- Lennar is one of the US’s largest home builders

- The company is trading at a modest P/E of 7

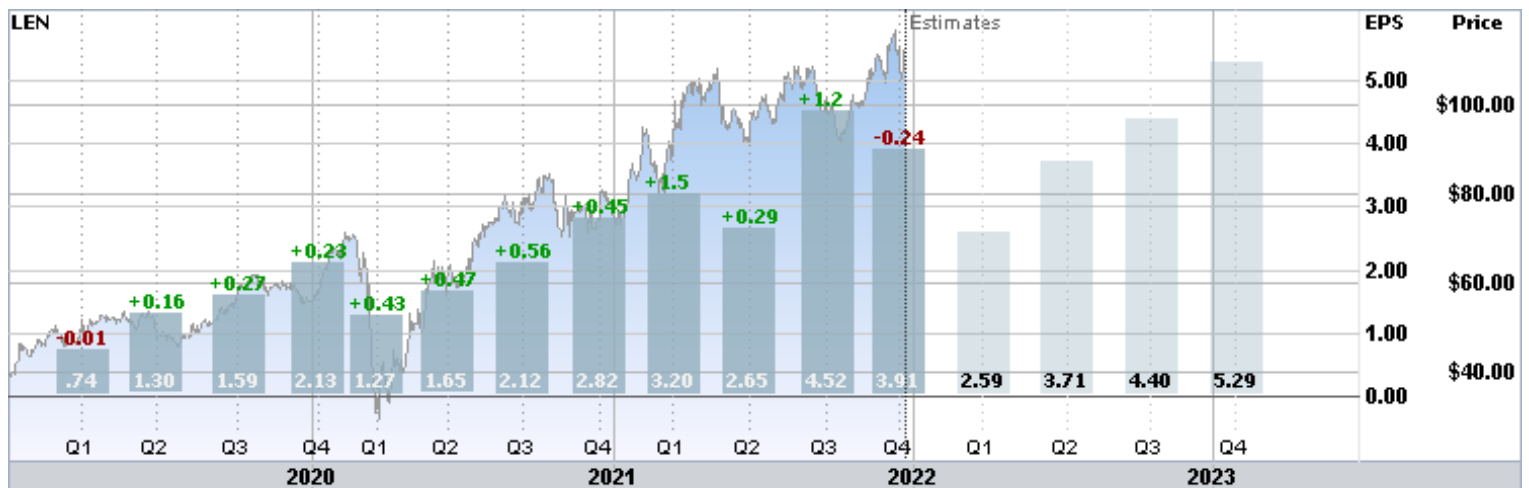

- The Q4 earnings, reported Dec. 15, slightly missed analyst expectations

- The Wall Street analyst consensus outlook continues to be bullish

- The view from the options market is neutral to the middle of 2022, becoming slightly bearish to early 2023

Residential real estate is in the midst of a major bull run, with homes prices in the US up by an average of 19.5% over the past year.

The surge in home prices has been driven by a number of factors, including an increase in millennials buying homes, something that's been helped by record-low interest rates. COVID has also boosted demand, as people who worked and recreated in or near their homes—as spending on restaurants and travel fell—sought more space and often, less crowded locations.

This increased buyer demand has been good for homebuilder Lennar Corporation (NYSE:LEN), notwithstanding the fact the company has faced headwinds from increased labor costs, inflation in building supplies, and supply chain disruptions.

Source: Investing.com

LEN has a trailing 12-month total return of 43.9% and a 3-year annualized total return of 43% per year. The homebuilding industry is cyclical, however, and the last few years have been strong. The 10- and 15-year annualized total returns are 19.7% and 5.9% per year, respectively.

The company has reported strong results throughout 2021. Its Q4 EPS miss was relative to overly high expectations. The Q4 earnings expectation, of $3.91 per share, was very high as compared to recent years, exceeded only by results in Q3.

Source: E-Trade

Real assets tend to perform well when inflation rises, favoring homebuilders. The Fed is also likely to respond to continued inflation by increasing interest rates, making monthly payments higher relative to purchase prices, which tends to put downward pressure on prices.

Rising interest rates also increase payments for homeowners with adjustable rate mortgages (ARMs) and home equity lines of credit (HELOCs).

I last analyzed LEN on May 17, 2021, about 7-½ months ago, and at that time I assigned a bullish rating to the stock. In May, the same fundamental factors were in play.

The second half of 2021 has been favorable for LEN, with the Fed managing market expectations to avoid major shocks. Lumber prices have come down substantially from their highs in May. Since my May post, LEN has delivered a total return of 14.8%, as compared to 14.5% for the S&P 500.

In forming my opinion on LEN, I considered the fundamentals as well as two forms of consensus outlooks. The first is the well-known Wall Street analyst consensus outlook, which was bullish in May. The second, the market-implied outlook, is the consensus view of buyers and sellers of options on LEN.

The price of an option on a stock reflects the market’s consensus estimate of the probability that the share price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strikes, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices.

In May, the market-implied outlook to early 2022 was neutral. With the strong performance of LEN, the reasonable valuation, a bullish view from Wall Street and a neutral view from the options market, I assigned a bullish rating overall.

I have updated the market-implied outlook for LEN to provide a view to the middle of 2022 and to early 2023 and compare these to the Wall Street consensus outlook over the next year.

Wall Street Analyst Consensus Outlook for LEN

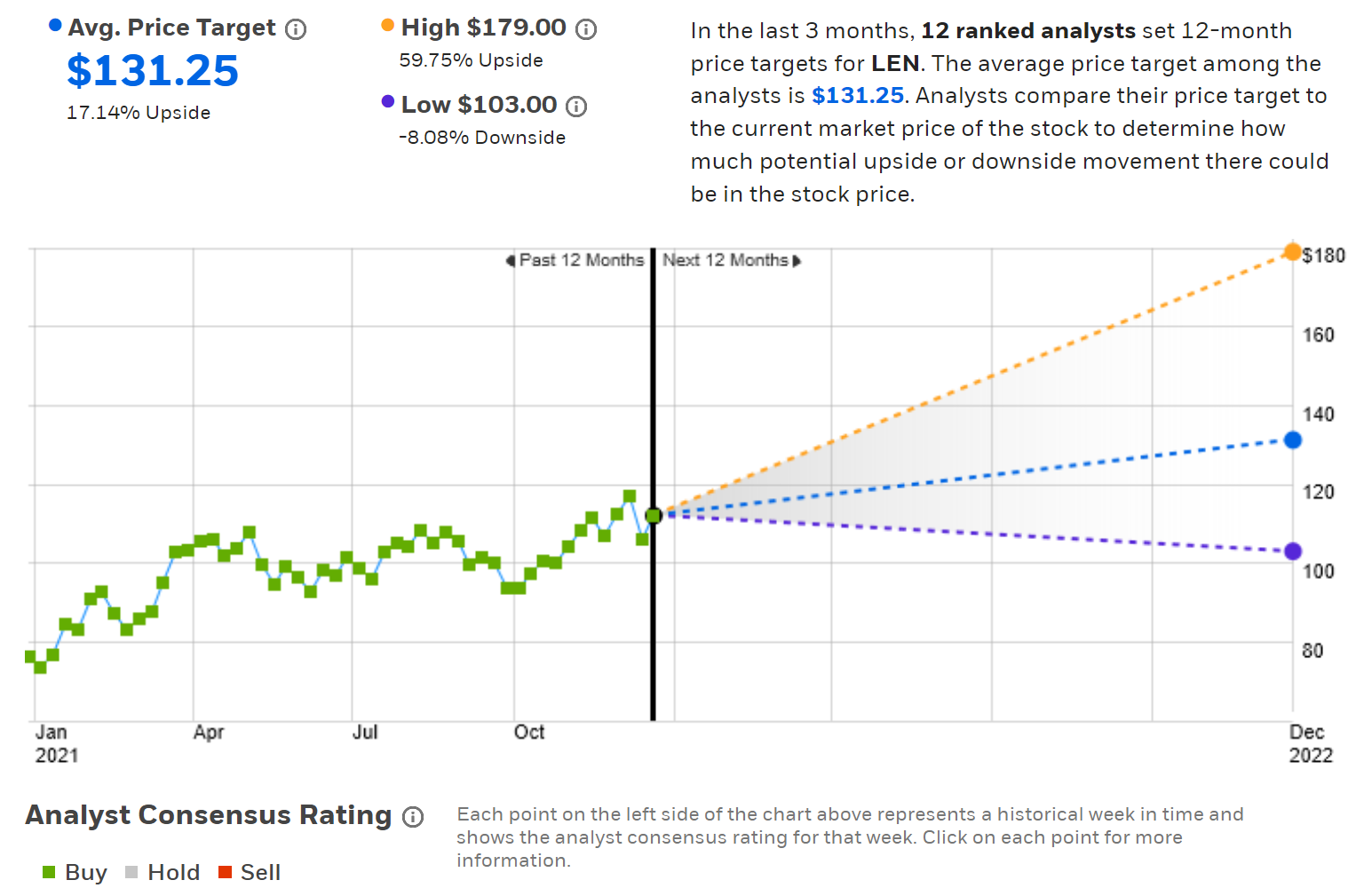

E-Trade calculates the Wall Street consensus outlook for LEN by aggregating the views of 12 ranked analysts who have published ratings and price targets over the past 90 days. The consensus rating is bullish and the consensus 12-month price target is 17.1% above the current share price.

Of the 12 analysts, 9 assign a buy rating and 3 assign a hold. One potential concern is that there is a fairly high level of dispersion among the price targets, which reduces confidence in the predictive value of the consensus.

The price target for LEN has risen faster than the share price since my last analysis, at which time the consensus 12-month price target was 12.9% above the share price.

Source: E-Trade

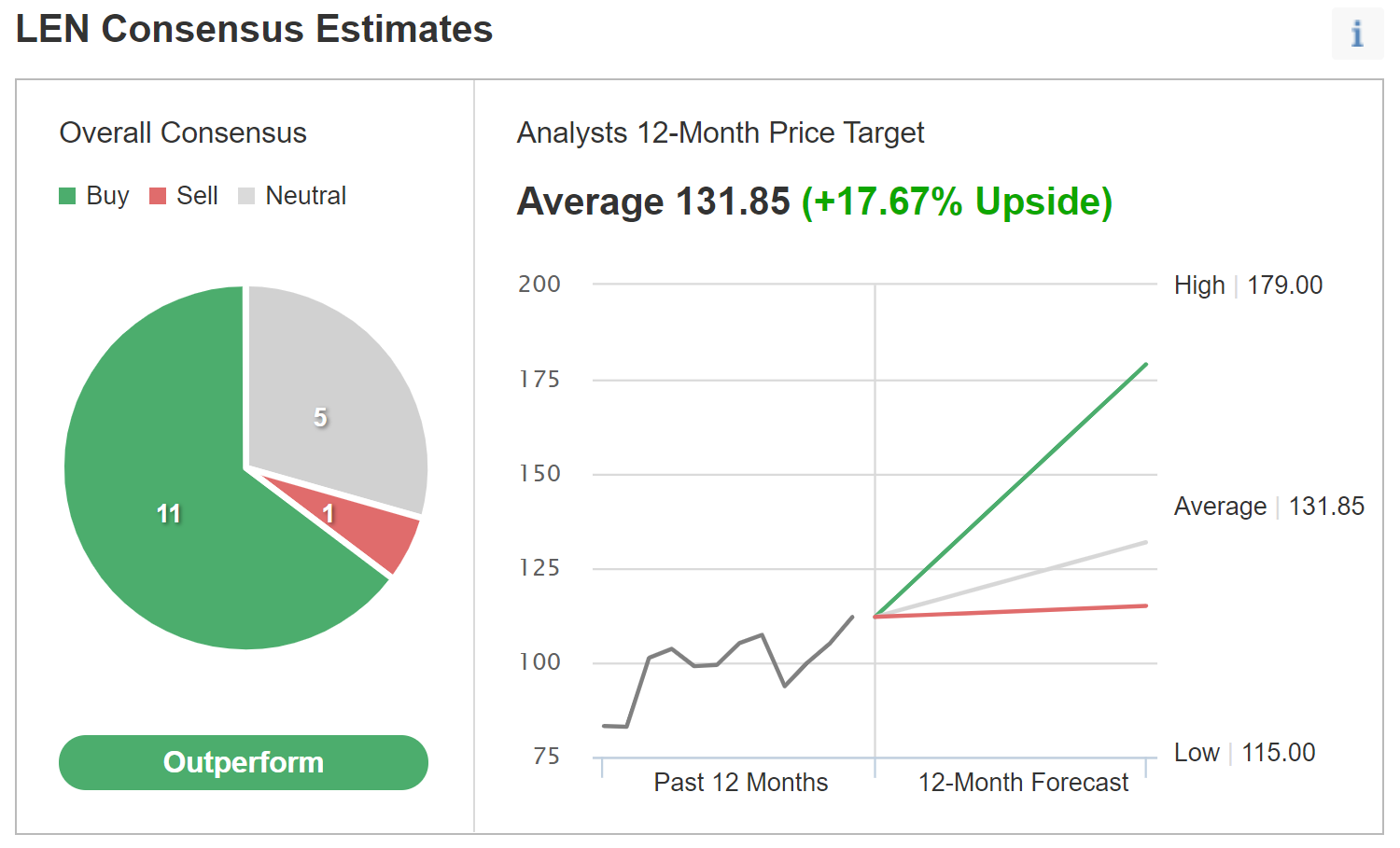

Investing.com’s version of the Wall Street analyst consensus is based on ratings and price targets from 17 analysts and the results are very similar to those from E-Trade. The consensus rating is bullish and the consensus 12-month price target is 17.7% above the current share price.

Source: Investing.com

The two calculations of the analyst consensus agree, with a bullish rating overall and expected 12-month price appreciation of about 17.4%.

Combined with the forward dividend yield of 0.9%, the consensus outlook for expected total return is 18.3% over the next year. This is in line with the trailing 10-year annualized return, but substantially less than returns over the past three years.

Market-Implied Outlook For LEN

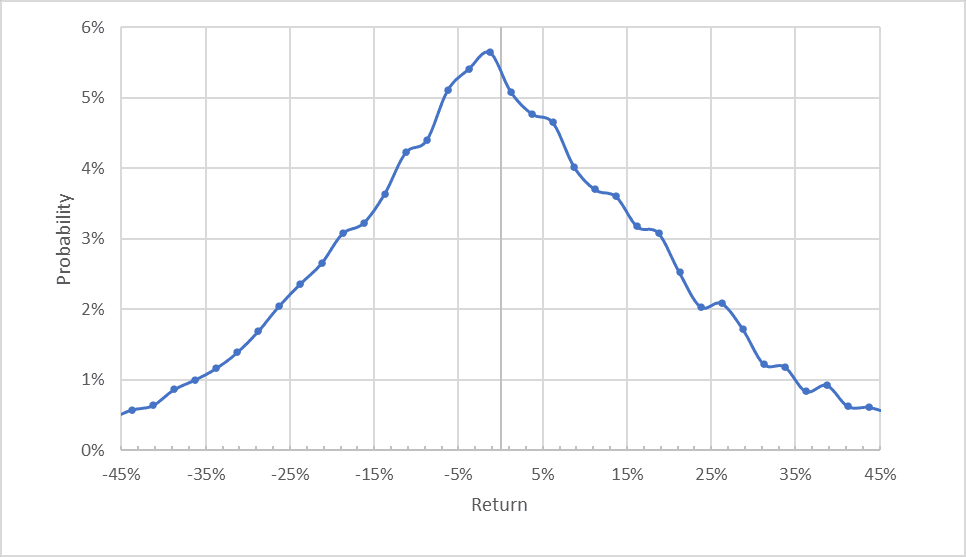

I have calculated the market-implied outlooks for LEN for the next 4.8 months using options that expire on May 20, 2022 and for the next 12.8 months using options that expire on Jan. 20, 2023. I selected these two expiration dates as these were the closest to the middle and end of 2022.

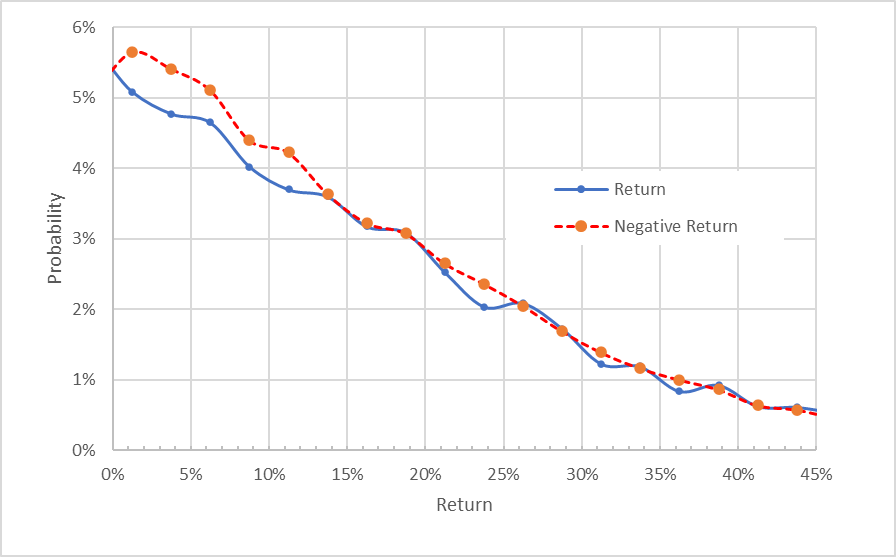

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook for LEN to May 20, 2022 is generally symmetric, although the peak in probability slightly favors negative returns. The annualized volatility calculated from this distribution is 35.2%, quite high for an individual stock.

This distribution gives a 1-in-5 probability that LEN will lose 17% or more over the next 4.8 months and a 1-in-5 probability that LEN will gain 17% or more over the same period.

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view shows just how closely the probabilities of positive and negative returns of the same magnitude match up (the solid blue line and the dashed red line are very close to one another), although the probabilities of negative returns are slightly higher for the higher-probability outcomes (the left third of the chart above).

Theory suggests that market-implied outlooks will tend to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. Considering the potential for such a bias, the market-implied outlook for the next 4.8 months looks neutral to slightly bullish.

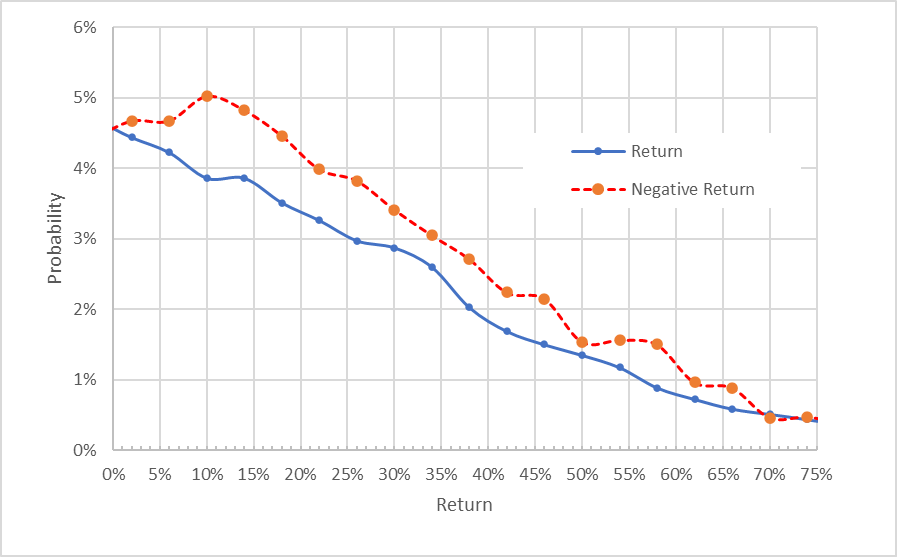

The market-implied outlook through 2022, calculated using options that expire on January 20, 2023, more strongly favors negative returns (the red dashed line is well above the solid blue line for the range of possible outcomes). This is a slightly bearish outlook. The annualized volatility calculated from this distribution is 37.6%.

Note: The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from E-Trade)

The market-implied outlook to the middle of 2022 is neutral to slightly bullish, shifting to slightly bearish for the outlook to early 2023. The expected annualized volatility is 35.2% for the mid-year outlook and 37.6% for the full year. This is consistent with there being greater concerns about rising interest rates as the year progresses.

Summary

Lennar has done very well in recent years. A number of factors have aligned to drive demand for homes.

The prevailing low interest rates and, more recently, COVID have been very good for homebuilders. With increasing inflation and the Fed signaling a less accommodative stance for 2022, along with record-high real estate prices in many US cities, the potential for a slowdown in the market is increasing.

The Wall Street consensus for the next year continues to be bullish, with expected 12-month total return of about 18.3%. Even with the uncertainties, as reflected in the high expected volatility, this is an attractive rate of return.

As a rule of thumb for a buy, I look for an expected 12-month return that is at least ½ the expected annualized volatility. LEN just manages to meet this criterion. The market-implied outlook for LEN is neutral to slightly bullish in the first half of 2022, but shifts to slightly bearish for the full year.

Considering LEN’s modest valuation, current economic conditions, and the two types of consensus outlooks, I am maintaining my bullish view for LEN for the time being. I plan to revisit this analysis around the middle of 2022, given the uncertainty in interest rates and the shift in the market-implied outlook to slightly bearish for the full year.