Investors looking for safety during a turbulent time have historically looked to the healthcare industry as a haven, due to its defensive qualities – consistent returns and stable earnings that are uncorrelated with the overall stock market or economy. However, the healthcare industry has been a source of innovation, and a recent drug invention has long-run potential to reshape the medical landscape going forward. This article will highlight recent developments in the medical space, the companies that are poised to benefit, and ETFs that provide exposure to these companies.

Performance trends in the healthcare sector

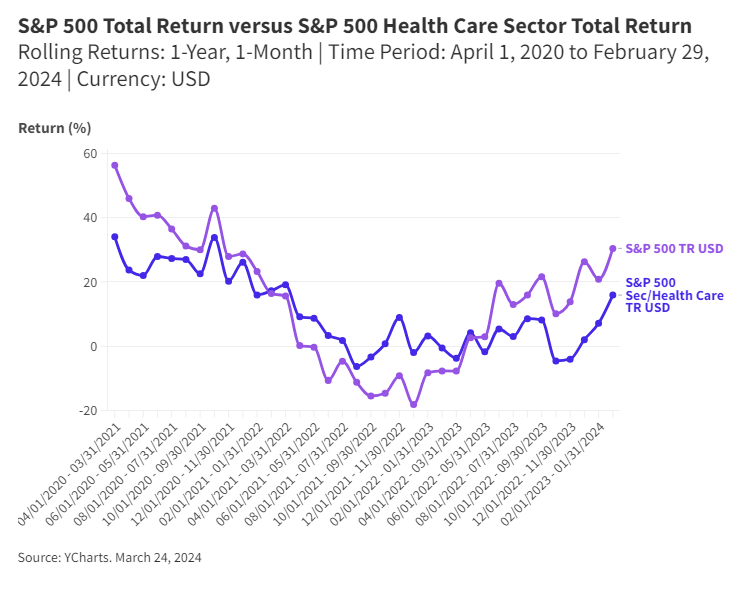

The healthcare sector tends to outperform when the general market is weak or the economy is slowing; throughout 2022 this was evident as the general market underperformed, but the sector buoyed. 2023 was a different story, as economic surprises rewarded the technology, consumer, communication services and industrial sectors, resulting in defensive investing having a difficult year. Recent developments in the healthcare sector are indicating that 2024 could be beneficial for investors this time around.

Growing popularity of Ozempic and weight-loss drugs

While the scientific term Glucagon-like peptide-1 agonists, or its abbreviation GLP-1 may sound familiar to some, the word Ozempic® has certainly risen in popularity over the last year. The newest generation of weight-loss drugs, namely Novo Nordisk (CSE:NOVOb)'s Ozempic® and Wegovy®, and Eli Lilly (NYSE:LLY)'s Zepbound™ and Mounjaro™, may transform how both diabetes and obesity are treated.

As reported by the Centers for Disease Contril and Prevention, in the U.S., 38.4 million people have diabetes, of which 29.7 million are diagnosed and 8.7 million are undiagnosed. Taking a global perspective, according to the World Health Organization, in 2022, 2.5 billion adults aged 18 years and older were overweight, including over 890 million adults who were living with obesity. As a result, these new drugs have a large total addressable market.

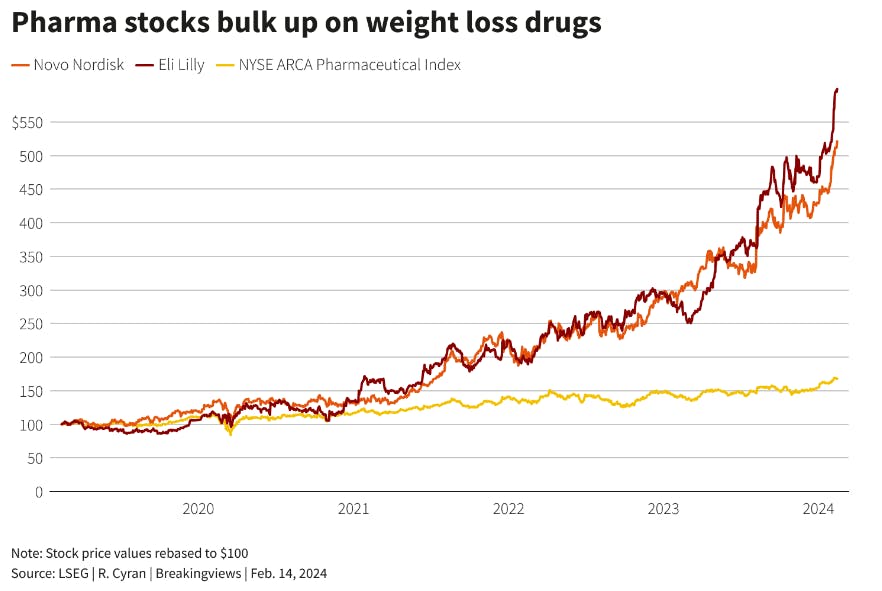

The hype around these new drugs has resulted in the stocks of these companies rising significantly in recent months (see chart below). However, the distribution and accessibility of these new drugs have been difficult, as supply shortages have limited the availability and increased the potential for falsified versions.

These distributions have in turn strengthened the demand for existing diabetes and obesity treatments. Firms like Insulet, which makes insulin pumps, and Inspire Medical Systems, a maker of devices treating sleep apnea have benefited during this period. Furthermore, firms that support the diabetes and obesity drug market, including life sciences tools and services companies such as Thermo Fisher Scientific (NYSE:TMO), which makes key components for these injectable medicines are also beneficiaries.

Other healthcare developments

A notable development taking place in the U.S. healthcare space is a change in the fee model being utilized by medical providers, in that, there is a gradual shift from the traditional fee-for-service model (in which providers are compensated based on the volume of visits and services they provide) to a value-based model (in which physicians are compensated based on patient outcomes rather than on service volumes). UnitedHealth Group (NYSE:UNH), one of the largest managed-care health insurers in the U.S., is a large proponent of this change, as they believe it will allow them to deliver care more efficiently and conveniently while meeting each patient’s needs.

Investing in Healthcare ETFs

For investors seeking to gain exposure to the firms mentioned above in a straightforward and comprehensive way, the following ETFs offer such exposure:

TD (TSX:TD) Global Healthcare Leaders ETF (Ticker: TDOC), tracks the performance of the Solactive Global Healthcare Leaders Index, which reflects the performance of global large and mid-capitalization issuers that are related to healthcare while imposing a limit of 2% to any single issuer.

As of February 29th, both Eli Lily and Co. and Novo Nordisk are among the fund’s top 10 holdings.

BMO (TSX:BMO) Global Health Care Active ETF (Ticker: BGHC) provides exposure to global publicly traded healthcare companies with significant growth potential. Experienced portfolio managers with extensive scientific and healthcare investment expertise employ a fundamental top-down, bottom-up process to screen for the most promising investment opportunities within the healthcare sector globally.

As of February 29th, both Eli Lily and Co, Novo Nordisk, UnitedHealth Group, and Thermo Fisher Scientific are among the fund’s top 10 holdings.

Evolve Global Healthcare Enhanced Yield Fund (Ticker: LIFE), tracks the performance of the Solactive Global Healthcare 20 Index Canadian Dollar Hedged while writing covered call options on up to 33% of the portfolio securities, at the discretion of the Manager. The level of covered call option writing may vary based on market volatility and other factors.

As of February 29th, both Eli Lily and Co, Novo Nordisk, and Thermo Fisher Scientific are among the fund’s top 10 holdings.

This content was originally published by our partners at the Canadian ETF Marketplace.