- July is expected to be another volatile month on Wall Street amid a plethora of market-moving events.

- Investor focus will be on the U.S. jobs report, CPI inflation data, the Fed’s policy meeting, as well as the start of the Q2 earnings season.

- As such, I used the InvestingPro stock screener to search for high-quality companies showing strong relative strength amid the current market environment.

- Looking for more actionable trade ideas to navigate the current market volatility? InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

Stocks on Wall Street are on pace to end June on an upbeat note as a recent batch of strong economic data helped ease recession fears.

The economically sensitive Russell 2000 index of small-cap stocks is on track to come out on top in June, with a roughly 7.5% gain heading into the final trading session of the month.

Meanwhile, the tech-heavy Nasdaq Composite and the benchmark S&P 500 index are both about 5% higher this month and are on track to book their fourth straight monthly advances.

The blue-chip Dow Jones Industrials Average is the relative underperformer, up just 3.7%.

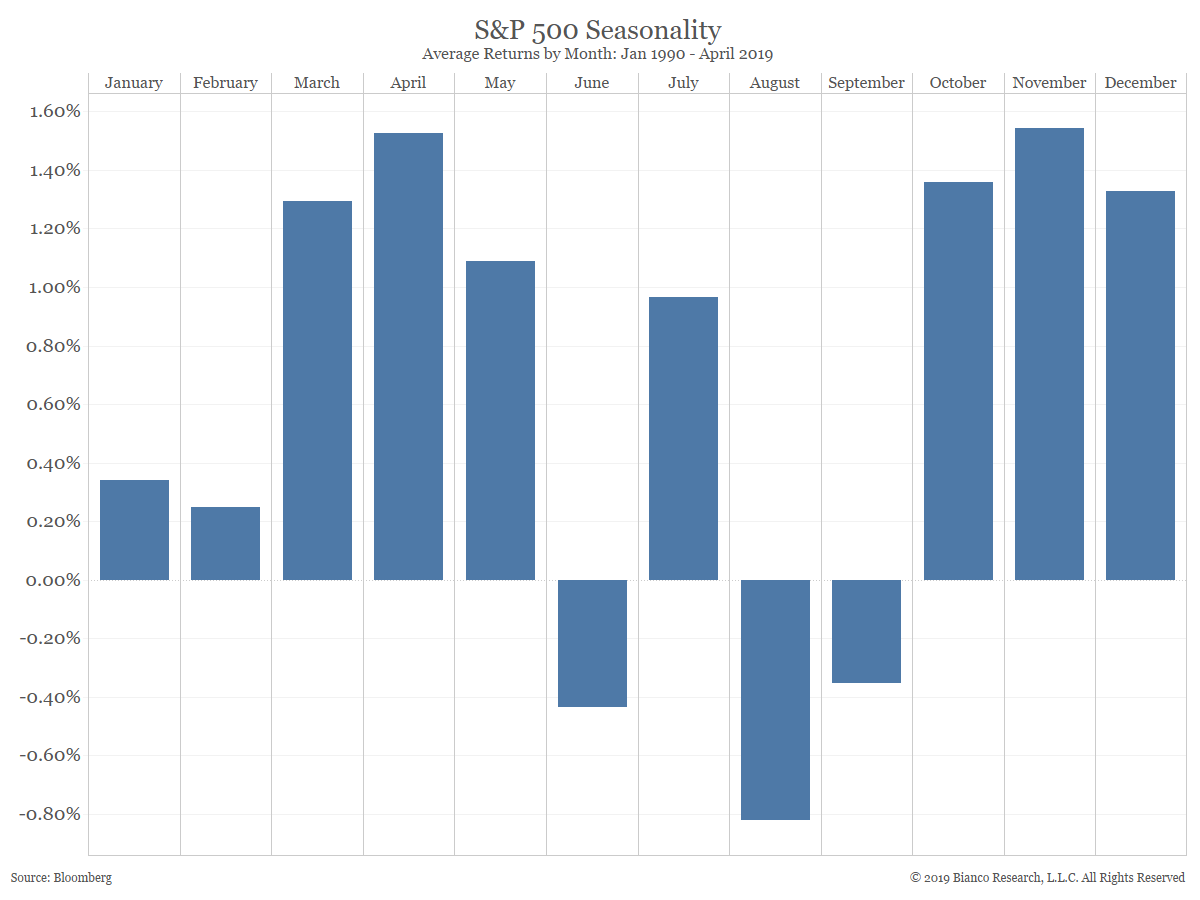

As June comes to an end, investors should prepare themselves for fresh volatility in July, which has a reputation for being a relatively strong month for the stock market. Since 1990, the S&P 500 has gained an average of 1% in July, making it the seventh-best month of the year in terms of performance returns. Source: Bloomberg

Source: Bloomberg

As such, here are key dates to watch as the calendar flips to July:

1. U.S. Jobs Report: Friday, July 7

The U.S. Labor Department will release the June jobs report at 8:30 AM ET (12:30 PM GMT) on Friday, July 7, and it will likely be key in determining the Federal Reserve’s next rate decision.

Forecasts center around a continued solid pace of hiring, even if the increase is smaller than in previous months.

The consensus estimate is that the data will show the U.S. economy added 200,000 positions, according to Investing.com, slowing from jobs growth of 339,000 in May.

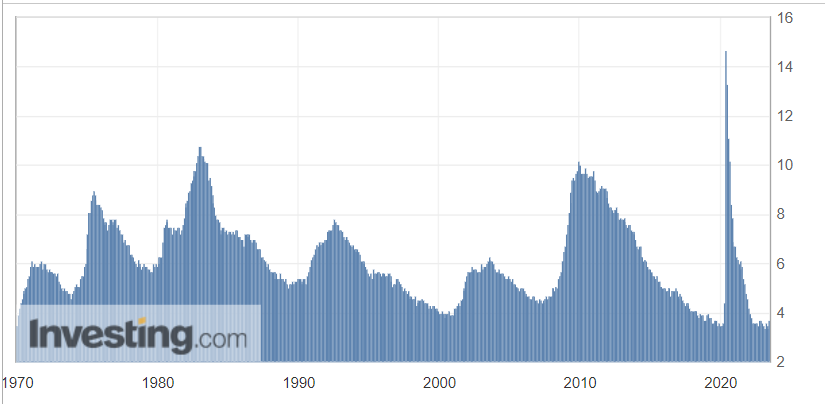

The unemployment rate is seen holding steady at 3.7%, staying close to a recent 53-year low of 3.4%.

Meanwhile, average hourly earnings are expected to rise 0.3% month-over-month, while the year-over-year rate is forecast to increase 4.1%, which is still too hot for the Fed.

Prediction:

- I believe the June employment report will underscore the remarkable resilience of the labor market and support the view that more rate hikes will be needed to cool the economy.

- Fed officials have signaled in the past that the jobless rate needs to be at least 4.0% to slow inflation. To put things in context, the unemployment rate stood at 3.6% exactly one year ago in June 2022, suggesting that the Fed still has room to lift rates.

2. U.S. CPI Data: Wednesday, July 12

The June consumer price index report looms large on Wednesday, July 12, at 8:30 AM ET and the numbers will likely show that neither inflation nor core inflation are falling fast enough for the Fed to end its inflation-fighting efforts.

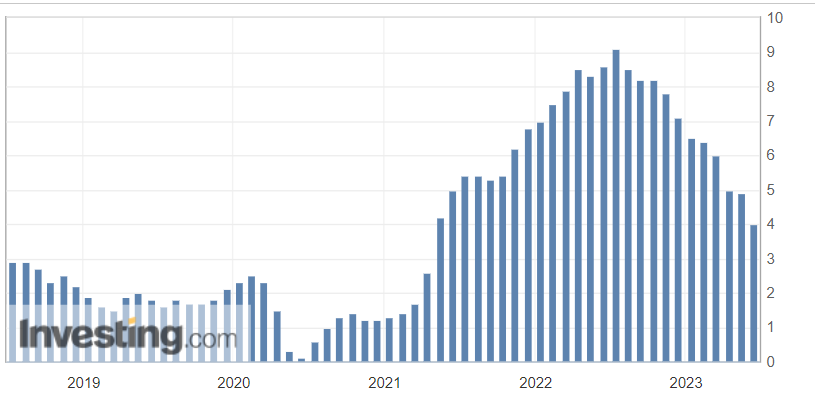

While no official forecasts have been set yet, expectations for annual CPI range from an increase of 3.6% to 3.8%, compared to a 4.0% annual pace in May.

The headline annual inflation rate peaked at a 40-year high of 9.1% last summer, and has been on a steady downtrend since, however prices are still rising at a pace well above the Fed’s 2% target range.

Meanwhile, estimates for the year-on-year core figure - which does not include food and energy prices - center around 5.0%-5.2%, compared to May’s 5.3% reading.

The underlying core number is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Prediction:

- Inflation may be cooling - just not yet fast enough for the Federal Reserve. Overall, while the trend is lower, the data will likely reveal that inflation continues to rise far more quickly than what the Fed would consider consistent with its 2% target range.

- With Chairman Powell reiterating that the U.S. central bank remains strongly committed to bringing inflation back down to its 2% goal, I believe there is still a long way to go before Fed policymakers are ready to declare mission accomplished on the inflation front. At a European Central Bank forum on Wednesday, Powell said he did not see inflation falling to the 2% target until 2025.

- A surprisingly strong reading, in which the headline CPI number comes in at 4% or above, will keep pressure on the Fed to maintain its fight against inflation.

3. Fed Rate Decision: Wednesday, July 26

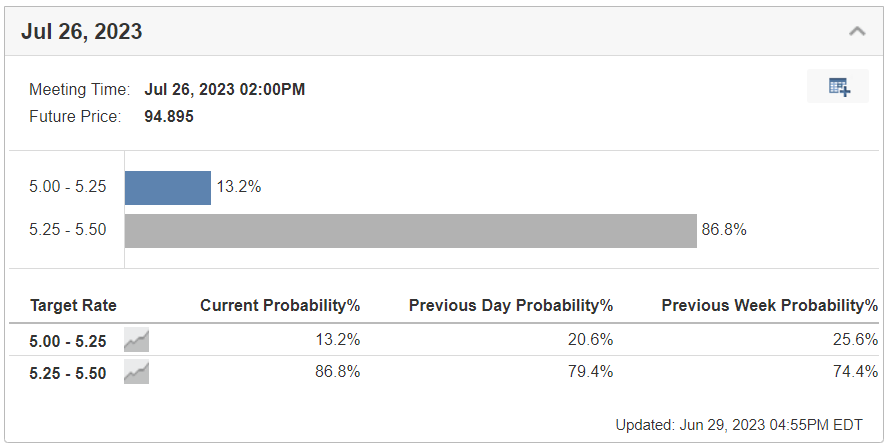

The Federal Reserve is scheduled to deliver its policy decision following the conclusion of the FOMC meeting at 2:00 PM ET on Wednesday, July 26.

As of Friday morning, financial markets are pricing in a roughly 87% chance of a 25-basis point rate increase and a near 13% chance of no action, according to the Investing.com Fed Rate Monitor Tool.

But that of course could change in the days and weeks leading up to the big rate decision, depending on the incoming data.

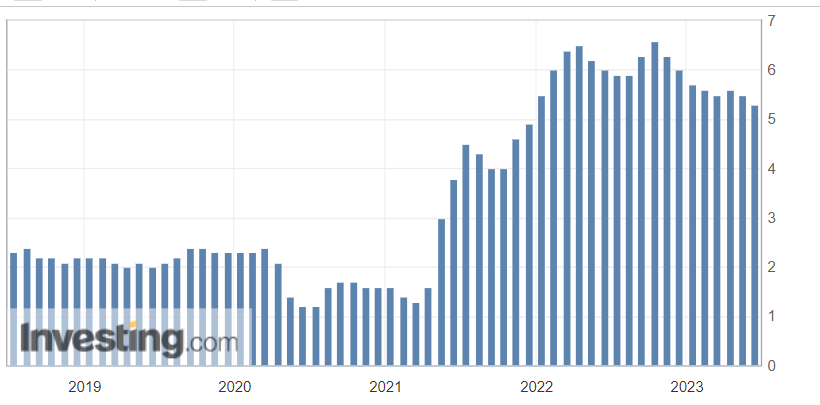

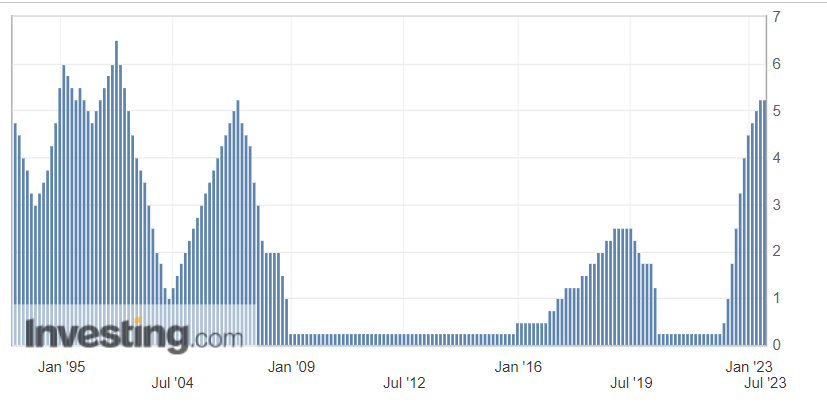

Should the U.S. central bank in fact follow through with a quarter-percentage-point rate hike, it would put the benchmark Fed funds target in a range between 5.25% and 5.50%, the highest since January 2001.

Fed Chair Powell will hold what will be a closely watched press conference shortly after the release of the Fed's statement, as investors look for fresh clues on how he views inflation trends and the economy and how that will impact the pace of monetary policy tightening.

Powell had said in Portugal that U.S. interest rates are likely to rise further and did not rule out moving at consecutive meetings.

"Although policy is restrictive, it's not, it may not be restrictive enough and it has not been restrictive for long enough," which leaves open the door for more increases, Powell said.

The Fed kept rates steady at its June policy meeting after 10 consecutive hikes and signaled there could be two more quarter-percentage point increases before the end of the year.

Prediction:

- As inflation remains stubbornly high and the economy holds up better than expected, my personal inclination is that the Fed will decide to raise rates by 0.25% at the July policy meeting.

- In addition, I believe Powell will stick to his hawkish stance on interest rate hikes and reiterate that there is still more work for the Fed to do to cool inflation.

- As such, it is my belief that the Fed will be forced to lift the policy rate to as high as 6.00%, before entertaining any idea of a pivot in its battle to restore price stability.

4. Q2 Earnings Season Kicks Off

A flood of earnings from some of the biggest names in the market will await investors in July as Wall Street’s second quarter reporting season kicks off.

The Q2 earnings season unofficially begins on Friday, July 14, when notable companies like JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), and UnitedHealth (NYSE:UNH) all report their latest financial results.

The following week sees high-profile names like Netflix (NASDAQ:NFLX), Morgan Stanley (NYSE:MS), American Express (NYSE:AXP), and United Airlines (NASDAQ:UAL) report earnings.

Earnings will gather pace in the final week of the month when the mega-cap ‘FAAMG’ group of stocks report their latest quarterly results. Microsoft (NASDAQ:MSFT) and Google-parent Alphabet (NASDAQ:GOOGL) report on Tuesday, July 25, followed by Facebook-owner Meta Platforms on Wednesday, July 26, and Amazon (NASDAQ:AMZN) on Thursday, July 27.

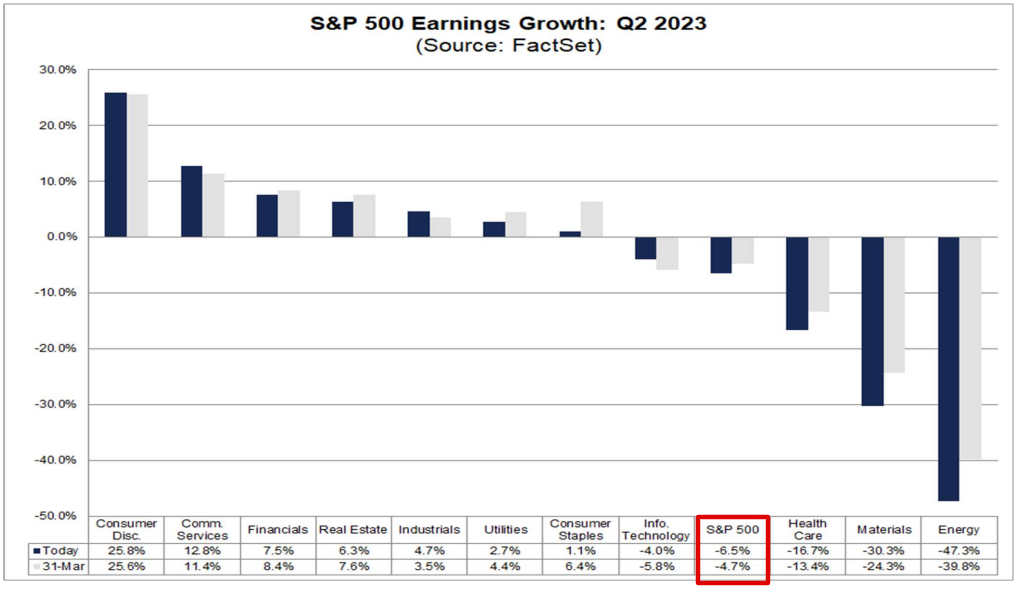

Investors are bracing for what may be the worst reporting season in three years amid the negative impact of several macroeconomic headwinds.

After earnings per share for the S&P 500 fell -2.0% in the first quarter of 2023, earnings are expected to drop -6.5% in the second quarter when compared to the same period last year, as per data from FactSet. Source: FactSet

Source: FactSet

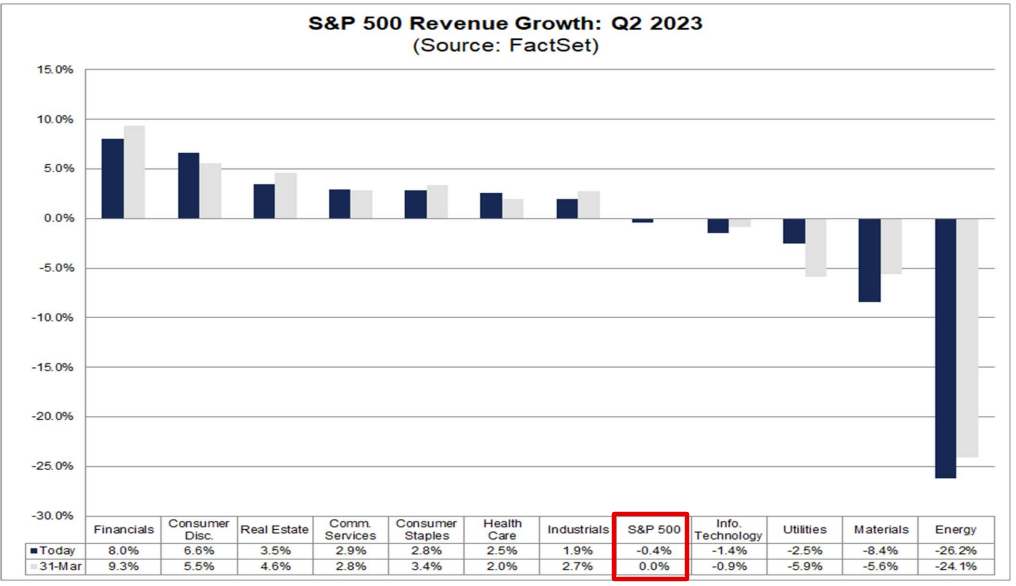

Likewise, Q2 2023 revenue expectations are also worrying, with sales growth expected to decrease -0.4% from the same quarter a year earlier.

Source: FactSet

Beyond the top-and-bottom-line numbers, investors will pay close attention to announcements on forward guidance for the second half of the year, given the uncertain macroeconomic outlook.

What To Do Now

While I am currently long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 (NYSE:SPY), and the Invesco QQQ Trust (NASDAQ:QQQ), I have been cautious about making new purchases.

Overall, it’s important to remain patient, and alert to opportunity. Not buying extended stocks, and not getting too concentrated in a particular company or sector is still important.

Taking that into consideration, I used the InvestingPro stock screener to build a watchlist of high-quality stocks that are showing strong relative strength amid the current market environment.

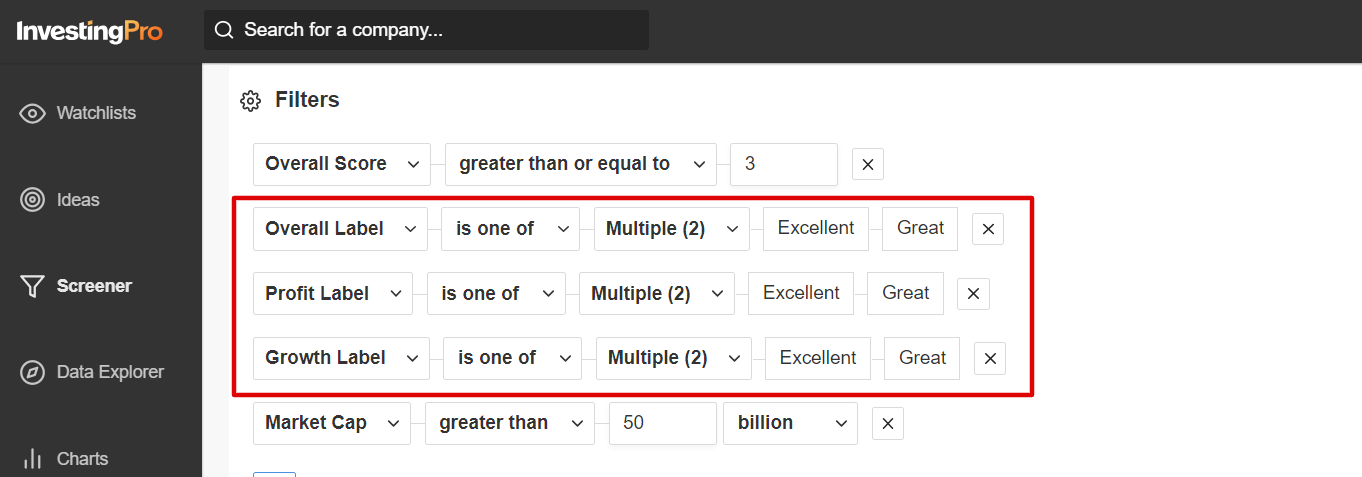

I kept it simple and scanned for companies with an InvestingPro Financial Health score above 3.0, while also displaying an InvestingPro Health Label, InvestingPro Profit Label, and an InvestingPro Growth Label of either ‘Excellent’, ‘Great’, or ‘Good’.

Source: InvestingPro

InvestingPro's stock screener is a powerful tool that can assist investors in identifying cheap stocks with strong potential upside. By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters.

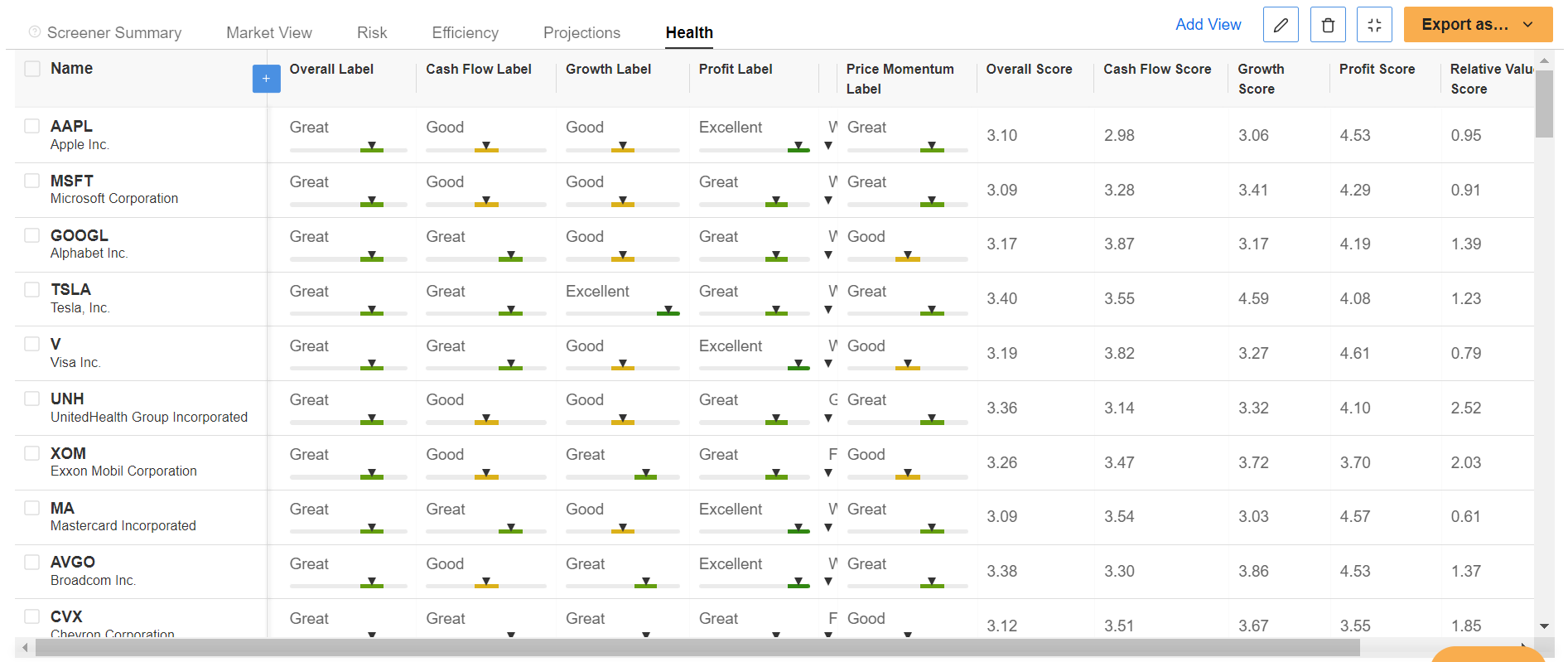

Not surprisingly, some of the names to make the list include Apple (NASDAQ:AAPL), Microsoft, Alphabet, Tesla (NASDAQ:TSLA), Visa (NYSE:V), Broadcom (NASDAQ:AVGO), Coca-Cola (NYSE:KO), Costco (NASDAQ:COST), Adobe (NASDAQ:ADBE), Fortinet (NASDAQ:FTNT), Chipotle Mexican Grill (NYSE:CMG), McKesson (NYSE:MCK), and TJX Companies (NYSE:TJX) to name a few.

Source: InvestingPro

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.

As part of the InvestingPro Summer Sale, you can now enjoy incredible discounts on our subscription plans for a limited time:

- Monthly: Save 20% and gain the flexibility to invest on a month-to-month basis.

- Yearly: Save a jaw-dropping 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Yearly (Web Special): Save an astonishing 52% and maximize your returns with our exclusive web offer.

Don't miss out on this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert insights. Join InvestingPro today and unlock your investing potential. Hurry, Summer Sale won't last forever!

***

Disclosure: I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.