Oil prices jump after Iran says critical Strait of Hormuz to remain shut

Investors who believe they have missed the rally in EV stocks should consider paying attention to the copper market over the coming years, as demand for EVs and related infrastructure is set to grow. Along with rare earth metals, copper is one of the main inputs in the EV industry, and investors can take advantage of this projected increase in demand through diversified copper ETFs.

Copper and the EV Market

It's easy to kick yourself for not having invested in Tesla (NASDAQ:TSLA) at any point over the last 10 years (except perhaps in 2022). The stock seems to have defied all short sellers’ expectations and powered ahead against all doubts. But of course, Tesla is no longer the only sheriff in town. It seems like every automotive company, from American darlings like Ford and GM, to European luxury brands like Porsche (ETR:P911_p), Audi, and Mercedes is racing to release new EVs with better range and better tech. It is far too soon to determine who the winner(s) will be, and so investing in any one of these can prove to be quite risky.

Investors are probably better suited to taking a "selling shovels in a gold rush" strategy by investing in the main inputs and raw materials that will be required to make these vehicles. Any investor who has at least considered investing in the EV market has, at the very least, heard that copper will be one of the main materials required. But as copper is also required for internal combustion vehicles, "what's the big deal?" you may be asking.

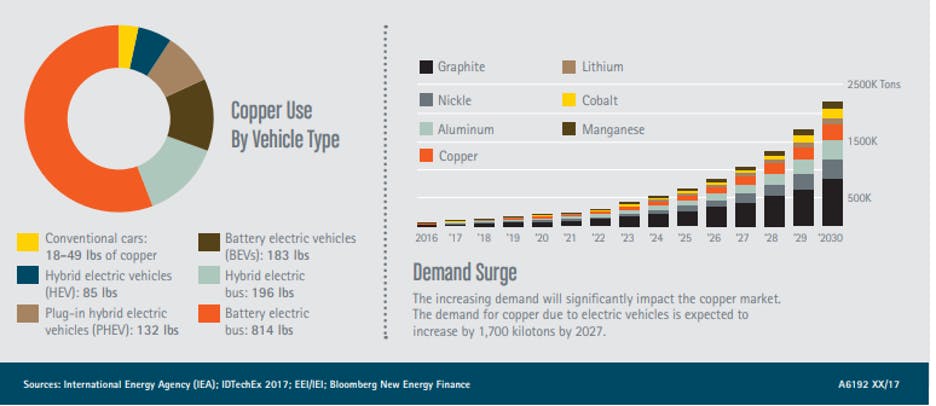

Well, it turns out the amount of copper required in a typical electric vehicle can be 5 to 10 times the amount required to build a conventional vehicle. A pure electric vehicle can contain more than a mile of copper wiring, which could equal up to 183 pounds per vehicle, compared to a conventional car which requires 18 to 49 pounds of copper, and so the difference is quite staggering:

It is estimated that by 2027 the demand for copper required only for EV production, will increase to 1,700 kilotons, which represents a more than three times increase from that in 2023. This does not even take into account the infrastructure that will be required to support all of these new EVs. We can also speculate that as the technology takes off, we will see more and more transit systems converting to electric, as well as boats and recreational vehicles.

Copper Supply concerns

The past two years have possibly conditioned investors to hear " supply constraints” and start quaking in their boots. After all, a lack of supply prevents most retailers from generating any sales. But commodities often play by different rules. Just look at the prices of oil and gas over the last 12 months.

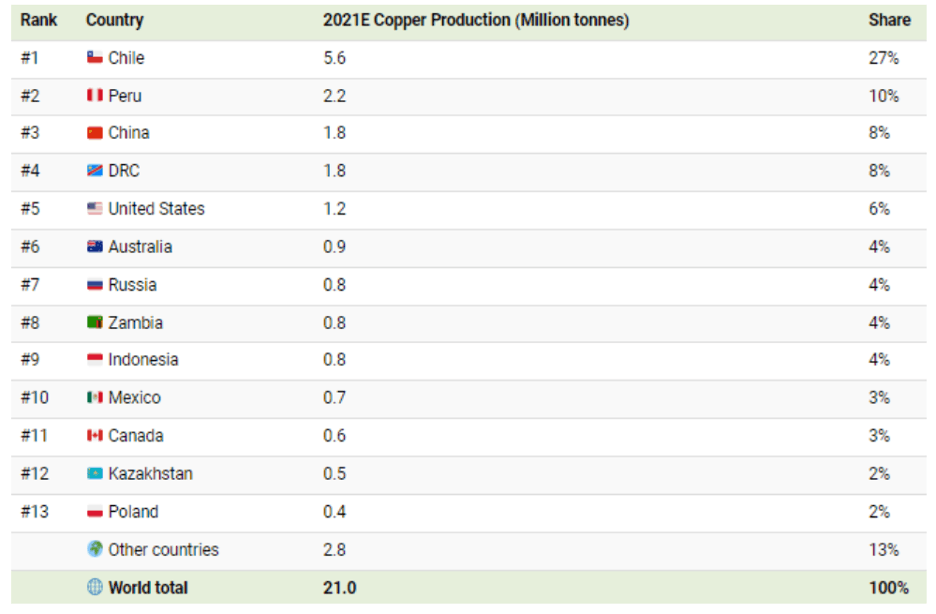

Very much like oil, global copper supplies seem to be constrained to certain geographical areas that, historically speaking, have not been without their share of political or social turmoil. The breakdown of copper mining as a percent of the global supply can be seen in the image below:

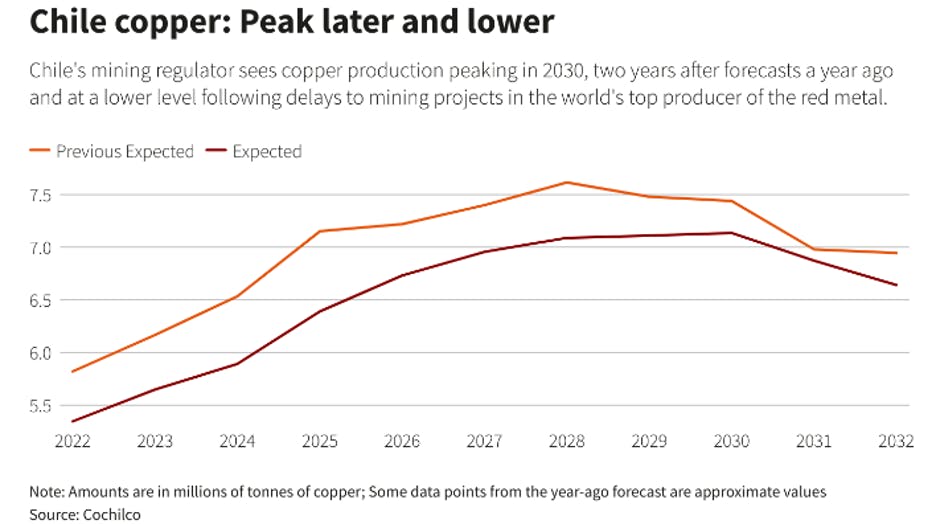

Of the top five producers, Chile is by far the largest but according to the most recent Chilean government report, it appears their production rates over the next decade will grow at a slower rate than they had previously hoped.

At the same time, production in Peru, the second largest producer, has significantly suffered over the last three years due to covid-19 restrictions and more recently from the political unrest in the country. As a result, the world’s two largest producers are behind schedule based on their own projections, while demand is projected to pick up globally.

All of this should add up to higher prices for the red metal in the next decade.

Getting Exposure to Copper ETFs

Having explored some of the factors affecting copper demand, production, and future prices, the main question is: How can investors get exposure? At the moment, the copper ETF market is somewhat limited in offerings, with no available copper bullion ETFs in either the U.S. or Canada.

Canadians have a few options available, however, when it comes to Copper Equity ETFs.

Horizons Copper Producers Index ETF (TSX:COPP)(COPP)

- Only Canadian traded Pure Play Copper ETF

- Focus: North American Copper Mining Companies

- Fee: 0.65%

- YTD Performance: 15.09%

BMO (TSX:BMO) S&P/TSX Equal Weight Global Base Metals (TSX:ZMT)(ZMT)

- Provides relatively equal exposure to a wide range of industrial metals, as well as copper

- Focus: Global Base Metal Producers

- Fee: 0.55%

- YTD Performance: 14.92%

iShares S&P/TSX Global Base Metals ETF (TSX:XBM) (XBM)

- Provides exposure to global industrial metal miners however the majority of the fund’s exposure comes from its top 10 holdings, which could partially explain the lower performance YTD.

- Focus: Global Base Metals Producers

- Fee: 0.55%

- YTD Performance: 11.55%

This content was originally published by our partners at the Canadian ETF Marketplace.