Interactive Brokers (NASDAQ:IBKR) is a name synonymous with innovation and efficiency in the brokerage industry, offering services globally and rated the Best Online Broker for Traders per Forbes. I have been using Interactive Brokers for several years, and I've experienced firsthand the access it provides to a broad range of securities, supported by best-in-class technology and low-cost commissions.

The company has established itself as one of the largest electronic brokers, offering best-in-class services and positioning itself as a premium low-cost alternative to competitors. The company has continuously leveraged its advanced platform while maintaining low costs and expanding its reach across the globe.

This article delves into Interactive Brokers' recent earnings, analyzes its competitive edge, and its growth potential in a rapidly evolving market where decreasing interest rates are reshaping the financial landscape.

Business Overview and Competitive EdgeInteractive Brokers has built a reputation as a technology-driven brokerage firm, offering clients access to over 150 markets across the world at some of the lowest fees in the industry. Its robust trading platform known as Trader Workstation caters to a wide range of customers, from institutional clients to retail traders.

Although traditionally more focused on institutional clients such as hedge funds, financial advisors, proprietary trading firms, and introducing brokers, Interactive Brokers has increasingly attracted retail investors by providing access to a wide array of securities, including equities, options, futures, forex, fixed income, and cryptocurrencies. Its ability to manage multiple currencies within portfolios, without imposing conversion fees, further strengthens its appeal to investors operating in different markets. The company's focus on automation has allowed it to maintain an efficient, low-cost structure, making it an attractive choice for high-net-worth individuals and institutions alike. Interactive Brokers has also attracted retail investors by offering educational opportunities and continually improving the user experience of its apps, making them increasingly user-friendly.

In my view, one of Interactive Broker's most formidable competitive advantages is its superior technology. The company has achieved a scale that allows it to operate at extremely low costs through automation, handling processes like account openings and withdrawals without human intervention. This streamlined approach not only cuts overhead costs but also enhances risk management, and the pass on the savings to its customers. In comparison, the company can offer low-cost margin loans and commissions compared to those offered by big banks, making it the broker of choice for investors seeking value.

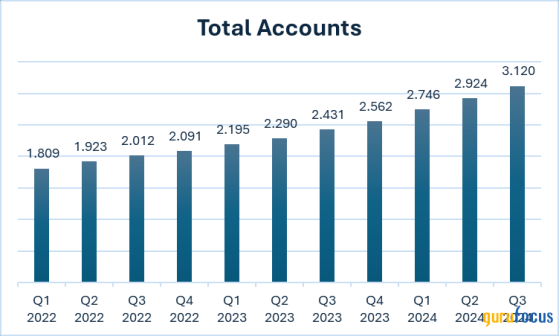

Moreover, with growing account equity and steady client account openings year after year, Interactive Brokers is well positioned to continue growing, even in a lower interest rate environment, operating in 34 countries, and supporting products in 27 currencies. Interactive Brokers has been able to attract customers with customer accounts reaching a record of 3.12 million, a 28% year-over-year (YoY) increase, with customer account growth of 196,000, in the third quarter.

Source: Author

A better metric to analyze Interactive Brokers' growth is customer equity, as customers can open accounts with little to no deposit, which increases total accounts but does not directly impact revenue. However, this wasn't the case, as new accounts brought in more cash, which helped raise customer equity by 46% YoY, reaching $541.5 billion. This has grown faster than customer accounts, thanks to higher stock market revaluations and larger deposits. Daily average revenue trades surged to 2.63 million, a 46% increase YoY.

Source: Author

Innovation and Product ExpansionInteractive Brokers continues to innovate with new product offerings and strategic innovations designed to enhance the client experience. The firm has introduced tailored tools for options traders and enhanced its mobile trading platform, making it increasingly attractive to retail investors.

In addition to its existing offerings, Interactive Brokers has introduced extended market hours, providing clients with more flexibility and opportunities to manage their portfolios outside of regular trading hours.

Additionally, Interactive Brokers has added "yes or no" contracts on key economic events, including U.S. elections and long-term developments like future global temperatures. These forecast contracts offer clients a unique avenue to hedge risks or speculate on outcomes, expanding Interactive Brokers' appeal.

Another temporary tailwind for Interactive Brokers was the addition of Forecast Contracts on Election Outcomes for U.S. customers. These contracts allow investors to speculate on election results, adding another layer of unique trading opportunities for clients. This focus on innovation reflects the company's commitment to differentiate itself from competitors, particularly those with a more retail-centric model.

Q3 2024 Earnings ReviewInteractive Brokers posted strong Q3 2024 earnings, reporting $1.37 billion in revenue, a 19% YoY increase. While the company slightly missed consensus EPS estimates of $1.82 by $0.07, the overall results are solid.

Source: Author

The 19% top-line growth was primarily driven by a 31% increase in commission revenue, reinforced by a 35% rise in options contract volumes and a 13% increase in futures contract volumes, well above industry growth, increasing Interactive Broker market share.

Higher trading volumes, particularly in options, have been a critical driver of the company's success, as clients use these instruments to hedge risks or speculate in uncertain markets.

Despite a 50 bps rate cut towards the end of the quarter, the company's net interest income (NII) rose by 9%, reaching a quarterly record of $802 million. Typically, a higher rate environment is better for NII margin, hence I believe it could face pressure in the coming year as interest rates are expected to decline. For every 25 bps cut, management estimates a $64 million reduction in annual NII. Nevertheless, I expect this potential decline to be partly offset by increased commission revenue as traders become more active in a risk-on environment.

On the expenses side, execution, clearing and distribution fees rose by 18% YoY, in line with revenue growth. A one-off consolidation cost of $12 million caused general and administrative expenses to spike by 67%, reaching $75 million.

The balance sheet remains in a healthy state, with leverage and liquidity metrics well within acceptable ranges. Importantly, the company has also slowed dilution, with shares growing just 1% YoY, compared to 4% in previous quarters, a trend I hope to see continue.

Interest Rate Sensitivity and Competitive PressuresInteractive Brokers is well-positioned for growth, but there are several risks to consider, primarily relating to interest rates and economic conditions. At present, the average duration of its portfolio is short, less than 30 days, which has benefited from the inverted yield curve. However, as interest rates are expected to decline, this benefit may diminish. The company's net interest income, which accounts for 62% of total revenues, is vulnerable to rate cuts, and a reduction in rates to around 3.5% in 2025 could decrease NII by as much as $384 million. If trading activity does not increase to offset this, Interactive Brokers could face challenges in maintaining its current growth trajectory.

Interactive Brokers operates in a competitive environment, with key players such as Charles Schwab (NYSE:SCHW) & TD (TSX:TD) Ameritrade, and Robinhood (NASDAQ:HOOD) competing for market share. Unlike many of its competitors, Interactive Brokers focuses heavily on advanced traders and institutional clients, rather than purely retail investors. While Interactive Brokers' focus on advanced traders and institutional clients gives it a more stable and profitable user base, it remains vulnerable to shifts in the competitive landscape, particularly if competitors continue to innovate and offer similar services.

Valuation

Source: Author

From a valuation perspective, Interactive Brokers currently trades at a price-to-sales (P/S) ratio of 3.2x, with a forward P/S of 3.1x, compared to industry peers' averages of 3.9x and 3.5x, respectively. Its price-to-earnings (P/E) ratio stands at 22.4x, with a forward P/E of 21.6x, which contrasts with the industry average of 29.6x and 17.5x. This divergence between Interactive Brokers' current and forward P/E compared to the industry suggests that the company is valued fairly but might lack the growth premium of some competitors.

The PEG ratio of 1.3x indicates that the company offers a reasonable valuation relative to its growth prospects. Additionally, its price-to-book (P/B) ratio of 3.8x aligns closely with industry peers, further supporting the case that the company is trading near fair value.

Source: GuruFocus

While the company is trading within its historical range, the valuation does not provide a significant margin of safety. However, its market share gains and consistent performance justify this valuation. Going forward, any potential upside will likely be driven by continued market share expansion, trading volume increases, and strategic initiatives.

My Final TakeInteractive Brokers has proven its ability to grow and adapt in a highly competitive industry. Its commitment to low-cost, technology-driven access to global markets, along with its innovative product offerings, positions it as a leading brokerage firm. However, the prospect of declining interest rates poses a risk to its net interest income, and competitive pressures remain a challenge.

Given the company's strong market position, I believe it is fairly valued. The stock has grown more than 75% YTD and it wouldn't surprise me if it started trading sideways for a while. Its consistent growth and advanced platform make it a stable long-term investment, though caution is warranted as it navigates potential headwinds from interest rate changes.

This content was originally published on Gurufocus.com