The stock market has been red hot over the past 5 months or so with both the S&P 500 and Nasdaq sporting big gains.

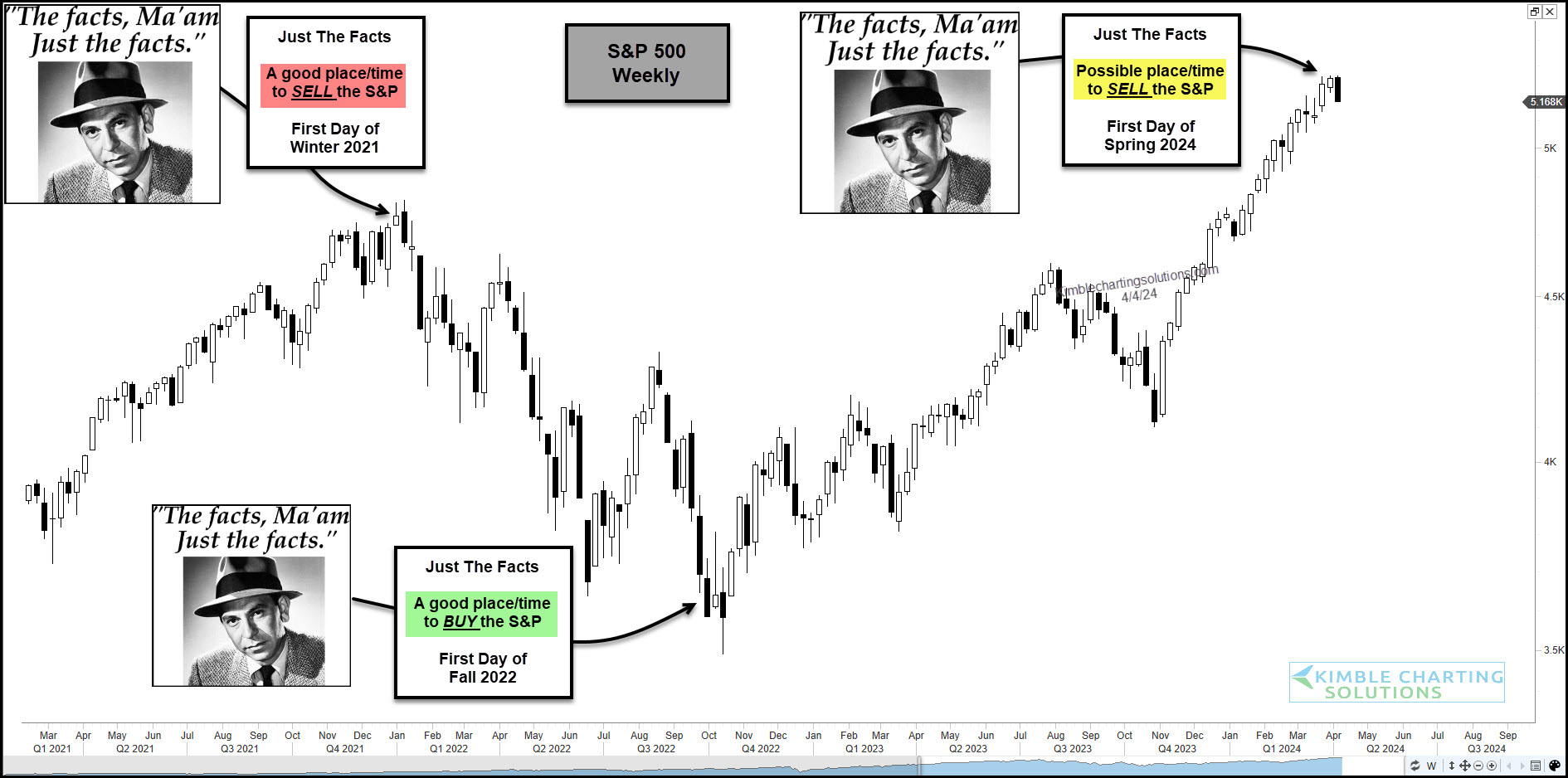

But as we will see in today’s “weekly” chart of the S&P 500 Index, the seasonal start of Winter, Spring, Summer, and Fall can sometimes be a time for directional changes.

Back on the first day of Winter in 2021, it was a good time to sell the S&P 500. And back on the first day of Fall 2022 it was a good time to buy the S&P 500. Heck, even the start of Fall of last year was a good time to buy.

Fast forward to today and it might just be a good time to sell the S&P 500 on the first day of Spring.

As you can, the S&P 500 is creating a bearish reversal bar this week. And now active investors will watch for selling in the weeks ahead to see if this is a “Not Bad” time/price point to take some action. Stay tuned!