-

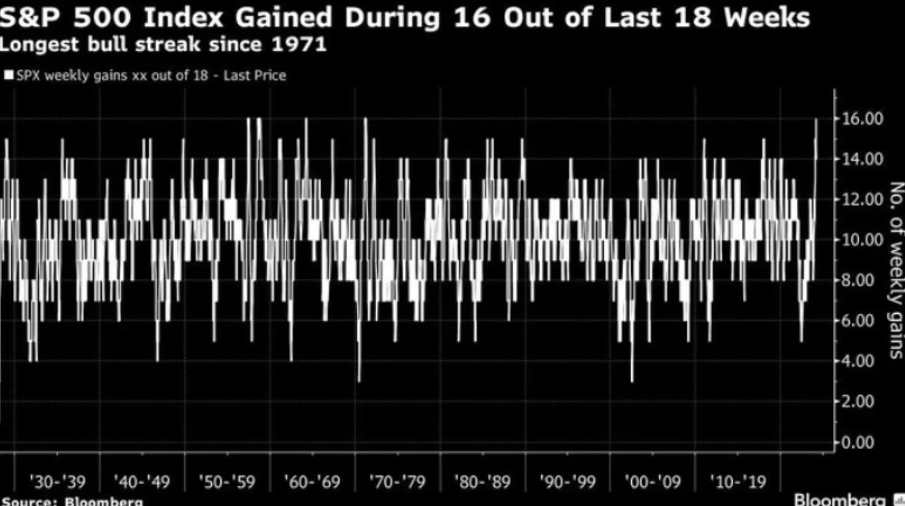

The S&P 500 has seen positive returns in 16 out of the last 18 weeks, an unprecedented trend since the 1970s.

-

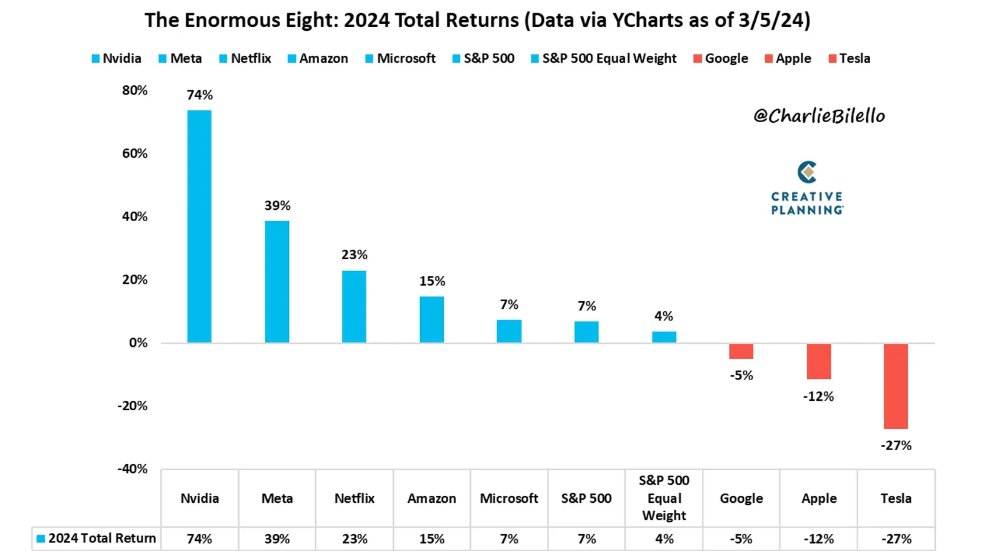

Despite the overall bullish market, notable players like Apple, Alphabet, and Tesla are not actively participating, raising questions about the sustainability of the current momentum.

-

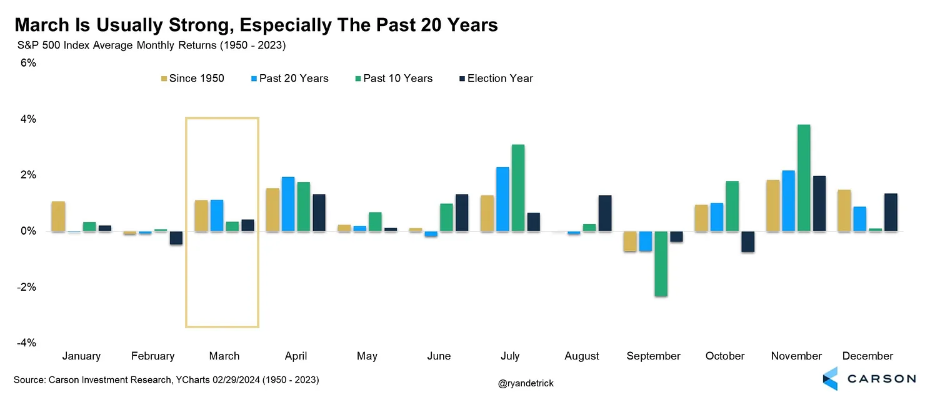

March, historically a robust month for stocks, is unfolding amidst all-time high sentiments, but caution is advised as excessive bullishness may pose risks.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The market remains near all-time highs, with no significant pullbacks in the last five months.

In fact, the S&P 500 has posted positive returns in 16 out of the last 18 weeks — a trend not seen since the 1970s.

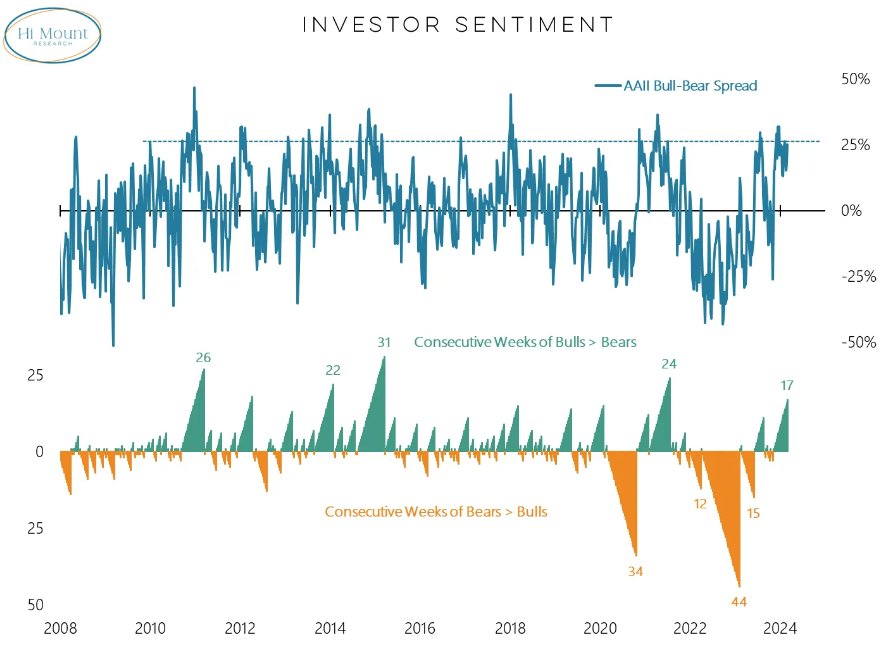

This situation is clearly making investors feel at ease about investing in stocks at the moment. Moreover, the bullish sentiment is at its highest level in the past two decades, according to the AAII survey.

The survey revealed that bulls have been outperforming bears for 17 consecutive weeks. This positive trend, following the persistent pessimism of recent years, marks one of the longest positive periods in the last 15 years.

The market has been bullish since the start of the year, and the momentum continues, but three big players - Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL), and Tesla (NASDAQ:TSLA) - are not actively participating as they have in the past.

March Set to Be a Bullish Month or Is a Pullback Imminent?

March has consistently proven to be one of the top-performing months for stocks, particularly for the S&P 500. Over the last two decades, the third month of the year has consistently ranked as the fourth-best month in terms of stock market gains.

The sentiment remains at all-time highs week after week, indicating a strong positive outlook for the market. Data suggest that the upward trend is firmly established.

However, it's important to be cautious. Investors, when overly bullish, can quickly turn bearish. Currently, we're observing excessively bullish levels, which pose potential risks.

During such times, it's crucial to remember that trends cannot last indefinitely.

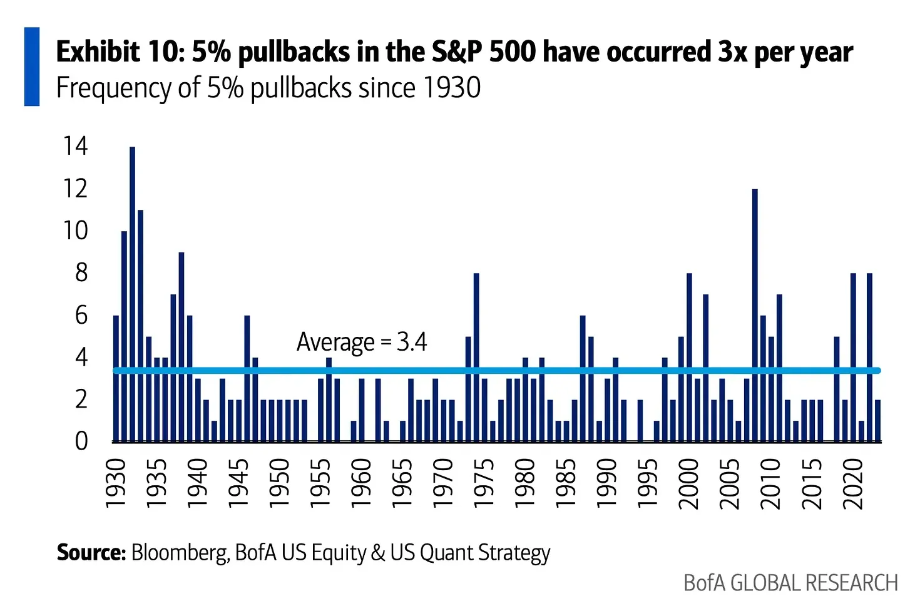

Historically, since 1930, the S&P 500 index has experienced declines of at least 5% at least three times a year, with an average total decline of about 14% annually. It's been over four months since the last significant pullback.

Corrections are a natural part of the market cycle, so it shouldn't come as a surprise.

Without corrections, the market can become abnormal and unsustainable. Take gold, for example. After years of moving sideways, it has now reached new all-time highs, outperforming Nasdaq.

Looking back, we notice that whenever the ratio favored gold, the Nasdaq index experienced a significant pullback.

Will this pattern repeat itself once more?

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.