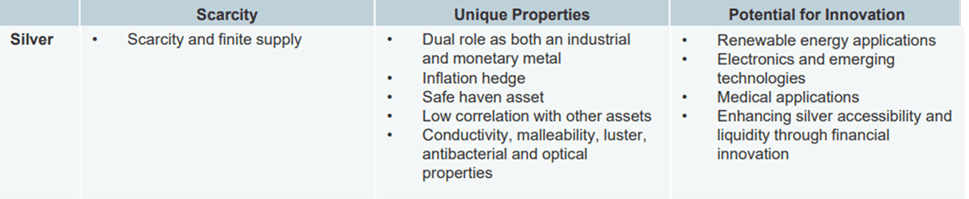

When thinking about precious metals, gold is normally the first type that comes to mind, which is understandable. It is a globally recognized store of value, it can be utilized as a hedge against inflation, and it has a low correlation with other asset classes. But guess what, silver also possesses these attributes and is an essential resource for industrial applications, making it truly versatile in nature. This article will focus on the commercial importance of silver and why investing in it, via Silver ETFs, can be beneficial going forward.

Newfound importance

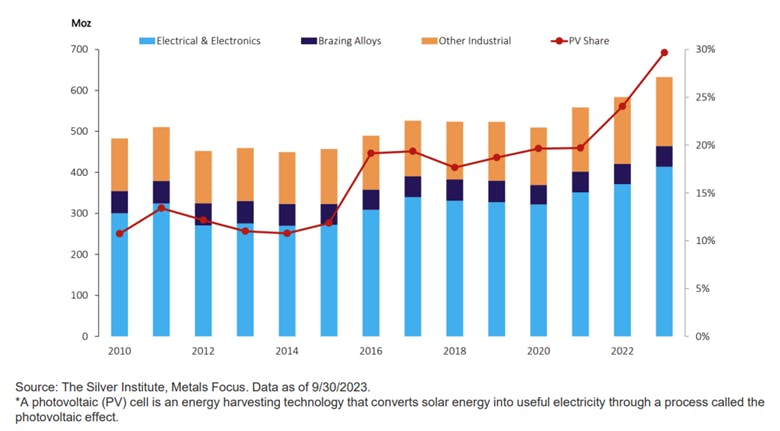

The versatility of silver as an industrial metal has elevated its demand in recent years. As the world moves toward electrification, silver has grown in importance due to its uses in solar panels and electric vehicles. As reported by the Silver Institute, industrial demand for silver rose in 2023 due to increasing investment in photovoltaics (PV), power grids and 5G networks, as well as increased use of automotive electronics and supporting infrastructure. Improvements in PV were particularly noticeable as the increase in cell production exceeded silver thrifting, which helped drive electronics and electrical demand higher.

With societies shifting toward electrification and green energy, the demand for silver as a precious metal is increasing. But there is a wrinkle, given that a majority (approx. 80%) of silver supply is a byproduct of lead, zinc, copper, and gold production, the availability of silver is dependent on the profit mines can garner from base metals, such as lead and zinc. Lead and zinc prices are currently reasonably low, so many of these mines are barely profitable. Hence, it is unlikely that additional silver production will come on stream anytime soon.

The growing industrial demand for silver, coupled with the decline in mine production, means significant tightening in the market for the precious metal, leading to potential impacts on its price now and in the future.

An investment opportunity

As electric vehicles and energy storage technologies become mainstays in our global economy, the raw materials that go into these technologies will represent a material portion of their economic value and be a source of wealth-building for investors. Thus, the electrification movement is not only about energy advancement but also an opportunity for wealth generation within an ecosystem focused on sustainability. As the world transitions to a low-carbon economy, investors are presented with an opportunity to participate in innovations that will usher in a new energy ecosystem. By having exposure to raw materials, such as silver, that are integral to clean energy, investors can benefit meaningfully over time.

For investors interested in investing in silver, there are notable ETF solutions that provide a pathway to gain exposure and profit from the potential rise in the price of the precious metal in the future, namely:

- Purpose Silver Bullion Trust ETF (Ticker: SBT): The fund invests in and holds substantially all of its assets in silver bullion to provide investors with a secure, convenient, low-cost alternative for investors interested in holding an investment in silver bullion. AuM: $4.88M (as of Jan 17th, 2024).

- iShares Silver Bullion ETF (Ticker: SVRSVR): The fund replicates the performance of the price of physical silver bullion. AuM: $66.82M (as of Jan 17th, 2024).

- Horizons Silver ETF (Ticker: HUZHUZ): The fund will track the performance of the Solactive Silver Front Month MD Rolling Futures Index ER. AuM: $25.98M (as of Jan 17th, 2024).

Images sourced from “Future Facing Metals, Both Precious and Critical” webcast on Dec. 12, 2023. Sprott Asset Management.

This content was originally published by our partners at the Canadian ETF Marketplace.