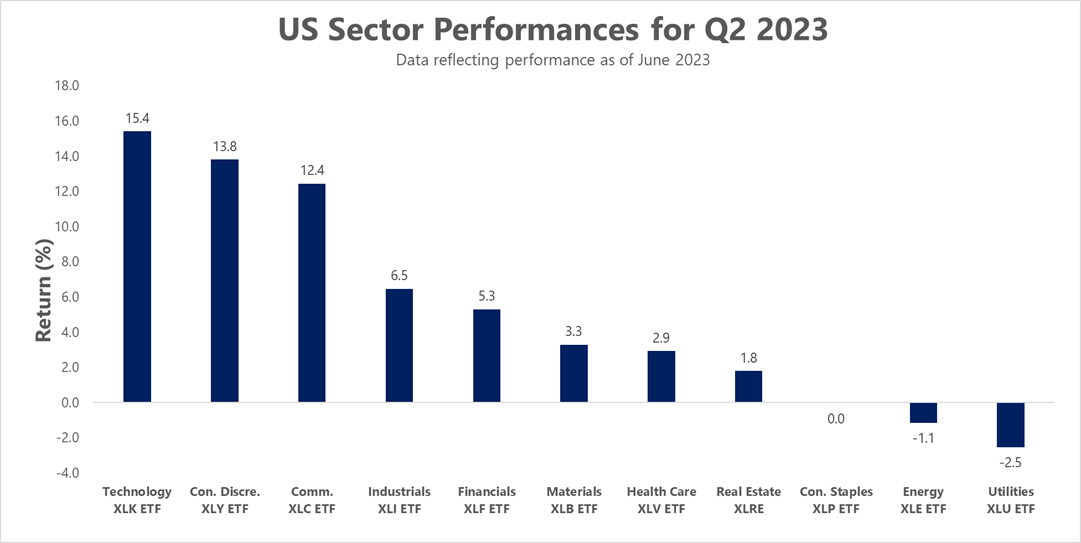

As US Stocks continued their strong surge into the second quarter of 2023, eight of the eleven S&P Sectors posted positive returns in Q2 of 2023. The Technology (Ticker: XLK) and Consumer Discretionary (Ticker: XLY) sectors led the way with 15.4% and 13.8% returns, respectively. Utilities (Ticker: XLU) were deepest in the red, finishing down -2.5% for the quarter.

According to research provided by FactSet’s Earnings Insight, in terms of revenues, 65% of S&P 500 companies have reported actual revenues above estimates, which is below the 5-year average of 69% but above the 10-year average of 63%. In aggregate, companies are reporting revenues that are 1.6% above the estimates, which is below the 5-year average of 2.0% but above the 10-year average of 1.3%.

At the sector level, the Health Care and Information Technology sectors have the highest percentages of companies reporting revenues above estimates, while the Materials sector has the lowest percentage of companies reporting revenues above estimates. Regarding earnings, eight of the eleven sectors are reporting year-over-year earnings growth, led by the Consumer Discretionary and Communication Services sectors. On the other hand, three sectors are reporting a year-over-year decline in earnings, led by the Energy, Materials, and Health Care sectors.

Looking ahead, analysts still expect earnings growth for the second half of 2023. For Q3 2023 and Q4 2023, analysts are projecting earnings growth of 0.2% and 7.6%, respectively. For the calendar of 2023, analysts predict earnings growth of 0.8%.

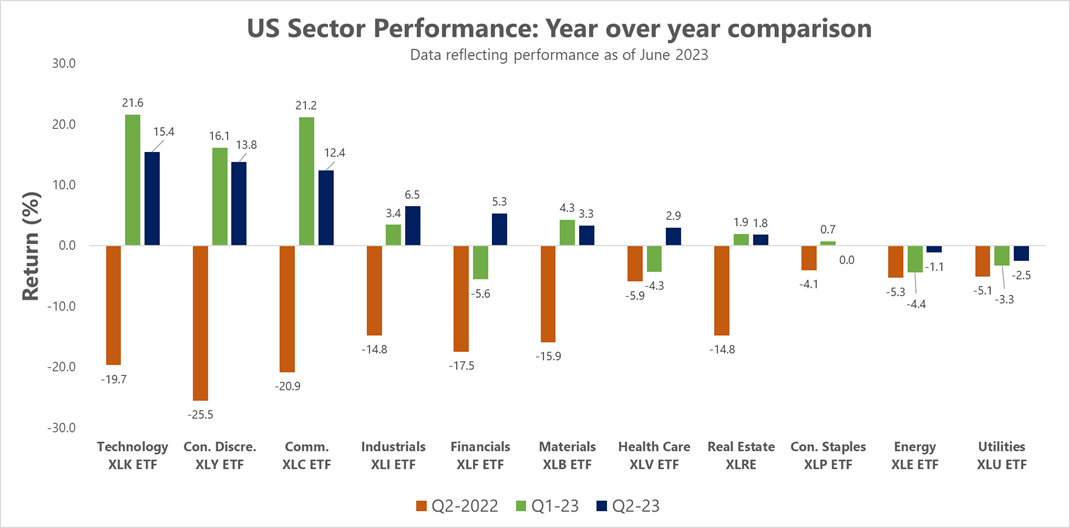

Looking across the performance landscape

As observed from the data, on a year-over-year basis, the performance of most sectors has materially improved in contrast to their Q2-2022 performance. While the performance of the technology, communication, and consumer discretionary sectors continue to be the pillars upon which the current US equity performance relies on, the decline in Q1 2023-to-Q2 2023 performance is noteworthy, particularly for the Technology (-6.21%) and Communication (-8.76%) sectors.

As noted in a previous article, the tech sector's performance continues to be driven by a select few firms. However, other sectors are exhibiting moderately strong performance, which may indicate the strengthening of the US economy. As noted in FactSet’s reporting, for the Consumer Discretionary sector, there were upward revisions to revenue estimates and positive revenue surprises reported by Ford Motor (NYSE:F) (to $44.95 billion from $42.64 billion) and General Motors (NYSE:GM) (to $44.75 billion from $41.06 billion), and the positive revenue surprises reported by Amazon.com (NASDAQ:AMZN) ($134.38 billion vs. $129.47 billion) and D.R. Horton ($9.73 billion vs. $8.27 billion). As inflation continues to decline from its previous highs, the purchasing power of households is acclimating to bettering economic conditions.

The Health Care Select Sector SPDR ETF (NYSE:XLV) (Ticker: XLV) which had a quarter-over-quarter performance increase of 7.25%, saw positive revenue surprises reported by McKesson (NYSE:MCK) (to $74.48 billion from $70.28 billion), AmerisourceBergen (NYSE:ABC) (to $66.95 billion from $63.93 billion), CVS Health (NYSE:CVS) ($88.92 billion vs. $86.53 billion), UnitedHealth Group (NYSE:UNH) (to $92.90 billion from $90.97 billion), and Elevance Health ($43.38 billion vs. $41.64 billion) positively contributed to the S&P 500 index performance.

The Financial Select Sector SPDR ETF (NYSE:XLF) (Ticker: XLF) exhibited the strongest quarter-to-quarter swing in performance (10.85%) following the regional banking distress in Q1-2023. However, with the recent Moody’s downgrade due to heightened funding costs, dwindling loan growth, and profitability strains, this sector should be looked at intently by interested investors. As noted in a recent news report from CNBC, Fitch Ratings may also be forced to downgrade banks' credit rating.

As investors look towards Q3-2023, the observed performance and overarching value proposition of some established companies and industries will make specific sectors a core to one’s portfolio. However, as new macroeconomic developments occur both domestically and internationally, it is important to understand the impact these developments may have on a sector and how best to manage or capitalize on it going forward.

This content was originally published by our partners at ETF Central.