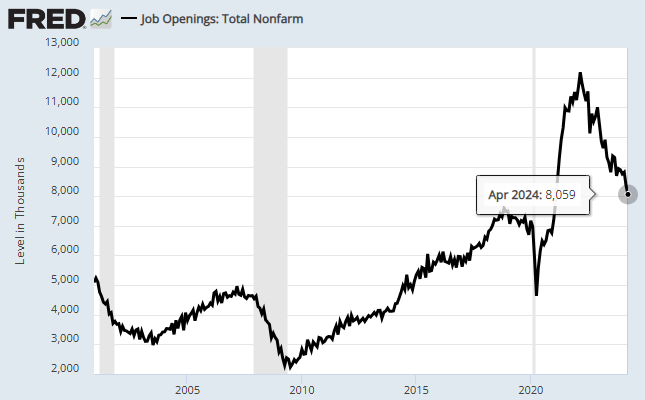

Here we go again. After yesterday’s news that US job openings fell to a three-year low in April, the data fueled the incentive for the bond market to reassess the view that the Federal Reserve will keep interest rates higher for longer.

The catalyst for what may be the start of a new phase in market sentiment: the number of new job openings listed in the US slumped to the lowest level since February 2021, the Labor Department reports. The update is widely seen as more evidence that the labor market is weakening.

A bit of context is needed, however. Job openings spiked in 2021 to an unusually high level as the rebound from the pandemic took root. The surge in openings, although welcome, was unsustainable. Even after the latest update, openings remain above pre-pandemic levels. Nonetheless, the downside directional bias is hard to miss – a trend that looks set to continue as the labor market continues to normalize.

The view that the recent deceleration in payrolls growth will persist — supported by the job openings numbers – suggests that the downshift will help take the edge off of the sticky inflation bias that’s prevailed in recent months. In turn, that will give the Federal Reserve room to start cutting interest rates, or so this line of reasoning runs.

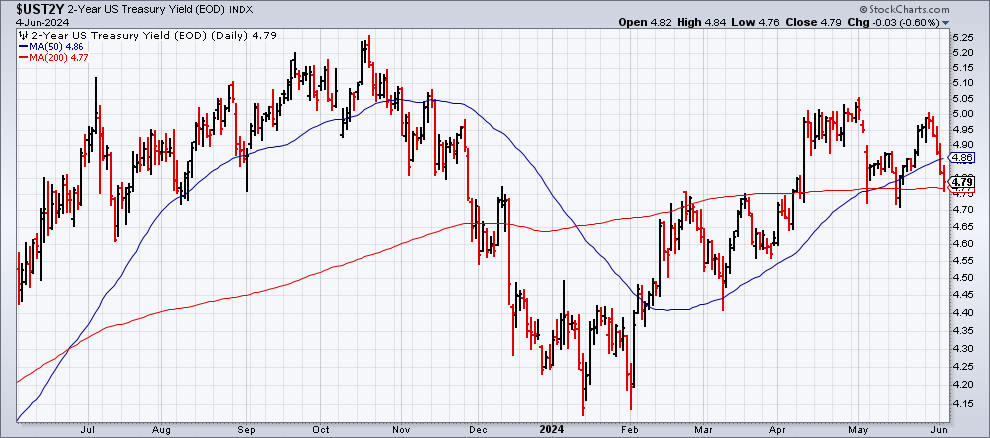

The Treasury market is pivoting to that view, based on trading in recent days. Notably, the policy-sensitive 2-year yield fell sharply for a fifth straight trading session on Tuesday (June 4), cutting this key rate to below 4.80% for the first time since May 15. This yield is now sitting just above its 200-day average – a break below that mark will be seen as a sign that even lower yields are likely in the near term.

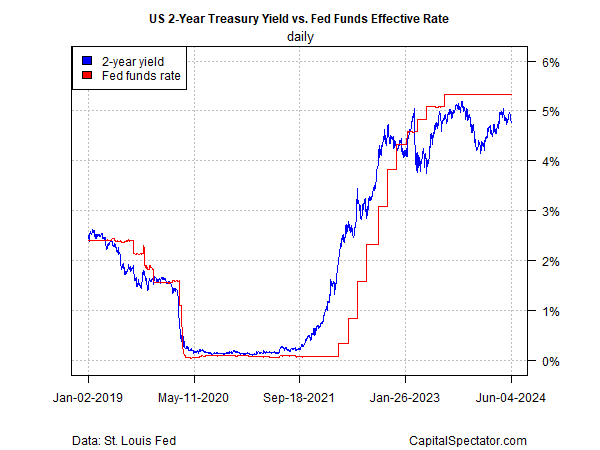

Meanwhile, the 2-year rate continues to trade well below the Fed funds target range (5.25%-to-5.50%). The gap reflects the market’s ongoing, but so far premature forecast that the central bank will soon begin cutting rates.

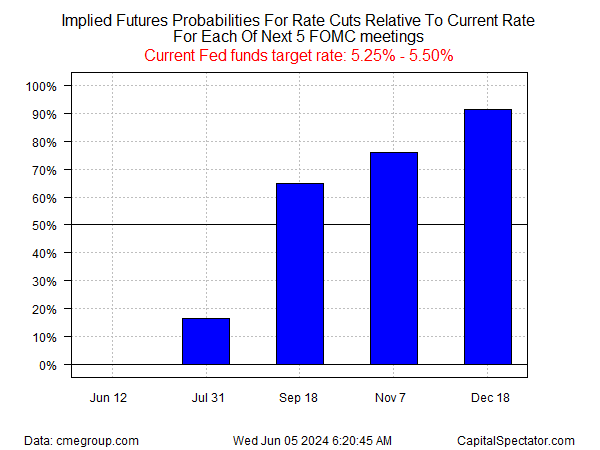

Fed funds futures have lifted the implied probability of a future cut in recent days, albeit only modestly. The September 18 FOMC meeting is still viewed as the earliest date for a lower rate. The market sees higher probabilities later in the year.

A key test for the new round of dovish expectations arrives on Friday (June 7), when the government publishes nonfarm payrolls data for May. But economists expect that hiring will pick up slightly vs. April, based on the consensus point forecast reported by Econoday.com.

If correct, the hard numbers for the labor market will reflect stability in hiring, which isn’t the narrative that the bond market has embraced in recent days. Will it matter? Unclear. But one thing that will likely survive: volatility in expectations for what the Fed will do and when.