The ETF industry continues to grow and develop at a breakneck pace, which makes keeping up with new developments more and more difficult by the day. Thankfully, for ETF aficionados looking for the latest thought leadership and industry data, Trackinsight has you covered.

Specifically, the results of Trackinsight's 2023 Global ETF Survey are now out. Each year Trackinsight asks professional investors how they select and buy ETFs. The result is a downloadable PDF with a detailed analysis of how over 500 professional investors and fund selectors employ ETFs, covering everything from their current interests, motivations, use cases, and thoughts for the future.

The full results are certainly worth a thorough read, especially for those looking to put their fingers on the pulse of the ETF industry. There are a lot of professionally curated insights contained within that can add value for many audiences, especially for professionals looking for new information to leverage for clients.

Here are some of the key takeaways that I think are particularly notable, along with some relevant ETF selections for each theme. Still, this is only my analysis. If you're interested in reading the full results for yourself, click here. You might uncover some novel insights I missed.

ETF interest remains strong despite a slowdown in net inflows in 2022

Investor sentiment is fickle. When markets do well, they pour money into funds, including ETFs. When markets do poorly, they can't wait to pull money out. Still, this trend was bucked in 2022.

"ETFs are an innovative investment tool for both investors and advisors, allowing for a more diverse investment portfolio with lower costs, increased tax efficiencies, and ease of accessibility to many investable areas of the marketplace. The ETF industry has experienced consistent growth of new issuance and innovation alongside significant positive cash flow, which is likely to continue as more investors choose ETFs as the preferred investment wrapper.” – Douglas Yones, Head of Exchange Traded Products at NYSE.

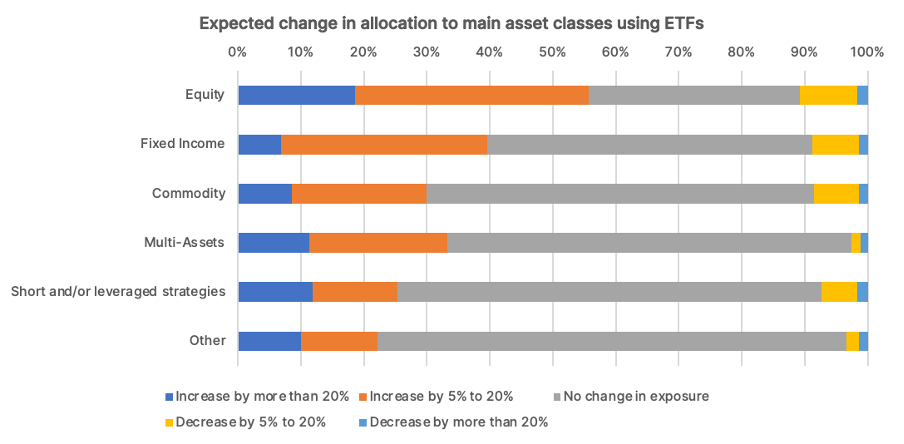

While net inflows fell from $1.2 trillion in 2021 to $782 billion in 2022, investor interest in ETFs remained high, especially for equity and fixed income-related strategies, with 56% and 40% of respondents planning to increase their exposure in 2023.

While the overall fixed-income category experienced significant weaknesses throughout 2022, not all ETFs suffered an exodus of outflows. In particular, short-duration actively managed ETFs like the JPMorgan (NYSE:JPM) Ultra-Short Income ETF (JPST) survived the sell-off quite well and attracted inflows as a result.

ETFs are seen as a strong substitution tool

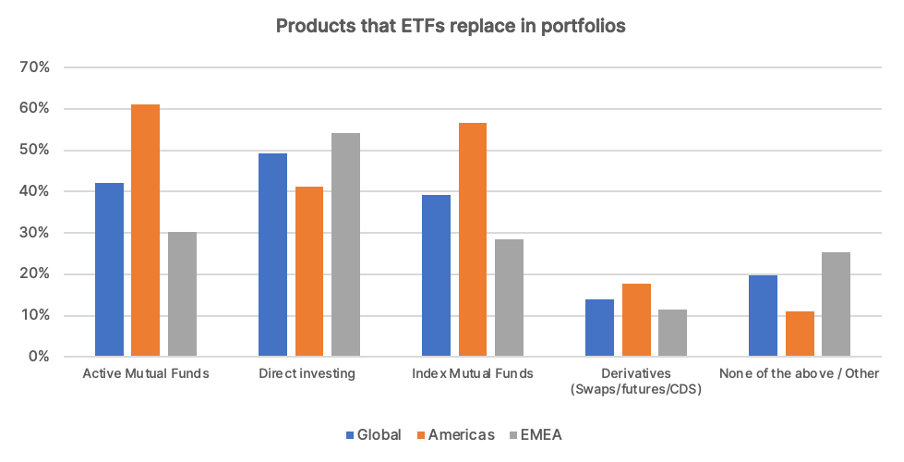

Investors increasingly view the ETF structure as an effective replacement for direct investing, index mutual funds and active mutual funds. In the Americas, 60% of respondents consider ETFs for active investing, compared to 30% in Europe, where investors see ETFs as a replacement for direct investing.

Fund managers have taken note of this. Consider the Dimensional US Small Cap Value ETF (DFSV), which Dimensional Fund Advisors released in February as the ETF equivalent to their popular, but relatively inaccessible Dimensional US Small Cap Value Portfolio (I) (DFSVX) mutual fund.

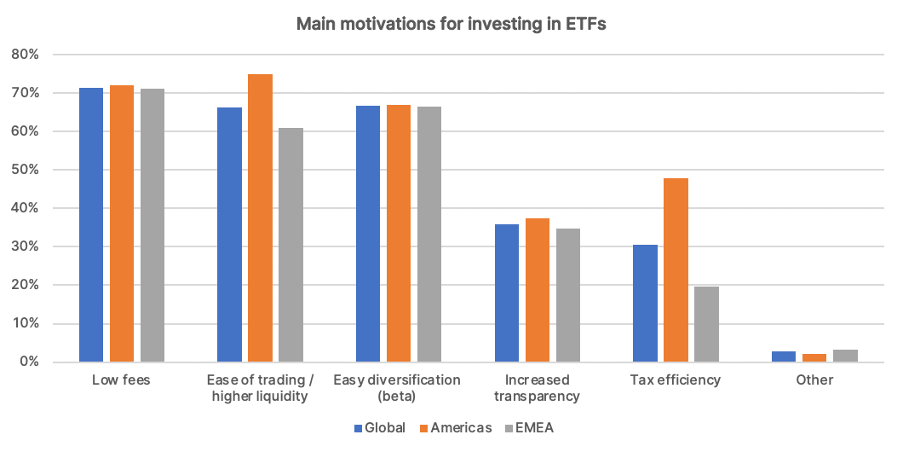

Low fees remain the primary motivation for investing in ETFs

All respondents agree that low fees, along with easy diversification and accessibility are the primary reasons to use ETFs. Almost half of the region’s respondents in the Americas also mentioned tax efficiency as a fundamental aspect of ETF popularity.

Leading the low fee movement is a little-known passive bond index ETF called the BNY Mellon Core Bond ETF (BKAG), which charges a true 0% expense ratio. This ETF tracks the popular Bloomberg US Aggregate Total Return Index but has only accrued around $430 million in AUM.

Active strategies continue to build pace

Despite the results of the latest SPIVA Scorecard from S&P Dow Jones Indices that continue to show passive indexing outperformance, interest in actively managed ETFs, especially those employing equity strategies, continues to strengthen among respondents.

The gap between American investors and others widens when we look at active fixed income and thematic space. In the Americas, a notable 80% of respondents stated they would be more inclined to invest in an active strategy if packaged as an ETF rather than a mutual fund, supporting the trend of mutual funds to ETF conversion.

This content was originally published by our partners at ETF Central.