“Let There Be Light” Stock Market (and Sentiment Results)…

Then God said, “Let there be light,” and there was light. And God saw that the light was good. Then he separated the light from the darkness. God called the light “day” and the darkness “night.” And evening passed and morning came, marking the first day.

With rates steadying and turning, we believe a new day has begun…

Last week we said the market always crashes when we go on vacation and that it would recover when we returned. So far that has been comically accurate!

End of the World? Stock Market (and Sentiment Results)…

I know in NYC (Wall Street) the last few weeks feels like the end of the world, but the picture above tells a different story… I’m writing this from Portugal this week – as we had a trip planned months ago to visit Lisbon, Algarve and Sintra. Being in this game long enough – you … Continue reading

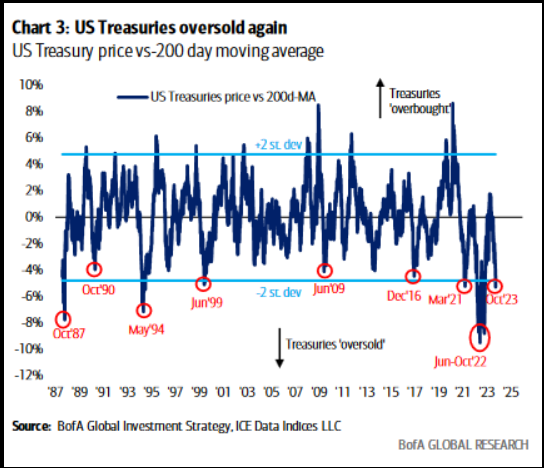

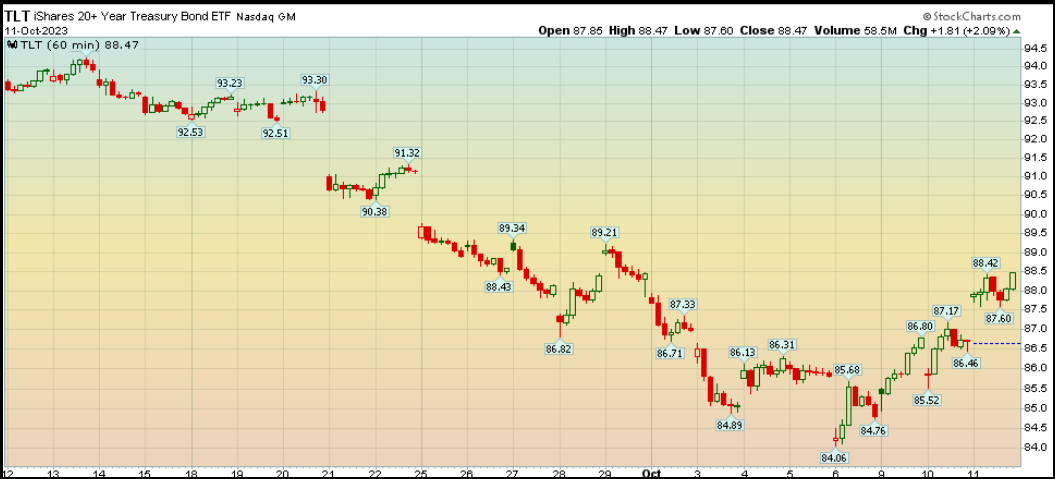

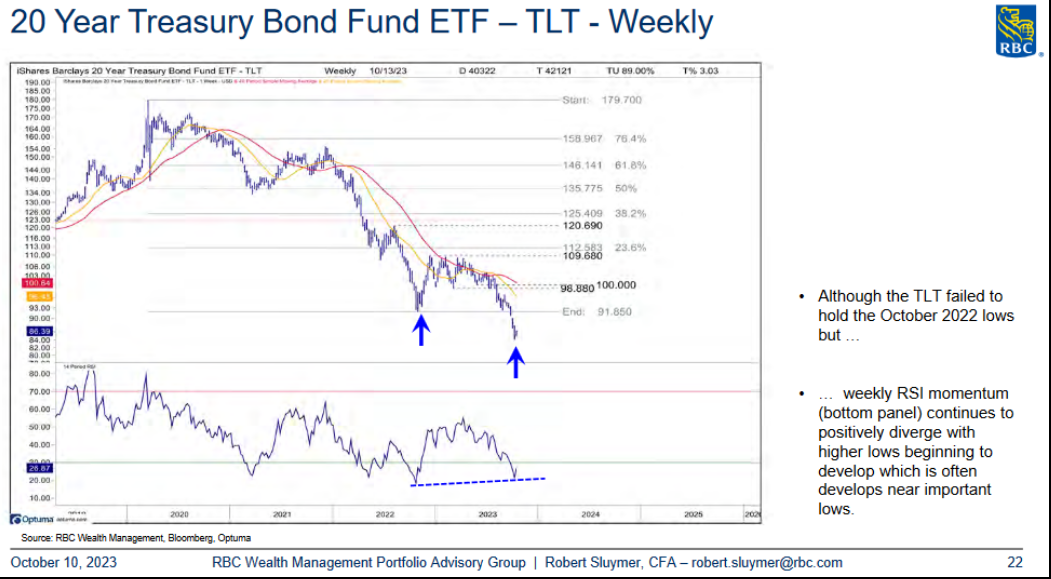

As we’ve repeated in recent weeks, the key to this market is rates. When rates stopped going up, everything would begin to change, for the better, all at once. This week is showing what that looks like. We believe this turnaround is in its early stages. You can see all of the instances of treasuries getting this oversold (2+SD) in the past ~35 years and how it played out:

Even the US Dollar is trying to cooperate (weaken):

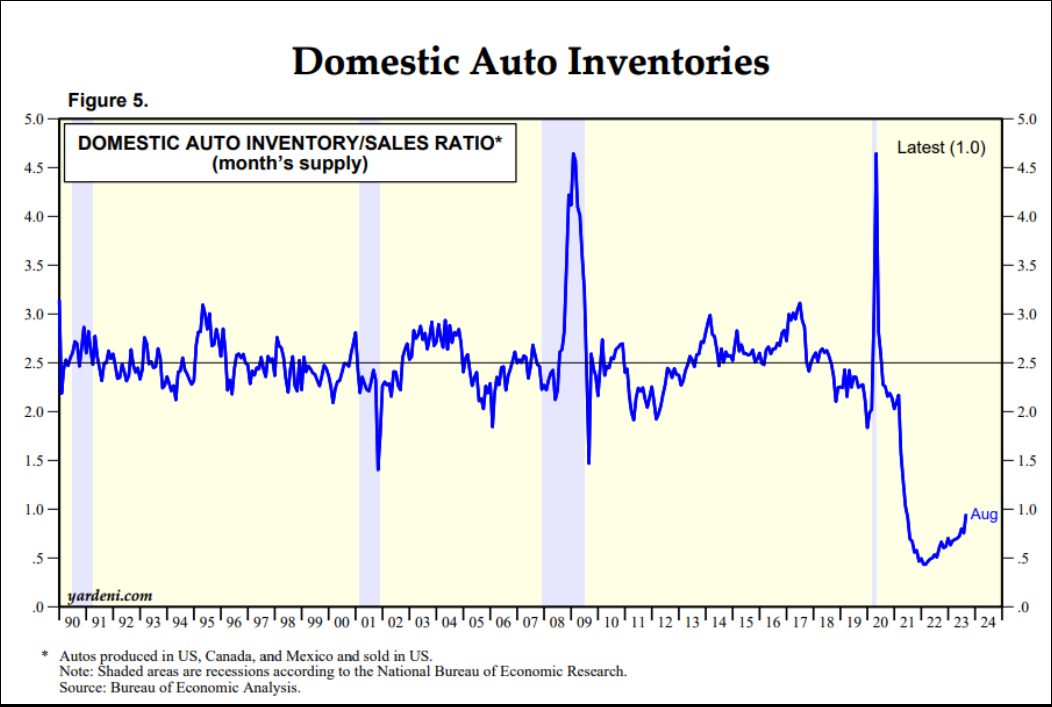

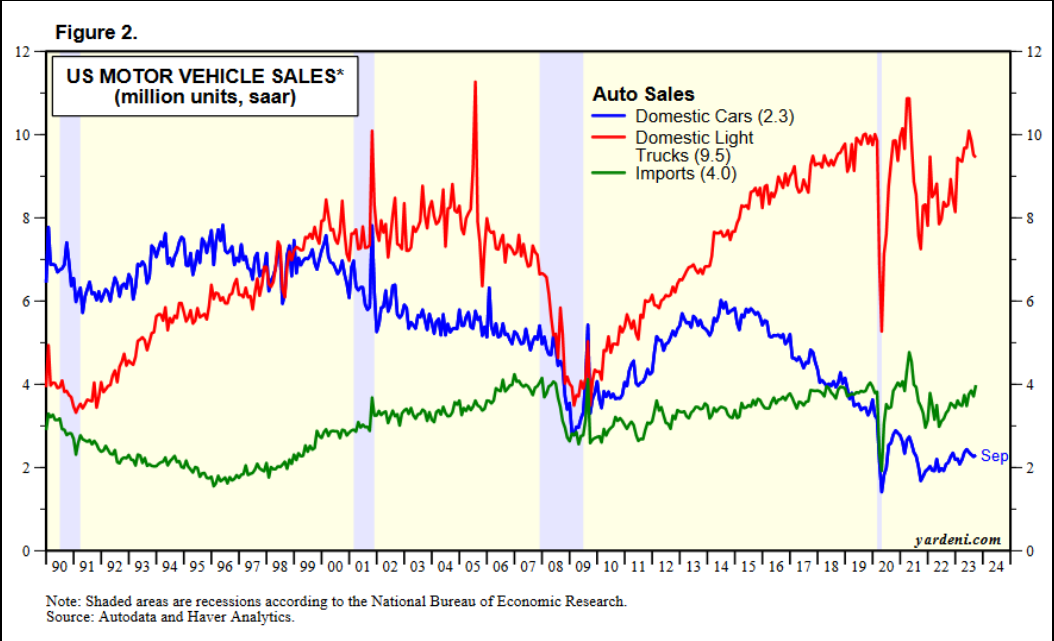

CPS Just Beginning

A lot of production coming in order to normalize inventory levels. UAW appears to be taking desperate measures as their cash reserves are declining by the day. Sooner or later the parties will come to a short-term agreement.

Mexico will be the biggest beneficiary as more production is forced offshore – to remain competitive with non-union producers. The UAW is effectively forcing the American consumer’s hand to buy foreign and non-union vehicles as US OEMs will no longer be able to compete on price. UAW will lose a lot of jobs over the next few years as a result of this (mexican) standoff.

Reasonable raises/COLA adjustments are good. Excess demands in exchange for less service provided rarely end well for any party involved.

What Happened To Medical Device Companies Yesterday (Including Baxter (NYSE:BAX))?

Novo Nordisk (CSE:NOVOb) halted a trial of semaglutide versus placebo on the progression of renal impairment in people with Type 2 diabetes and chronic kidney disease early because of its efficacy.

The dialysis market has been supported by high rates of obesity and diabetes, which contribute to kidney damage, but GLP-1 drugs such as semaglutide have been shown to improve both conditions in trials.

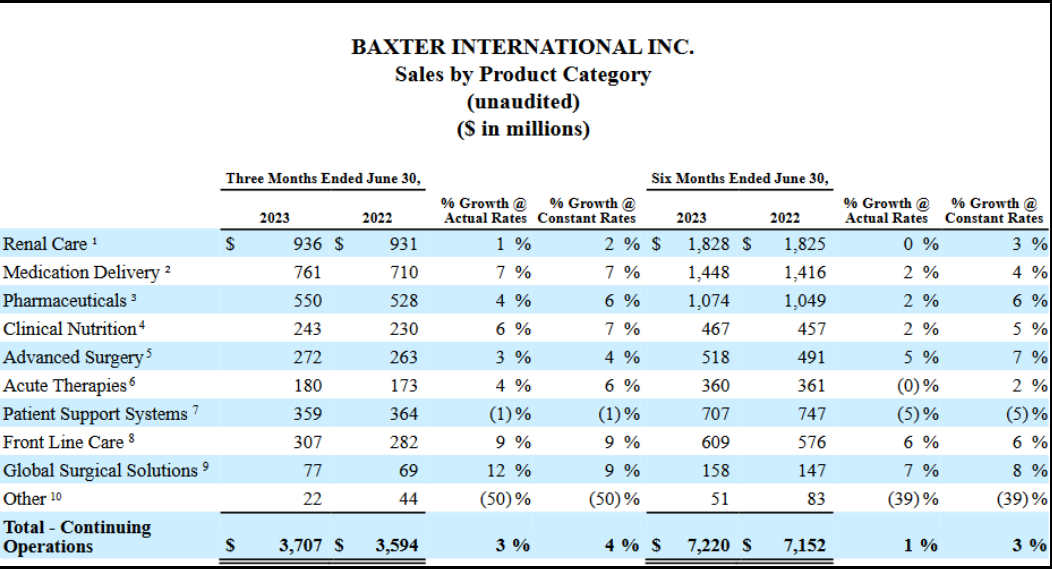

In the case of Baxter, the renal care business represents ~25% of revenue:

Baxter is already spinning out the renal care business to shareholders because it has a lower growth rate and lower ROIC than the rest of its segments. This will be effected by July 2024.

Here’s the CEO talking about this division as well as the GLP-1 impact on renal care in September:

More on outlook of the separate businesses moving forward:

The optimistic sell side estimates of GLP-1 coverage in the US by 2030 range between 7-9% of the population.

The real issue these analysts miss when they say “if everyone just loses 10 lbs, United Airlines (NASDAQ:UAL) can earn another 20 cents per share” is who is going to pay the $14,000-$16,000 per year so everyone can lose 10 lbs and we use less paper bags at McDonalds? Maybe you can get Cigna (NYSE:CI) to pick up your $50 tab for this:

But they aren’t going to pay $14-16k per year so you can fit into a size 6 or save your airline of choice a few bucks on fuel costs.

Even for diabetics the math is complicated. The estimated excess cost to the insurers of a diabetic patient is ~$9,600/yr. So they can pay $9,600 per year and know what they are getting into versus $16k per year and have no idea of the long-term side effects/additional costs. What do you think they will choose? I actually heard one analyst on TV say that McDonalds “could still succeed” if they get into the business of selling carrots and salads. He said this with a straight face. Where do they find these people? You can’t make this stuff up…

What about “self-payers” you say? The top 10% of household incomes in the US start at $191,406. That’s probably around $110K after tax (depending where you live). Add a mortgage and property tax and you’re at $60k of disposable income. Are you spending $16k before you consider food, clothes, auto, insurance, kids and other expenses? And that’s the top 10% of the country (30M people – who have a lower propensity toward obesity and diabetes to start with). What about the remaining 90%? How is United airlines ever going to save that twenty cents on fuel if we don’t figure this out?

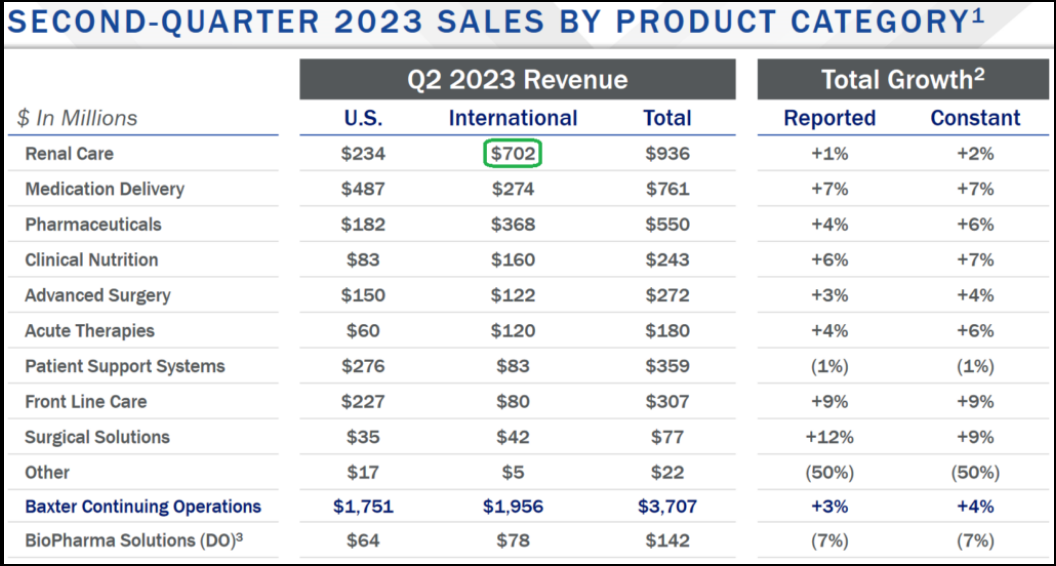

The other point that few have noticed is that the majority of Renal revenues for Baxter come from OUTSIDE the US. US renal care is just ~6% of total revenue. So while GLP-1 penetration in US is optimistically projected to hit just 7% of the US population (wealthiest in the world) by 2030 (according to Morgan Stanley (NYSE:MS) this week), penetration outside the US is much lower:

It’ll take Mr. Market a little while to figure this out and reverse his bi-polar reaction to a news headline – which is why we only added at the margin today to what already is a small weighted position in the portfolio. Even medical device makers that had no exposure to kidneys were slaughtered on the assumption that everyone will be skinny and never need another procedure at a hospital again.

Last time I checked, the there were a lot of hips, knees and shoulders getting done from pickelball, padel, tennis and golf. When people lose weight they get active. Why weren’t sneaker stocks and airlines (lower fuel costs if everyone is skinny) up today, lol?

Whether you’re replacing a heart or a hip, you’re still gonna need a hospital bed, iv, syringe and anesthesia. We may consider additional weighting with Baxter and other opportunities in the space while this dislocation is available.

What about Safety?

Here’s what makes the least sense to me about today’s move: If GLP-1s have been used to treat type-2 diabetes (95% of all diabetes) for 15 years, why are there still ANY dialysis/dialysis related companies still in business today?

In other words, it’s new for weight loss (okay), but those exact patients who require renal care today have been using GLP-1s for 15 years and the dialysis business is still growing ~5% per year. The price response to the study results headline says one thing, but the fact it’s already been used for 15 years and there is still dialysis demand tells me everything I need to know.

What’s next?

Here’s a synopsis of JPM’s take, followed by a Doctor’s take, followed by a sell side analyst’s take. The most interesting takeaway was the CEO of Fesenius (largest dialysis provider in US) who said these drugs will actually BENEFIT dialysis providers as the patients will now live longer and need their services for longer than expected!

There’s a pony in this pile:

The joke concerns twin boys of five or six. Worried that the boys had developed extreme personalities – one was a total pessimist, the other a total optimist – their parents took them to a psychiatrist.

First the psychiatrist treated the pessimist. Trying to brighten his outlook, the psychiatrist took him to a room piled to the ceiling with brand-new toys. But instead of yelping with delight, the little boy burst into tears. “What’s the matter?” the psychiatrist asked, baffled. “Don’t you want to play with any of the toys?” “Yes,” the little boy bawled, “but if I did I’d only break them.”

Next the psychiatrist treated the optimist. Trying to dampen his outlook, the psychiatrist took him to a room piled to the ceiling with horse manure. But instead of wrinkling his nose in disgust, the optimist emitted just the yelp of delight the psychiatrist had been hoping to hear from his brother, the pessimist. Then he clambered to the top of the pile, dropped to his knees, and began gleefully digging out scoop after scoop with his bare hands. “What do you think you’re doing?” the psychiatrist asked, just as baffled by the optimist as he had been by the pessimist. “With all this manure,” the little boy replied, beaming, “there must be a pony in here somewhere!”

I think that will prove to be the case with medical device companies following this abrupt reaction…

Now onto the shorter term view for the General Market:

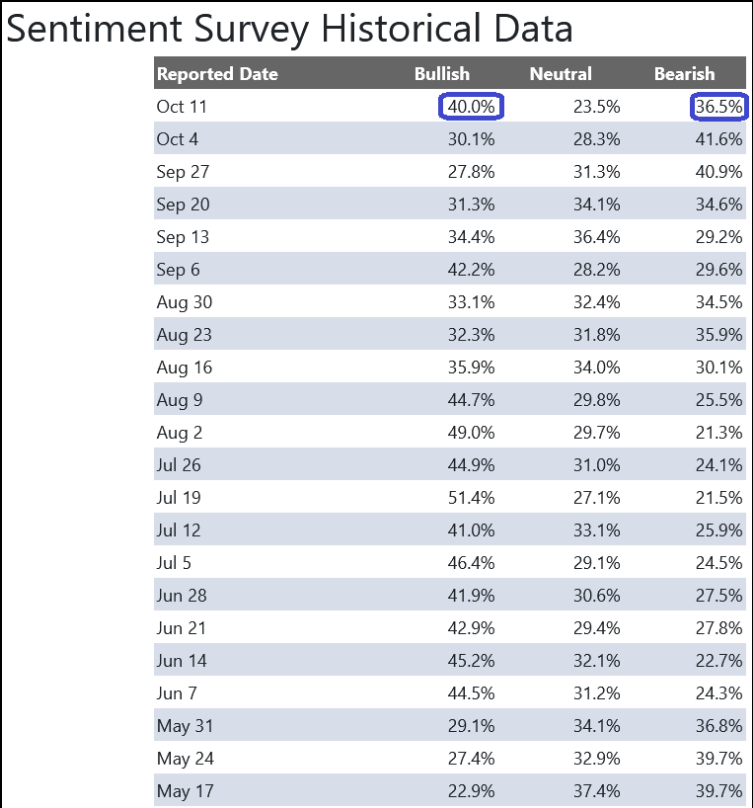

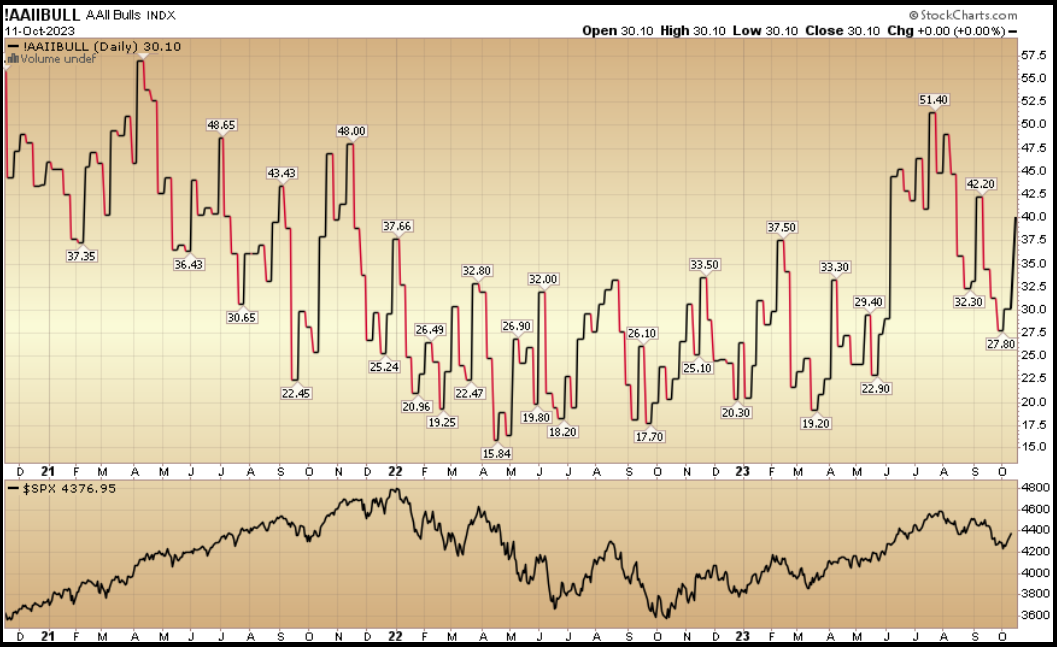

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 40.0% from 30.1% the previous week. Bearish Percent moved down to 36.5% from 41.6%. Retail investors are feeling more optimistic.

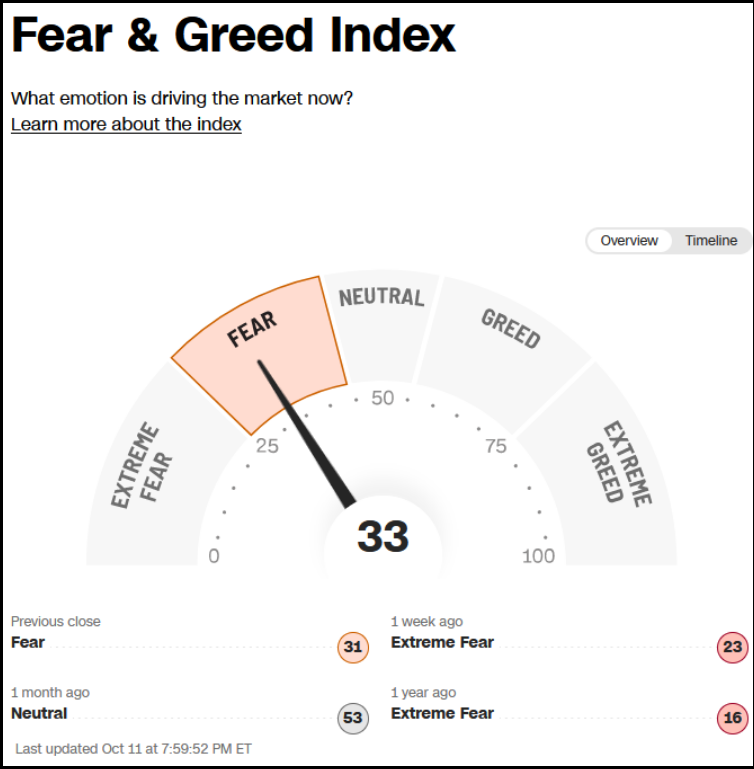

The CNN “Fear and Greed” rose from 19 last week to 33 this week. Investors are still fearful. You can learn how this indicator is calculated and how it works here: (Video Explanation)

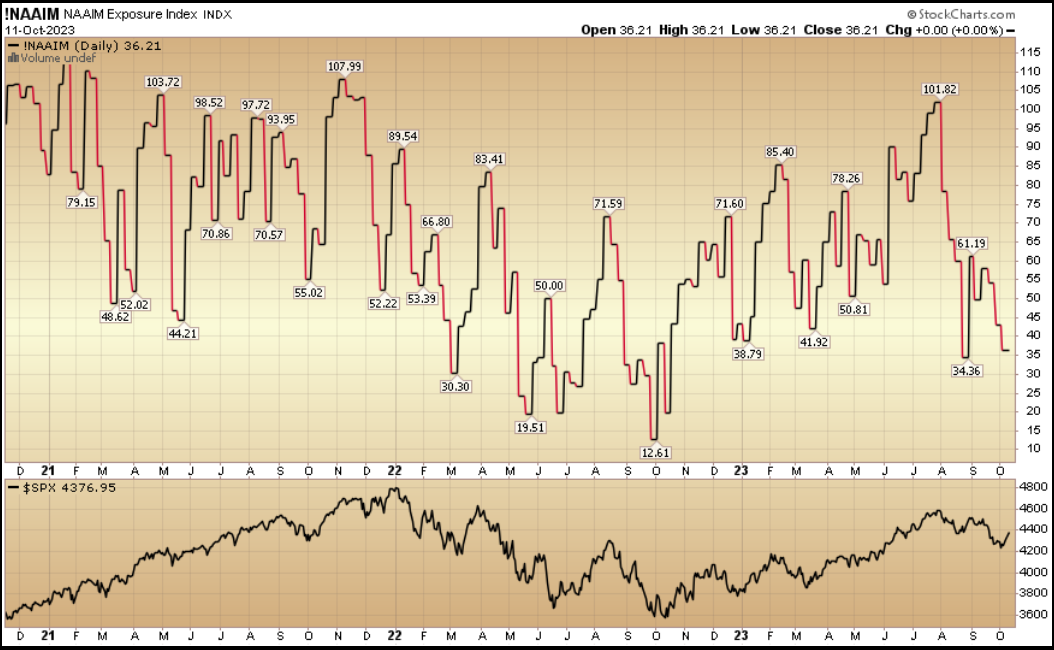

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 36.21% this week from 43.01% equity exposure last week. As the tide continues to turn, the “end of year chase” will be on full force.

This content was originally published on Hedgefundtips.com.