- Apple has been the best-performing mega-cap technology company this year

- However, its momentum could be under threat due to slowing global consumer spending

- Bank of America recently downgraded Apple stock to neutral from buy

Investors have been treating Apple (NASDAQ:AAPL) as one of the few safe long-term options amid this year's rout. The reason for that seems obvious: the iPhone maker has a diversified source of revenue on the back of a robust global portfolio of products and services.

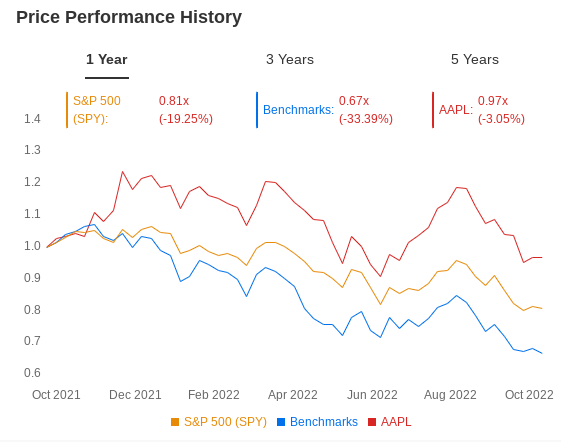

With a nearly $2.249 trillion market value, Apple is still the world's most valuable company. It has also been the best-performing stock among the mega-cap technology companies, falling about 20.5% in 2022, compared to a 32.8% decline for the Nasdaq 100.

Source: InvestingPro

But that could be under threat as slowing global consumer spending begins to hurt the company's growth momentum, especially in markets like Europe and China, where growth is faltering due to geopolitical conflicts and COVID restrictions.

Pressure from a stronger dollar is another headwind that could hurt the company's bottom line.

In the previous quarter, Apple reported an almost 11% decline in profit after weathering supply constraints and shutdowns in China. On the bright side, however, iPhone sales continued to grow despite economic challenges.

The latest test of Apple's resilience will come when the company reports its fiscal fourth-quarter earnings on Oct. 27.

Apple's rival, Samsung (KS:005930) Electronics (OTC:SSNLF), the world's biggest maker of semiconductors, smartphones, and televisions, has already lowered expectations for smartphones this year.

A Rare Downgrade

In a recent note, Bank of America downgraded Apple stock to neutral from buy, citing incremental risks to the company's earnings going forward. The note says:

"Shares have outperformed significantly YTD...and have been perceived as a relatively safe haven. However, we see risk to this outperformance over the next year, as we expect material negative estimate revisions driven by weaker consumer demand."

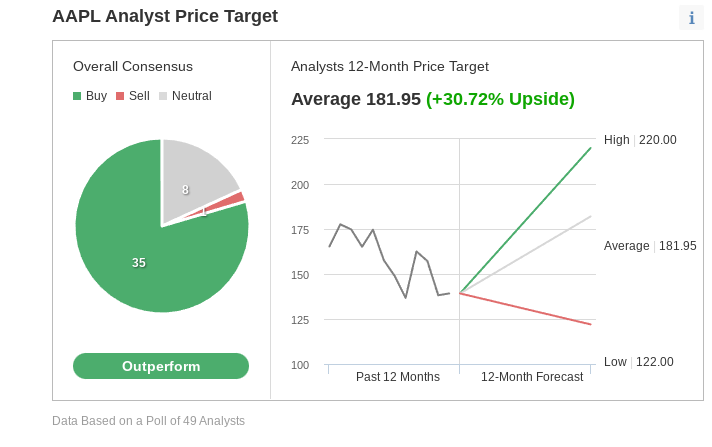

Bank of America's downgrade is a rare event for Apple stock as the majority of analysts are still bullish on the company's growth prospects. According to an Investing.com poll, about 70% of the 49 analysts covering the stock recommend buying Apple shares, while only one suggests selling.

Source: Investing.com

The major driver of this optimism is Apple's wealthy and loyal consumer base, in theory, more resilient to macroeconomic headwinds.

Investors also consider Apple a safe bet in the current market turmoil due to its vast global market share in the cellphone market, its long-term track record of profitability, and its fortress balance sheet.

This year, Apple also introduced the iPhone 14, new AirPods Pro earbuds, and new Apple Watch models. The latest pre-order data showed that the iPhone 14 Pro Max was the best-selling model, surpassing what the older version did in a similar timeframe, according to a report by Bloomberg.

Apple's cash pile offers another solid reason for investors looking to take refuge in the current uncertain times. With the world's largest corporate cash reserves of more than $200 billion, the company has enough firepower to support its stock through share buybacks.

Investors like repurchase programs as they reduce a company's share count and lift earnings, especially during turbulent times like the ones we're now facing.

Warren Buffett, whose investment firm is one of the largest shareholders of Apple, has immensely benefited from this trend. Buffett has built a $153-billion stake in Apple since his Berkshire Hathaway (NYSE:BRKa) started buying the stock in late 2016. Now it's the company's top holding.

Bottom Line

Apple's earnings this month may feel the impact of a worsening economy and more cautious consumers. But that doesn't mean the company has lost its haven status. In my opinion, any weakness should be taken as a buying opportunity for long-term investors looking for a company that is likely to rebound strongly, backed by a robust share buyback plan, a resurgence in sales, and impressive margins.

Disclosure: At the time of writing, the author was long on Apple stock. The views expressed in this article are solely the opinion of the author and should not be taken as investment advice.