Cupertino-based tech giant Apple (NASDAQ:AAPL) has been on a superb six-month surge, rebounding sharply from its April lows with impressive momentum. Since April, it has been a sea of green for Apple investors, pocketing more than 30% in gains over the past six months. Moreover, with the iPhone upgrade super cycle underway and despite the concerns, the iPhone 16 is proving to be a strong seller, with analysts optimistic about Apple stock's performance. However, after its powerful surge in value, the stock trades at a sizeable premium, outpacing its historical benchmarks and peers. Nonetheless, with the upcoming Apple intelligence rollout for the iPhone 16 and strong October-November seasonality, I expect the stock to continue moving higher despite the risks.

iPhone 16 Rollout Off to a Strong Start

Apple has been building a healthy head of steam leading up to the recent iPhone 16 launch, fueled by bullish calls from analysts like Wedbush's Dan Ives. Ives touted an upgrade supercycle driven by the release of AI-powered features for the company's flagship iPhone device earlier this year. Following the highly anticipated OpenAI partnership revealed at Apple's Worldwide Developers Conference, Ives called it a home run.Moreover, he talked about the pervasive impact of the AI-driven super cycle that'll likely extend beyond iPhones and into their services. Ives felt Apple didn't receive enough credit for its AI monetization, a scenario likely to change with 1.5 billion iPhones primed to upgrade.

Roughly three months have passed since the WWDC event, and the iPhone 16 is in stores, boasting an impressive opening weekend. Ives wrote in a recent investor note that iPhone 16 sales are likely to rise by high single digits, potentially reaching double digits by the fourth-quarter. Moreover, he added that the iPhone 16's AI features, camera upgrades, and improved battery life could drive its upgrade cycle to exceed 90 million units at launch, ahead of its predecessor, the iPhone 15, by 8 million to 10 million units. Following the encouraging launch numbers, Ives maintains his Outperform rating on the stock, assigning a $300 price target.

Similarly, JPMorgan (NYSE:JPM) analyst Samik Chatterjee reaffirmed his bullish buy rating on Apple stock, boosting his price target to $245 from $225. Chatterjee expects Apple to sell 244 million iPhones next year, representing a solid 10% jump from the 222 million expected this year. Additionally, he forecasts sales to climb to a massive 268 million by 2026. Additionally, he's raising estimates for services growth, which will be driven by stronger monetization through third-party AI applications in the coming years.

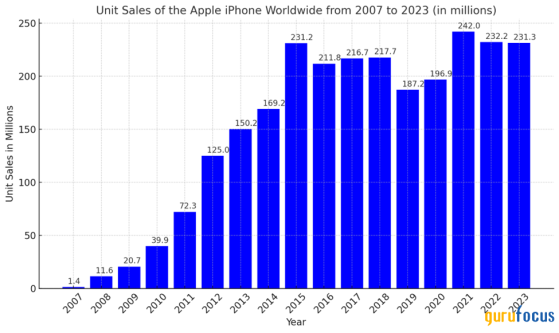

Authors own based on historical data

The chart above shows the global trajectory of iPhone sales from 2007 to 2023, highlighting their growth and steady performance over the years. Since 2015, iPhone sales growth has been relatively flat, with considerable drops in 2018 and 2019. However, growth has picked up remarkably since 2021, and based on Chatterjee's estimates, we could see 5% to 10% growth in the upcoming years, with robust upside expected from the introduction of Apple Intelligence.

Profitability and Financial Resilience Remain Strong

Perhaps the biggest catalyst for iPhone stock over the years has been the strength of its bottom line and its stand-out liquidity metrics. Therefore, despite the relatively uninspiring iPhone sales, the stock has returned more than 54% in the past three years, beating the S&P 500's 28% gain. Its diversified services and hardware ecosystem and effective cost management continue to fuel its robust earnings.Gurufocus rates Apple's profitability rates at a perfect 10/10, showcasing its dominance in financial strength compared to its peers and historical metrics. The company's gross margin of almost 46% is comfortably ahead of industry averages, reflecting its superior cost management and premium pricing power. A major driver behind Apple's success has been a shift towards services, accounting for 22.2% of total sales. Additionally, this segment surged from $3.69 billion in Q1 2013 to a remarkable $24.2 billion in Q3 2024.

Furthermore, the company's operating margin at 31.27% and net margin at 26.44% are equally impressive, highlighting its efficiency in managing its operational expenses. Also, its return on equity (ROE) is at a superb 151.08%, shedding light on its exceptional efficiency in using equity to generate profits. Additionally, Apple's ROIC-WACC% has soared, climbing from 15% in 2020 to an impressive 22% in 2023, indicative of the company's growing ability to generate returns over its cost of capital.

Naturally, we see that trickle-down effect on its financial strength rating, which attracts an impressive 7 on 10 rating. Perhaps the standout metric for Apple is its exceptional interest coverage ratio of around 120.35 times, showing its powerful ability to meet its interest obligations. Likewise, its debt-to-EBITDA ratio of 0.75 aligns with its historical benchmarks and peers, reflecting the effective management of its debt load relative to earnings. On top of that, with a Piotroski F-Score of 8/9 and an Altman Z-Score of 10.13, Apple is deemed financially safe, signaling low distress levels.

A Deep Dive into Apple's Valuation Dynamics

As I mentioned, Apple's stock has been on a superb run in the past six months after bottoming out in April. The stock has continued to notch higher highs and is currently trading close to its 52-week high price of $237.23. It has been linked to the enthusiasm surrounding its Apple Intelligence, which will likely be a pivotal talking point over the next several months. However, so far, given the relatively strong opening sales for the iPhone 16, without the AI features in place, investors are licking their lips over what's to come. Depending on where it may go from here, the stock has found support around $196.72 and is unlikely to move below that level in the near-term. Moreover, it has seen strong resistance around the $238 mark, close to its 52-week highs.Apple Stock Seasonality (Courtesy TrendSpider)

Another advantage for Apple stock is that October and November historically show strong seasonality, with October standing out, as shown by the chart above. We can see that October tends to be the third-strongest month in terms of seasonality for the tech giant, with July being the strongest.

Furthermore, Apple's 12-month price target of $240.58 represents almost a 6% upside from current price levels. The high estimate of $300 aligns with Dan Ives's price target, pointing to a superb bullish sentiment, while the low-end projection of $183.90 points to a conservative outlook. Notably, the GF Value of around the $200 mark points to a reversion back to its critical support level, implying that though the stock is considerably overvalued.

The bearish picture painted by Apple's GF value is supported by its unattractive pricing metrics at this time. Apple's current price of around $227.40 comfortably exceeds multiple valuation metrics, underscoring its overbought status. Discounted cash flow (DCF) models based on free cash flow and earnings suggest fair values of $154.88 and $174.53, reflecting sizeable gaps of 32% and 23%, respectively. Other metrics, including the Peter Lynch value of $113.99, show an even greater disparity, reinforcing the overvaluation narrative.

The chart mirrors 2021 when Apple (AAPL, Financial) saw a healthy bump in iPhone sales driven by the iPhone 12's 5G debut, similar to the current momentum sparked by the iPhone 16's new AI features. However, as you can see from the 2021 chart below, while Apple's stock price is fair value estimates, it still maintained closer alignment with fundamentals compared to 2024. In fact, in 2021, Apple's DCF based on free cash flows was at a solid $149.38, comfortably above its stock price of $132.69, signaling better alignment with its intrinsic value.

Risks To The Thesis

A huge part of Apple's stock's bull case is linked to Apple Intelligence, but multiple risks will likely impact its price. Firstly, AI features central to the iPhone 16's appeal are still in their nascency and will roll out over time, with its most advanced features unlikely to be fully operational until months after launch.Additionally, while commendable, Apple's commitment to privacy could significantly hamper its ability to compete with more aggressive AI development that's taking place at Google (NASDAQ:GOOGL) and OpenAI. This will likely impact Apple's innovation curve, impacting its long-term bull case. Furthermore, the overvaluation narrative persists with Apple stock, which trades at a premium and already reflects much of the AI-fueled growth potential, as discussed extensively.

Bottomline On Apple Stock

Apple stock has been running hot, fueled by the excitement surrounding its highly touted AI-powered features, likely to propel its business into its next phase of expansion. Moreover, iPhone 16 sales are off to a strong start, even without the AI features, pointing to more upside ahead. Additionally, historically, the stock tends to perform well in the next couple of months, adding to its bull case. However, investors should be cautious of the risks, especially if the full potential of Apple Intelligence isn't realized.This content was originally published on Gurufocus.com