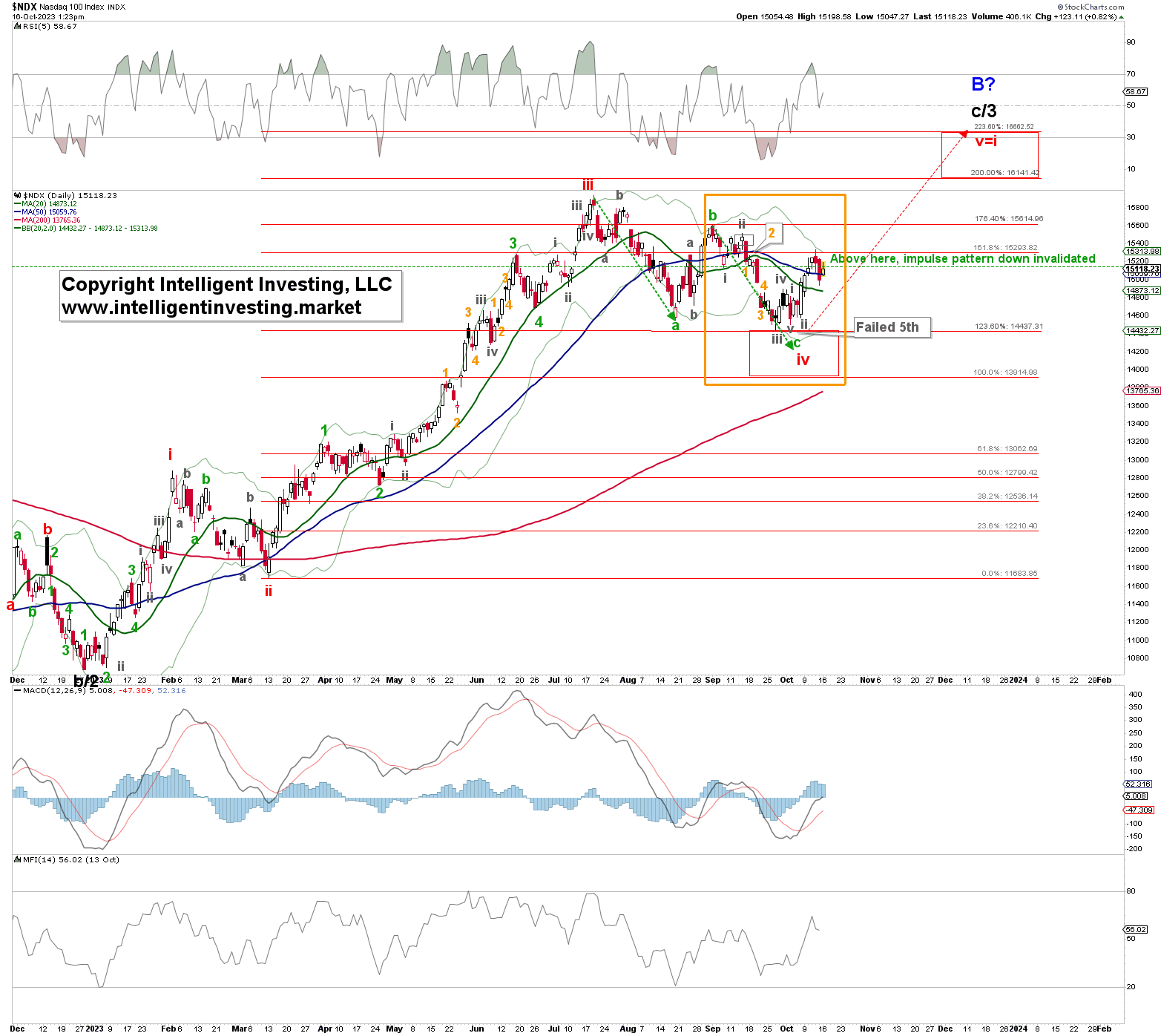

Those who read my articles regularly know that over the past month, we have been tracking an Elliott Wave Principle (EWP) impulse move (grey W-i, ii, iii, iv, and v in the orange box in Figure 1 below) lower from the September 4 high. Back then, we found

“…the index was most likely working on a five-wave move lower to ideally $14435-14500 as long as it stayed below $15600.”

We followed up on that prognostication two weeks ago, see here, when we found

“…So far, so good, as the index bottomed out last week at $14432 and has staged a rally since into today’s [October 2] high. … The index should have completed the grey W-iv and ideally be at the start of the grey W-v. … The green (arrows) W-c = W-a extension targets $14238, and the grey W-v target zone is now $14245-485.”

Figure 1. NASDAQ100 daily resolution chart with technical indicators and detailed EWP count. A day later on October 3, the index bottomed at $14504 and has staged a rally since, surpassing the October 2 high (grey W-iv high) and the critical “Above here, impulse lower invalidated” level at $15200 (green dotted horizontal line)” However, although the Nasdaq 100 bottomed in the $14435-14500 target zone prognosticated a month ago, the index presented us unfortunately with a higher low in the cash market; $14504 vs. $14432, whereas the futures market (NQ_F) came remarkably close ($14446) strongly suggesting a failed 5th as all waves are now accounted for. Thus, as you can see, a lot can happen in two weeks. It, therefore, pays to stay informed more frequently than only once every other week because the index presented us with an admirable impulse up from the October 3 low into the October 4 high, which means the October 5-6 pullback was a buying opportunity.

A day later on October 3, the index bottomed at $14504 and has staged a rally since, surpassing the October 2 high (grey W-iv high) and the critical “Above here, impulse lower invalidated” level at $15200 (green dotted horizontal line)” However, although the Nasdaq 100 bottomed in the $14435-14500 target zone prognosticated a month ago, the index presented us unfortunately with a higher low in the cash market; $14504 vs. $14432, whereas the futures market (NQ_F) came remarkably close ($14446) strongly suggesting a failed 5th as all waves are now accounted for. Thus, as you can see, a lot can happen in two weeks. It, therefore, pays to stay informed more frequently than only once every other week because the index presented us with an admirable impulse up from the October 3 low into the October 4 high, which means the October 5-6 pullback was a buying opportunity.

We can now determine that if the index stays above the October 6 low, with a first warning for the Bulls below the $14800-900 zone, it should ideally be on its way to $16660. That price level is where red W-v equals the length of red W-i (the December 2022->January 2023 rally), a typical relationship for a 5th wave. Although we prefer W-v to comprise a standard, non-overlapping impulse higher, as those are relatively easy to forecast, track, and trade, we also know the markets don’t owe us anything the W-v can morph into an aberrant, i.e., overlapping, ending diagonal. Lastly, a break above $15615 will seal the deal for the Bulls.

Thus, while the index did not bottom precisely where we would have liked it to, as we say in the Elliott Wave Community, “never bank on the last 5th waves”, we have precise price levels below which we know our assessment is wrong. Until then, we prefer to look higher.