By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

It's been a quiet start to what will surely be a busy week in the foreign-exchange market. There are two monetary policy announcements, China’s trade balance, Canada and the U.S.’ labor-market reports on the calendar. USD/JPY remains stuck near 114 and its inability to rally is surprising some investors who have watched March rate-hike expectations rise from 40% in late February to 96% today. Janet Yellen made it very clear on Friday that a March hike is appropriate if the economy evolves as expected. Considering that the U.S. labor market is in focus this week, her comments are directed at payroll and wage growth. Economists are looking for lower nonfarm payrolls in February but average hourly earnings are expected to pick up pace as the unemployment rate is expected to drop to 4.7% from 4.8%. Yet the dollar is struggling to extend its gains as investors realize they will need to wait until Friday for data meaningful enough to boost expectations for March tightening. Between now and then, the dollar will be marking time, which should mean consolidative trading for USD/JPY. The levels to watch are 114.75 on the upside and 112.50 on the downside. Ultimately, the dollar should be trading higher with the Fed gearing up to raise interest rates, but there are no major U.S. economic reports until Friday -- so profit taking until then is just as likely.

In the meantime, traders are focused on Monday night’s Reserve Bank of Australia monetary policy meeting. While the central bank is widely expected to keep interest rates unchanged, the Australian dollar is the best-performing currency this year and its strength could worry the RBA. Since Jan. 1, AUD is up more than 5.5% versus GBP, more than 4.5% versus USD and CAD and over 4% versus EUR, NZD and China's yuan. There have also been areas of weakness. Labor-market conditions in particular deteriorated significantly at the start of the year, inflation expectations have fallen, service-sector activity slowed, parts of the Chinese economy are losing momentum and the trade balance shrank significantly. Yet commodity prices are on the rise, retail sales and consumer confidence is up and manufacturing activity remains strong. Prior strength is beginning to fade and the RBA will need to decide whether the outlook is murky enough to emphasize the headwinds created by a strong currency. Last time it met, RBA was upbeat but we expect less optimism this month. If we are right, AUD/USD could make a run for 75 cents. The Canadian and New Zealand dollars continued to fall. No economic reports were released from Canada but New Zealand business approvals rebounded. Canada’s trade balance and IVEY PMI reports are scheduled for release Tuesday along with New Zealand’s global dairy auction.

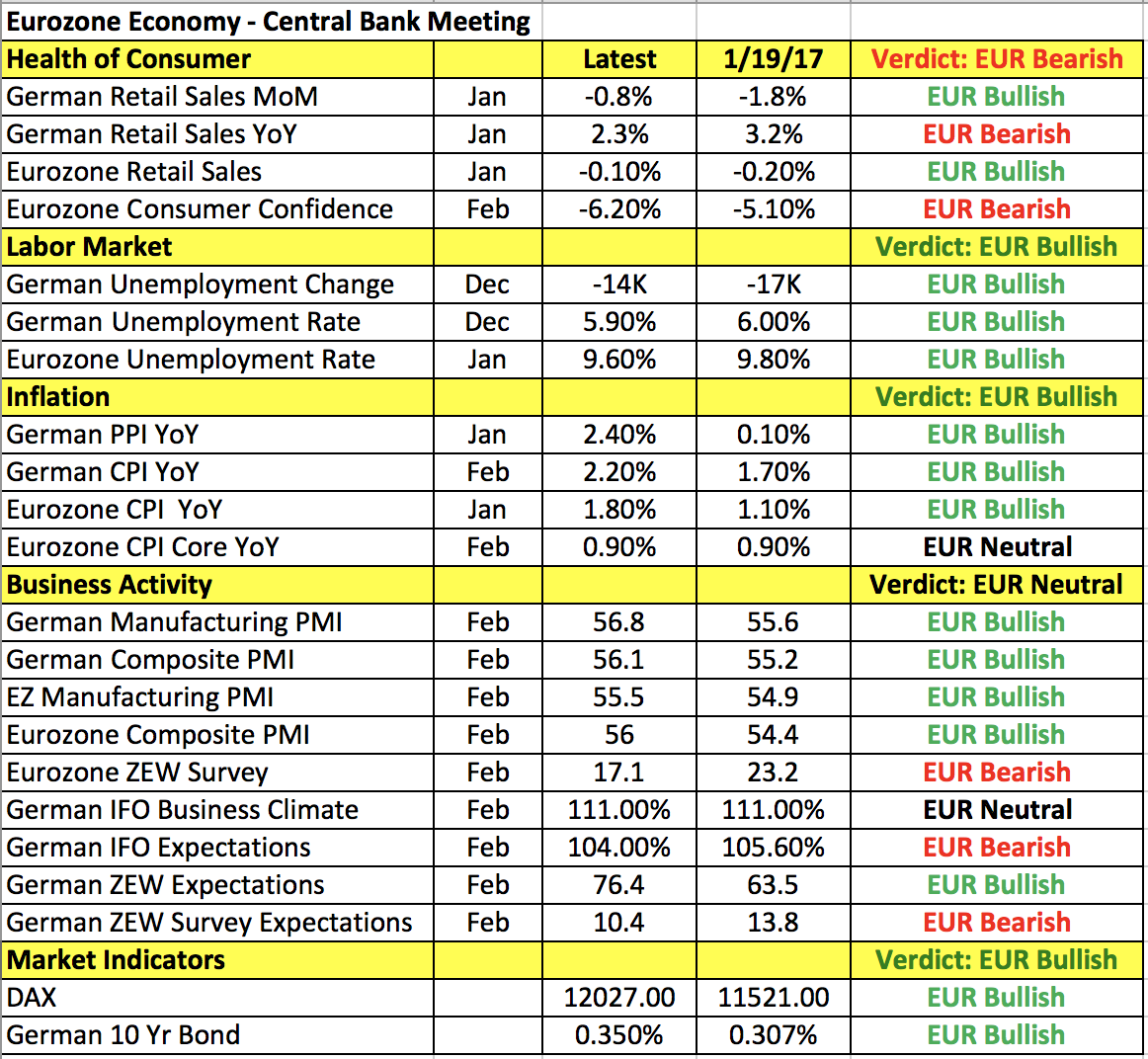

It was a topsy-turvy day for EUR/USD, which raced as high as 1.0640 before retracing below 1.0575. Monday morning’s Eurozone economic reports were mixed with retail PMI in Germany improving but the same index for the Eurozone declined. As reported by our colleague Boris Schlossberg, Alain Juppe’s decision to not run for president caused the currency to crash as he was seen as a “palatable replacement for scandal-embattled Francois Fillion. The news clearly disappointed investors who had hoped that Juppe could peel away some of the conservative support from Marie Le Pen. Ms. Le Pen’s support remains at an unwavering 27% while her opponents continue to jockey for positioning. Although Le Pen trails badly in second-round runoff polling (losing 40% to 60% in Monday’s daily poll to Mr. Macron) investors remain very leery of trusting the polling numbers. With both Brexit and Trump's win fresh in their minds, investors are highly concerned that Ms. Le Pen could somehow eke out a victory that could put EZ's second-largest economy in the grip of populist rebellion.” Aside from French politics, the European Central Bank’s monetary policy meeting is the main focus for the euro this week. We expect the central bank to upgrade its inflation forecasts but President Draghi may try to downplay this move by saying that they will look past the temporary affect of higher commodity prices and keep policy accommodative.

While sterling extended its losses, it continues to hold above 1.2200 versus the U.S. dollar. No major U.K. economic reports were released on Monday and no major data is expected on Tuesday. Article 50 is expected to be triggered in the next 2 weeks. Some market watchers believe that it could happen this week but others feel that it could happen on March 15. The House of Lords’ decision to pass an amendment guaranteeing rights for EU citizens was a setback for Prime Minister May, but the House of Commons will take up the amendment on March 13 and 14. If they reject it, PM May will most likely press forward with triggering Article 50, which formally kicks off the U.K.’s divorce proceedings with the EU. However if the House of Commons approves rather than rejects the amendment, May will be faced with a far more difficult decision of overturning Parliament’s decision.