The Foundation of Lloyds Banking Group (LON:LLOY)

Lloyds Banking Group (:LYG), one of the largest financial services organizations in the UK, has a long history that dates back to 1765 when John Taylor and Sampson Lloyd founded a private banking business in Birmingham. Initially known as "Taylor & Lloyd," the firm provided banking services to local businesses and individuals, gradually expanding its operations over the following decades.In 1995, Lloyds merged with TSB Group, which allowed it to enhance its retail banking presence significantly. This merger positioned Lloyds as a major competitor in the UK banking sector, offering a diverse range of financial services, including personal and commercial banking, insurance, and investment services. By the early 2000s, Lloyds had established itself as a trusted institution, renowned for its customer service and robust financial products.

The Onset of the Global Financial Crisis

As the world approached the global financial crisis, (GFC) of 2008, Lloyds Banking Group found itself at a critical juncture. The GFC originated from the collapse of the US housing market, characterized by the proliferation of subprime mortgages that led to widespread defaults. Major financial institutions in the US and Europe faced severe liquidity challenges, as asset values plummeted and confidence in the banking system eroded. Among the banks severely affected was HBOS, (Halifax Bank of Scotland), which had expanded aggressively in the years leading up to the crisis. HBOS's business model relied heavily on high-risk lending practices, including subprime mortgages and commercial real estate loans. By September 2008, HBOS was on the brink of collapse, with its stock price plunging nearly 90% from its peak, signaling a catastrophic loss of investor confidence.In a desperate bid to stabilize the financial system and prevent a potential bank run, the UK government intervened with a 20 billion bailout as it facilitated a merger between Lloyds TSB and HBOS in October 2008. This merger resulted in the formation of Lloyds Banking Group. As part of this intervention the UK had acquired a 43% stake in the newly formed bank, effectively nationalizing a significant portion of its operations. Following the merger, Lloyds inherited a concerning portfolio of non-performing loans from HBOS. In 2009, the bank reported a 6.3 billion loss, the largest financial setbacks in its matured history. The immediate challenges posed by the merger highlighted deficiencies in risk management practices and necessitated an urgent overhaul of the bank's operations. In response to the financial turmoil, Lloyds implemented a comprehensive restructuring plan focused on reducing costs, enhancing operational efficiency, and restoring profitability. The bank committed to divesting non-core assets and streamlining its business operations, which included reducing the number of branches and closing unprofitable divisions. These measures aimed to stabilize the bank's financial position and lay the groundwork for future growth. By the end of 2010, Lloyds had initiated a series of asset sales, including the disposal of Lloyds TSB Scotland and parts of its international operations, to strengthen its balance sheet and focus on core markets.

The Payment Protection Insurance Scandal

As Lloyds endeavored to navigate its financial challenges, it faced a new crisis that would have far-reaching implications: the widespread mis-selling of Payment Protection Insurance (PPI). PPI was introduced in the 1970s to protect borrowers from defaulting on loan repayments in the event of illness, accident, disability, or unemployment. It was marketed as a safety net for consumers, especially in high-stakes lending scenarios involving credit cards, high street store cards, mortgages, home improvement loans, business loans, and student loans.Between 1990 and 2010, the sale of PPI skyrocketed, driven by aggressive marketing tactics employed by financial institutions. However, many consumers were sold PPI policies they neither needed nor could use. Many consumers didn't even know what the PPI was and just accepted it as an additional fee; Reports indicated that banks, including Lloyds, utilized high-pressure sales tactics and failed to adequately inform customers about the terms and conditions of the policies. It became increasingly clear that many consumers were misled into believing they were required to purchase PPI to obtain loans, leading to widespread dissatisfaction and a growing number of complaints. This rising trend of complaints would eventually prompt regulatory scrutiny by the Financial Services Authority (FSA), and later the Financial Conduct Authority (FCA), who launched investigations into PPI mis-selling practices across the banking industry. In response to the mounting evidence of consumer detriment, the FCA implemented measures to ensure fair treatment for those mis-sold PPI, including setting a deadline of August 29, 2019, for customers to submit claims for compensation.

To address potential liabilities stemming from PPI claims, Lloyds set aside approximately 20 billion to cover the anticipated costs of refunds and compensation. However, as the scale of claims escalated, the total cost ballooned to over 21.9 billion by April 2021, representing a majority of the 40 total payout burden shared by the other big banks that were involved in the scandal with Barclays (LON:BARC) contributing approximately 10 billion to this total, the Royal Bank of Scotland (LON:NWG) contributing 5.3 billion, HSBC contributing 4 billion, and Yorkshire Bank contributing 2.6 billion to this total, just to name a the notable few. These figure include payouts for both successful claims and estimated future liabilities and indicates that Lloyds had mildly underestimated the extent of the scandal's repercussions.

The PPI scandal profoundly damaged Lloyds' reputation as a trusted financial institution as the perception of unethical behavior and poor customer service contributed to a loss of consumer confidence. Legal challenges would also emerge as consumers; and Claims Management Companies (CMCs) pursued restitution for mis-sold policies. At this stage, Lloyds faced a barrage of lawsuits, further pressuring its recovery efforts and necessitating substantial legal and compliance resources. The legal cost and fines associated with these legal battles would cost Lloyds billions of dollars over the years, however, as time went on the barrage of legal issues would slow. In the aftermath of the scandal, Lloyds has undertaken significant measures to rebuild its reputation and restore customer trust. The bank has established dedicated teams to manage PPI claims, implemented new training programs for staff, and enhanced transparency in its sales practices. Additionally, Lloyds launched a public relations campaign to communicate its commitment to ethical banking and to reassure consumers of its dedication to fair treatment.

The legal situation surrounding PPI claims over the years has continued to evolve over the years as more and more claims came rolling in especially so, with the August 2019 deadline established by the FCA. This deadline resulted in a surge of late claims which aligns with the extra 2 billion in repayment Lloyds hadn't originally accounted for. However, this deadline signals the end of most claims through the complaints process. However, the potential for legal challenges in the courts remained, as the deadline did not apply to claims made in specific special circumstances. Despite this, the recovery and restitution effort which really began to ramp up in 2011 seems to finally be coming to a close as of 2021 which is where the FCA provided it's final data points for monthly PPI repayments across the industry.

Financial and Economic Metrics

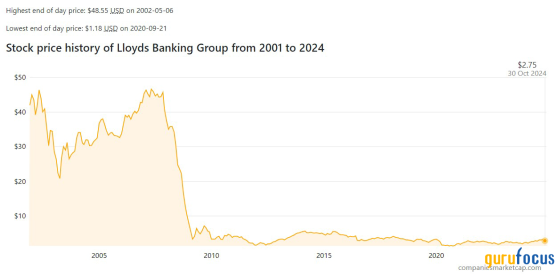

The UK government, which acquired a substantial stake in Lloyds during the 2008 financial crisis, has played a vital role in the bank's trajectory. Initially, the government held over 40% of Lloyds' shares, this was part of the initial bailout effort as the nation was essentially saving the bank from the debts it owed to it, over time the bank would be nationalized and put under heavy supervision by the UK Government to assure its recovery efforts. Over time as the bank performed, the government would get their money back through a series of share sales, before the repercussions of the scandal were realized, shares of Lloyds traded at around $9-$15 however, during the collapse of the bubble in 2008 Lloyds dropped over 90% to only $1 per share:Source: Companiesmarketcap.com

This represented a one year market cap decline from the high of $62 billion in 2007 down to just $11 billion by the end of 2008:

Source: Companiesmarketcap.com

This market cap drop and share price decline would be followed by share issuance going up 20-fold rising from a low of 1.45 billion shares in 2008, topping out at nearly 30 billion shares by 2016.

Source: Companiesmarketcap.com

The rise in outstanding shares mainly displays a dilution of shareholders as new shares were issued to the government who had then acquired a massive stake in the Bank it had bailed out. Since then, the price per share has traded within a range of 1-3 dollars as the government slowly rolled off (sold) their total stake in the company . Essentially this has acted as a way for the company and its shareholders to repay the nation for all the government debt it borrowed during the collapse to save itself.

In early April 2017, the government stake in the company had been reduced to less than 2%; announcing that it had recovered over 20 billion for the taxpayer and were very close to recovering all of the money taxpayers injected into the bank during the financial crisis.

A month later in May, the UK Government announced the selling of its final stake in the company, thus bringing it back to full privatization and paying back all the taxpayer debt. Much of this selling seems to have occurred when the market cap peaked near 60-100 billion dollars between 2015 and 2017 which is most likely why the price stayed suppressed to around below 4-5 dollars. The amount of progress made on this gradual divestment was celebrated as a significant milestone in the bank's recovery, bringing ownership back to the company and its shareholders, along with reprivatizing the company which is likely to boost investor confidence and is also likely to result in higher share pricing as the government is no longer acting as a key seller of the shares within the current price range as Lloyds has successfully demonstrated its ability to navigate post-crisis.

Since 2014, Lloyds's Net Income has steadily risen going from a low of negative $2.8 billion to a current high of $6.53 billion.

Source: Macrotrends.net

This rising income was paired with a recent rise in the bank's Cash Balance which went up from a low of just over $100 billion during the 2020 COVID-19 crash, to quickly rising back to the upper range near $400 billion in 2024.

Source: Macrotrends.net

As the income and cash balances have increased so have their Total (EPA:TTEF) Current Assets; going from $314 billion during the pandemic to nearly $1 trillion in 2024, putting its Liabilities to assets at just under a ratio of 1:1 which is what you would typically expect from the balance sheet of a big bank.

Source: MacroTrends.net

As Lloyds has made progress on its assets, cash and income, the company has also successfully eliminated much of its Total Debts, improving from the highs of over $400 billion during the crisis, down to $109 billion as of September 2024.

Source: Companiesmarketcap.com

Lloyds has maintained a Book Value per Share above 3 dollars since the incident yet the stock has traded significantly below that value presumably because of the weight of the UK Government selling its stake of the company over the years:

Source: TradingView.com

This divergence in market price per share and book value per share has resulted in a Price to Book ratio of 0.71 which is notably better than the Industry median of 0.94, making it a better book value proposition than 69.18% of 1528 other companies within the industry:

Source: GuruFocus.com

Lastly on the front of EPS and PE Ratio, Lloyds has fallen far from its pre GFC highs in 2006 as illustrated by the chart below it can be seen that it had an EPS of $4.5 but after the GFC it dropped into the negatives:

Source: Companiesmarketcap.com

It is however apparent that if you zoom into the last several years one can see an impressive amount of improvement in EPS, rising from the low of -0.17 in 2014 to the high of 0.35 in the first quarter of 2024:

Source: Macrotrends.net

With shares of Lloyds trading at around $2.5 and EPS coming in at around $0.28-$0.38, it can be deduced that the Price to Earnings ratio comes in at a low reading of around 7x which is lower than the industry median of 10.84, making it a better P/E valuation than 68.28% of other banks in the industry.

Source: GuruFocus.com

Lloyds Banking Group is now Fundamentally, and Economically poised to enter a new era characterized by transparency, consumer-centric practices, and a commitment to ethical banking. The bank's focus on digital transformation is evident in its strategic initiatives to enhance online banking services and provide seamless customer experiences. Over the years Lloyds has invested billions into cloud and operation efficiency as it works to digify the banking experience allowing for a simpler self-serving consumer interaction on all fronts of banking and improving their cloud capabilities in collaboration with Google (NASDAQ:GOOGL) Cloud. Leveraging advanced data analytics and artificial intelligence, Lloyds aims to tailor its offerings to meet the various needs of its customers.

These efforts have made themselves known when looking into the bank's financial metrics; Lloyds's commitment to sustainable banking practices aligns with broader environmental and social responsibility goals. The bank has undertaken initiatives to promote sustainable lending, support green financing, and minimize its carbon footprint. As part of its long-term strategy, Lloyds aims to position itself as a leader in responsible banking, demonstrating a unit that is both profitable and sustainable.

As regulatory frameworks continue to evolve, Lloyds intends to remain agile in its compliance and risk management strategies. The challenges posed by economic uncertainties, changing consumer preferences, and technological advancements necessitate a proactive stance in adapting to market dynamics. Right now it is made apparent that Lloyds is serious about remaining agile and sustainable as it reduces debts, steadily increases income, and maintains healthier leverage ratios.

From its foundation to its rise of being the UK's 2nd biggest bank; the journey of Lloyds Banking Group has been marked by significant obstacles and transformative changes. Through it all, the bank has positioned itself to becoming a more responsible player within the industry and this new approach has gotten it through the years of turbulence that came with the GFC and the following PPI scandal.

Moving forward, Lloyds positions itself as setting a good example to its peers; embracing a future characterized by resilience, innovation, and a commitment to ethical banking practices. By focusing on sustainable growth, digital transformation, and customer-centric services, Lloyds Banking Group aims to solidify its position as a trusted financial partner in the UK and around the world.

Technical Outlook:

Source: TradingView.com

Since the GFC, shares of LYG have traded within the range of 1-5 dollars, this stability was a result in UK Tax Payer dollars stepping up to stabilize the economic conditions for the bank as price has neared the top of the range is where we've seen the UK Government selling most of its shares, since the intra-range 2014-2016 peak, the price has been kept under the 200-week Simple Moving average, however since the UK finished selling its stake of the company in 2017 followed by the updated announcement of the last of the PPI claims in 2021, In 2020 during the pandemic, we witnessed LYG trade into the bottom of the range aligning with the 0.886 Pattern Completion Zone of a Bullish Bat pattern, since then we've seen price begin to trend away from these COVID-19 lows and put in higher lows, this resulted in 2024 being the first time LYG has traded substantially above the 200-week SMA since 2013. Based off the circumstance one may assume that this is the start of a new trend that could take it to the top of the 5 dollar range. If all goes smoothly, LYG may even break the range and begin to trade near it's past value highs of 9-16 dollars. Given that LYG has been more responsible lately it is in my opinion, probable that in the event of another macroeconomic downturn, LYG would be better equipped than most banks to deal with and weather the storm.

This content was originally published on Gurufocus.com